It's now widely known that the foreclosure crisis and the resulting recession have been devastating to homeowners and neighborhoods across New York State. Sadly, the foreclosure crisis has also generated a second wave of hardship for homeowners: foreclosure rescue fraud.

Foreclosure rescue scammers aggressively seek out New Yorkers in financial distress and take advantage of them while they grapple with foreclosure. They prey on people navigating a complicated mix of programs and processes, promising a quick fix. But after they charge a steep fee -- about $4,200 on average -- they disappear.

The damage caused by these scammers is shocking. As of September 2014, New York homeowners have submitted over 2,700 complaints to the Lawyers' Committee for Civil Rights' Loan Modification Scam Database, while over 42,000 complaints have been submitted in total, nationally. All told, homeowners in New York have reported total losses of $8.25 million. Nationwide, homeowners have reported total losses of almost $100 million.

Yet these numbers do not begin to reflect the incalculable damage done when homeowners are derailed from reaching legitimate help--or having finally reached it, finding that they are too far behind to recover.

Read the full report at cnycn.org/scams

Since 2008, the Center for NYC Neighborhoods has been helping working- and middle-class homeowners at risk of foreclosure and protecting the stability of the many neighborhoods that provide affordable housing to hundreds of thousands of New York families. Our approach is to work with community-based organizations in the hardest hit neighborhoods and support them in delivering housing counseling and legal services to help homeowners keep their homes.

This year, the Center joined with the Lawyers' Committee to increase awareness and enforcement of these scams in New York State. From our research, released yesterday in our new joint report titled Who Can You Trust, we discovered that scams were becoming more sophisticated. For instance, there is an alarming trend of increased attorney involvement in foreclosure rescue scams. The majority of rescue scams in New York now involve a person who is, or claims to be, an attorney. And in these cases, the average loss is over $1,400 more than in scams without attorney involvement.

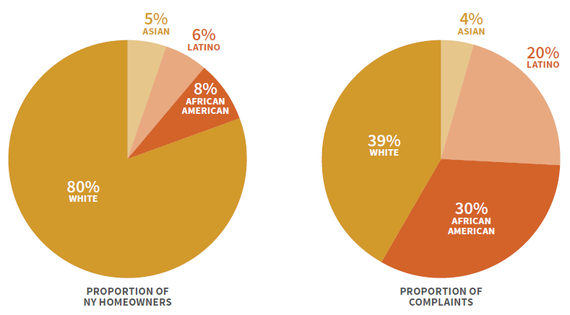

As with the predatory subprime lending that preceded the foreclosure crisis, foreclosure rescue scammers have also disproportionately targeted minority homeowners. While African American homeowners make up 8 percent of homeowners in New York, they represent 30 percent of reported foreclosure rescue scams. Similarly, Latino homeowners own 6 percent of homes, but are 20 percent of reported scams.

We can defeat foreclosure rescue scammers. But we need more legal enforcement and consumer education to help homeowners distinguish between legitimate services and scams. Homeowners need to know that scammers are peddling high-cost, no-return services -- and they need to know where to find quality services that won't cost a dime. When homeowners know who to trust, scam operators will find they simply have no market.

Visit cnycn.org for more information. Homeowners in New York can access high-quality help at no cost by calling the New York State Attorney General's Homeowner Protection Program hotline at 855-HOME-456 (855-466-3456).