Students of America, the government will forgive your debt. Just sign up for the PAYER Plan (Pay as you Earn Repayment) and lose your chains. The only caveat (there's always a caveat) is you will have to pay some interest.

Here's how it works. Your payments will be capped at 10 percent of your income for twenty years. After that, all is forgiven. Oops, another caveat: You will be taxed on what is forgiven. It's even better if you work in public service. You only have to make payments for ten years before forgiveness sets in.

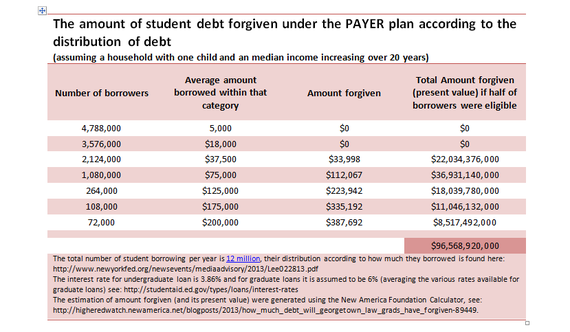

Of course the taxpayer is left holding the bag. If all eligible students sign up, taxpayers would lose $97 billion a year in forgiven debt (see table below). Remember, the government borrows all of the money it lends to students, so taxpayers must pay creditors without receiving payments from students. This leaves the taxpayer holding one rope but not the other.

If college graduates represent the average median, they will get a job paying $30,000 that doubles over twenty years. Assuming a $75,000 family student debt (very typical for a graduate and spouse), PAYER would provide $112,067 in debt forgiveness or all of the principal plus interest.

Why is the government being so generous with taxpayer money? First, it believes that only a fraction of eligible students will actually join PAYER. Its skepticism is based on how few signed up for past income based repayment plans. PAYER could prove costly if economic conditions change, compelling more students to join. Why take this open ended risk?

The explanation could be political. Parents (voters) are angry about the likelihood that their children will fall into debt for college. A recent poll showed 57 percent of students are worried about their ability to pay for college. A few years ago student debt relief was one of the principal concerns of Occupy Wall Street. Subsequently, Americans watched as the British government came under intense fire from students rioting in protest of tuition increases. The issue can become toxic over night.

Still another explanation is that the student debt system is breaking down. About 61 percent of students are not making their payments on time. Why not forgive some of it so students are more willing and able to repay.

Much depends on the government getting this issue right. Equality of opportunity is at stake. Right now the government loads poor kids with enough debt to get them to college. That may have to change. The health of higher education is also at stake. When a student borrows, the government sends the money directly to colleges which use it to stay afloat. Higher Education is now dependent on student loan disbursements for half of its revenues. Too much of a good thing is almost always too much of a good thing.

It is a legitimate question to ask if student debt may soon disappear as a result of default and forgiveness. Ultimately, taxpayers may want to support students with upfront grants rather than to suffer losses from forgiveness.