Jodie M. Gunzberg, vice president at S&P Dow Jones Indices, wrote an interesting piece in the S&P Dow Jones Indices blog, Indexology. The blog is titled "Fear Gauge Spikes: Let's Play Hot Potato" and in it Gunzberg tries to answer a number of questions, but the basic question is: why have commodities reacted differently to spikes in the Chicago Board Options Volatility Index (VIX), or fear gauge, as Gunzberg refers to it, since the credit crisis of 2008 than they did to spikes in the VIX pre-2008.

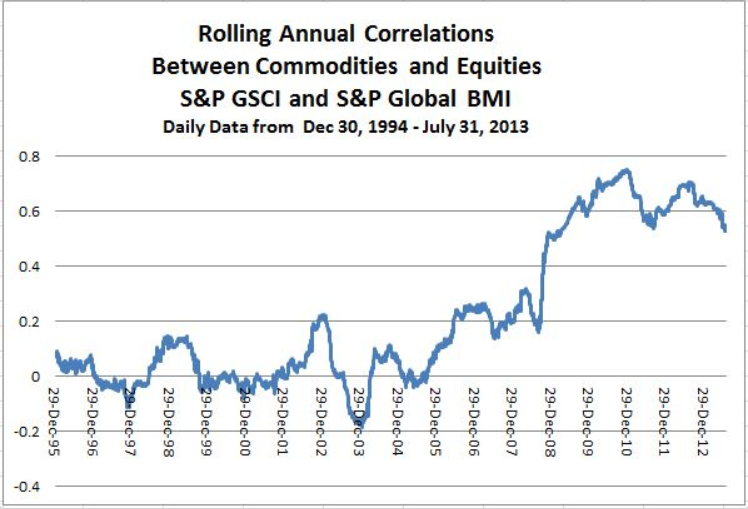

The reference to the VIX itself is a bit of subterfuge in my opinion because basically what she is describing though avoiding saying explicitly is that commodities markets in general and the S&P GSCI in particular has become increasingly correlated to the S&P 500 since 2008 (See chart below).

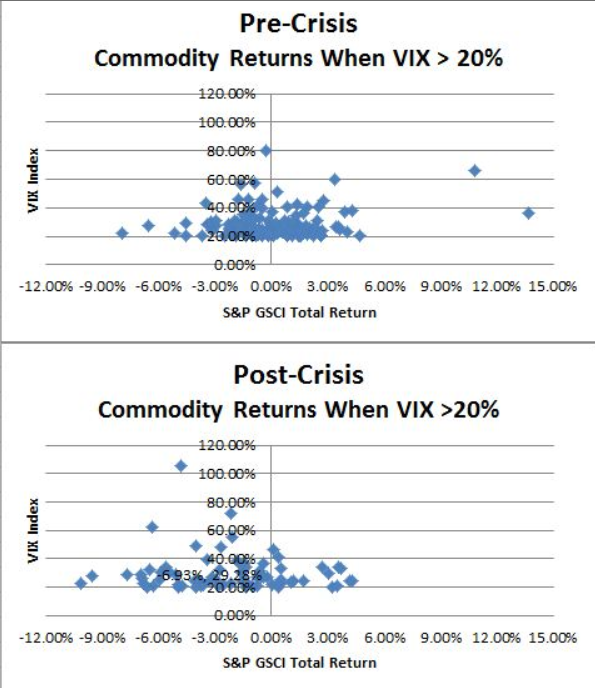

She asks, "For what risk does the commodity investor get paid? At what point is the fear gauge so high the risk gets passed like a hot potato? The answers to these questions will help explain why post the global financial crisis there has been a link between VIX spikes and commodity losses."

Huh? You can compare any asset classes to each other but commodity traders do not trade off of the VIX. The VIX measures implied volatility in the S&P 500. Speculators always assume the risk of hedgers, when they are wrong they get out. They don't pass the risk around; they just realize they were wrong or no longer want to assume the risk.

She then asks, "At what point is the fear gauge so high the risk needs to be passed like a hot potato?"

Her answer: "In times of financial distress, or 'post-crisis,' commodity investors reduce their net long positions in response to an increase in the risk as measured by VIX, causing the risk to flow back to the hedgers."

Once again, huh?

People were sold on investing in passive commodity indexes as an inflation hedge that would be non-correlated to their equity investments. A simpler conclusion could be that since VIX is negatively correlated to S&Ps and most investors have a core investment in equities, a significant loss in their portfolio will cause them to reduce other investments. We saw this in 2008 when money flew out of managed futures despite strong performance because investors were losing money everywhere else in their portfolio and managed futures were liquid.

After going through the article a couple of times I have come to the conclusion that this is a convoluted attempt to avoid the most obvious conclusion. Apparently Gunzberg is not familiar with Occam's razor. According to Wikipedia, Occam's razor is a principle of parsimony, economy, or succinctness used in logic and problem-solving. It states that among competing hypotheses, the hypothesis with the fewest assumptions should be selected. Put more simply, it says the simplest answer is usually the right one.

I am a bit weary of criticizing Gunzberg because she does a lot of good work here and cites numerous academic studies but it all seems to be an attempt to get readers to pay no attention to the man behind the curtain. Gunzberg wrote a piece ignoring the elephant in the room, at least from the perspective of a VP for the S&P Dow Jones indexes. And the elephant in the room is the correlation between the S&P 500 and S&P GSCI.

The obvious point which she convincingly illustrates with her data, though doesn't point out, is that since the credit hit in 2008, commodities have become increasingly correlated with the S&P 500, especially when you don't want it to be as an investor. It is an inconvenient truth for someone marketing the S&P GSCI because that index's biggest selling point over the years has always been its non-correlation to traditional assets, the S&P 500 in particular (see chart).

Gunzberg, in her conclusion, puts the blame on the changes in correlation -- or game of hot potato, as she puts it -- on the risk on/risk off nature of market action since the credit crisis hit and holds out hope that it could be coming to an end with the taper and eventually end of QE infinity. Perhaps academics can spend their days trying to figure out the why but the what is the correlation and the conclusion one should draw from the data is that right now and for the past five years an investment in a passive long-only commodity index has not provided a non-correlated return stream from traditional investments.

What has provided the desired non-correlated return stream are active managed futures strategies, particularly of the trend following variety.

Many folks in the managed futures space are wringing their hands over the poor performance of managed futures over the last two and a half years but that should not be a concern, particularly given the performance of equities (see S&P 500 chart below).

S&P 500 3-year

Now if managed futures performed the way it has over the last 30 months during a bear equity market there would be cause for concern.