Beware of national averages like “One

in Four Borrowers Is Underwater.” The

problem is heavily concentrated in places like Phoenix, where 54% of

homeowners with mortgages have negative equity. That’s about half a million

underwater mortgages, more than the combined totals in Texas and New York state,

where 10 times as many people live.

University of Arizona law professor Brent T. White

says anyone with negative home equity should simply walk away. Arizona, like

California, is a non-recourse state, where a home lender cannot legally pursue

repayment beyond the value of the underlying collateral.

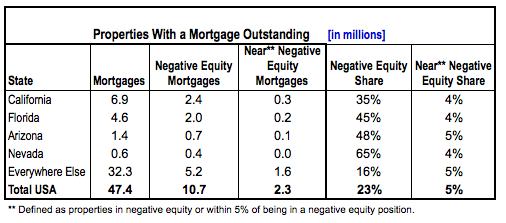

The situation looks much worse in America’s

Dubai, Las Vegas. Almost three-quarters Las Vegas homeowners with mortgages

have negative equity or near negative equity. A lot of them are really

underwater. Almost half of Nevada homeowners with mortgages have negative

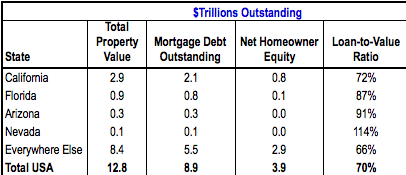

equity in excess of 25%. The total residential mortgage debt in Nevada is 1.14

times the value of the underlying real estate.

The majority of America’s underwater mortgages,

about 5.5 million, are located in the four sand states: California, Florida,

Arizona and Nevada, according to a new study by First American CoreLogic. That’s

where homeowners face each month with a renewed sense of anxiety. Many

wonder if the next mortgage payment means throwing away good money after

bad. And almost all wonder how the next foreclosure will affect neighborhood

property values, and the fabric of their community.

Don’t feel smug if you live elsewhere, say Deutsche

Bank analysts Karen Weaver and Ying Shen. By 2011, they predict, one half of all American homeowners will

have negative equity, plus another 20% who will have borderline negative

equity. They expect the New York market, which so far has held up fairly well,

to collapse. By 2011, they estimate, three-quarters of homeowners in the New

York-White Plains-Wayne, NY-NJ market will be underwater.

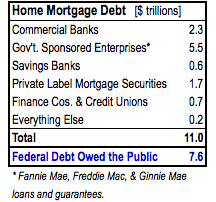

Whichever numbers you accept, it’s clear that the

size of this mortgage crisis dwarfs everything else, including healthcare

reform, the war in Iraq and social security. America's $11 trillion in home mortgage debt is 45%

larger than public

debt owed by the federal government. And half of that $11 trillion was lent

or guaranteed by Government Sponsored Enterprises like Fannie Mae or Freddie

Mac. It's not just the solvency of the GSEs that’s at stake; it's the health of

the overall economy. Federal revenues were down by $400

billion this year because people have less taxable income.

President Obama will issue admonishments to

the banks. Robert Reich says we should change the

bankruptcy laws to allow for cramdowns. All well and good, but it's unrealistic

to hope that banks will fill the vacuum of leadership at the top. We’re talking

about sorting out the problems of 10 to 15 million individual mortgage

loans. The financial incentives

are too fragmented and too misaligned and too nontransparent for any private

party to sort out the mess. Given the numbers involved, these mortgage problems

are too big, and too interconnected, to be resolved on a scattershot basis in a

dysfunctional marketplace.

If the government wants the job done right, it

must do the heavy lifting itself. Here

are the three proposals to untangle the mortgage mess:

1. Perform due diligence on all borrowers at

risk.

Step one is to find out what’s going on with each

distressed borrower. It’s a very time consuming and labor intensive job, which

is why no one wants to do it. It requires a face-to-face meeting with the

borrower, plus independent verification of a borrower’s employment and income,

his financial assets and obligations. It requires figuring out if the

borrower would be motivated to continue servicing the loan if it were reduced

to an amount below the property’s current market value.

Each delinquent mortgage loan is a multi-layered

story. Some borrowers took out mortgages as part of a flipping scheme.

Some, who took out a loan they could not afford, were deceived by dishonest

mortgage brokers. Others took out a fully-documented 80% loan on a house that

lost 50% in market value. All the evidence shows that mortgage fraud went

viral during the real estate boom.

The root cause of the mortgage meltdown, and most

other financial scandals, was that everyone piggybacked off of somebody else’s

due diligence, which was never performed properly in the first place. As a

substitute, investors relied on credit ratings and financial models that were

fatally flawed. Now that millions of borrowers are in trouble, everyone

acts as if the situation can sort itself out on its own. If we really want to

take charge of the problem, the federal government should temporarily hire

50,000 people to perform actual due diligence on these borrowers and

loans. The private parties who contributed to the situation don’t have

the same incentive to do things right. They’re conflicted.

2. Nationalize loan servicing for private label

mortgage securitizations.

When mortgage loans are sold to securitizations,

the loan servicing process is outsourced to a company that has no financial

stake in the loans and has all sorts of incentives to play all sorts of tricks

on the borrowers. The loan servicer is ostensibly acting on behalf of the

security holders, who, because if different levels of subordination, have

varied and conflicting claims. The problem is compounded by the fact that

none of the private label mortgage securities have standardized loan

documentation or workout policies. The incentives are very different when a

bank keeps a loan on its own books, or when Fannie Mae guarantees mortgage-backed

securities. In those instances, one creditor has a singular financial interest

in working out the best possible solution for a problem loan.

By nationalizing this function, the federal

government would be able to assure that the workout function would be done with

honesty and integrity.

3. Create a transparent national

registry for every ownership claim, including every derivative claim, on a

mortgage securitization.

Here’s a very common scenario in loan workout

negotiations. Several creditors agree to some kind of temporary forbearance to

keep the borrower out of bankruptcy. But one holdout creditor shows no

flexibility. He prefers to push the borrower into bankruptcy, even if it means

that the eventual recovery will be far less. The holdout owns a credit default

swap, kept secret from everyone else, that will reimburse him immediately. With

complex securitizations and credit default swaps, the opportunities for bad

faith dealings in debt restructuring grow exponentially.

The only way to achieve an orderly and fair

workout process is to clarify who comes to the table with clean hands.

Once the government assembles the data of what’s

actually happening, it can assert pressure to enforce an orderly and reasonable

restructuring of America’s financial albatross.

Of course, this approach holds political peril. It’s easier to harangue against the

banks than it is to take responsibility for the mess created by someone else. Any

kind of government

intervention is red meat for the tea bagging crowd. Remember how it all

started in February 2009?

Do we really

want to subsidize the losers’ mortgages? This is America! How many of you

people want to pay for your neighbor’s mortgage? President

Obama, are you listening?… We're thinking of having a Chicago Tea Party in July. All

you capitalists that want to show up to Lake Michigan, I'm gonna start

organizing.

CNBC’s Rick Santelli, who disclaimed any political affiliation

after his famous rant, provided inspiration for Larry

Kudlow and countless others. You would think that people would have wised

up by now. But consider this, the sand states’ economies are all

blighted by record multi-year droughts.

Yet large blocks of voters are still brainwashed by a cable network that

says global warming is not real.

Finally, here are the numbers, simplified:

Source:First American CoreLogic

Sources: Federal Reserve, Congressional Budget Office