Angel investments in Europe are increasing and into diverse sectors. In the latest survey made by European Business Angels Network (EBAN), a total of 7.5 billion Euros have been invested in the early stage market in 2013. Of this amount, 5.5 billion was made by angels, 2.0 billion by early stage VCs and 80 million by equity crowdfunding.

European angels' investments have increased by 10 percent in 2013, which amounts to 5.543 million Euros. This created 184, 170 jobs. The top 3 countries in terms of angel investments, in Euros, are: UK, with 84.4 million; Spain, 57.6 million, and Russia, 41.8 million.

In terms of sectors, the first in the list is ICT, 32 percent; followed by biotech & life sciences and mobiles with 10 percent each; manufacturing at 9 percent; health care at 8 percent; energy at 6 percent and other sectors, 8 percent.

It is in this backdrop that the EBAN Helsinki 2014 European Business Angels Conference took place in Helsinki, Finland. The conference's main theme is "ICT, Mobile, and Games". It brought together more than 350 participants that included venture capitalists, EBAN members, angel network members, and upcoming entrepreneurs from Europe and beyond for the conference.

Organized by the Finnish Business Angels Network (FiBAN), the two-day conference had over 70 speakers on timely relevant topics. Startup investing experts shared angel investing best practices and success stories in the first day. Likewise, the participants availed of the networking opportunities with the international investor community and sector focused groups.

Among the broad topics explored during concurrent sessions were: startups and corporations, creative industries, cross border investments, profitable impact investing, edutech, crowdfunding and inspiring private investments. The potential of crowdfunding as a market is growing rapidly in Europe, particularly when the masses are educated about it, and marketing. Crowdfunding empowers the crowd as much as it empowers the individual.

According to Candace Johnson, EBAN President, "EBAN Helsinki 2014 has provided the perfect opportunity for intelligent, experienced early-stage investors to meet and exchange best practices as well as to experience and participate in THE innovation, entrepreneurial event of the year, SLUSH. I am particularly grateful to our FIBAN Colleagues that EBAN Helsinki 2014 also gave us the platform to bring together 10 different Angel Networks from 10 different countries to invest half a million Euros in the winner of SLUSH, Enbrite.ly and thus realize at once our goals of increasing cross-border investment and creating and investing in European Success Stories."

Johnson continued, "A special highlight of EBAN Helsinki 2014 was the participation of our Business Angel colleagues from Africa who came together to create ABAN, the African Network for Business Angels, Seed Funds and Early Stage Market Players during the conference and also contributed a number of their start-ups to SLUSH."

Riku Asikainen, FiBAN President, thanked the attendees for participating in the conference. He says, "We hope you are enriched, energized and inspired with the sharings and the talks. It will help you in your work as a business angel."

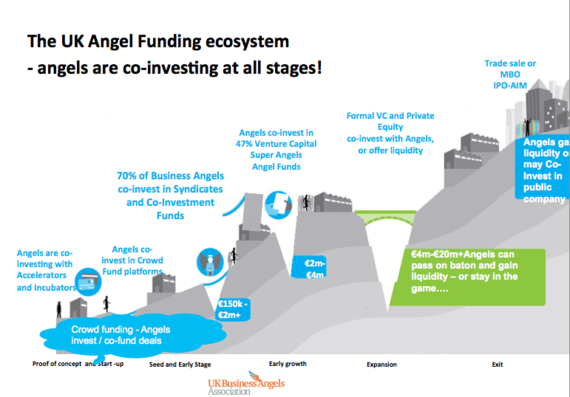

Jenny Tooth, the CEO of UK Business Angels Association, talked about co-investment as a catalyzer for syndication. She said that angels are co-investing in all stages of investment.

She showed it graphically in her powerpoint presentation:

Source: Jenny Tooth. (2014). UK Angel Market- Co-investmentas a Catalyserfor Syndication. Paper presented in the EBAN Helsinki Conference 2014.