This blog post, if it happened at all, was not supposed to come this soon.

Thanks to a series of happy flukes, I have just started in on two books: Boggs: A Comedy of Values by Lawrence Weschler and The Ascent of Money by Niall Ferguson. Both books are about money. Ferguson's is a sweeping history. Weschler's is a meditation triggered by the work of an artist who drew fake currency and then managed to pay for meals by getting restaurants to (knowingly) accept his drawings of money in lieu of actual money.

I meant to read the books, think about them, and do some extra homework about our ongoing global financial crisis. Then I'd write something here. Or not.

Instead, something in Weschler's book set me off. In the preface. In a footnote in the preface. Before the book even had a chance to get started. Before the page numbers even switched from Roman numerals to Arabic numerals.

Here, writing way back in the late 1990s, is what Weschler put in that footnote:

"Or the parallel stories about those two Nobel Prize-winning economists, honored a few years back for their brilliant work in elaborating excruciatingly complex formulas for determining the precise true value of variously arcane financial instruments, who, in turning around to put those theories into practice with the now-notorious Long-term Capital Management hedge fund, somehow managed to end up jeopardizing over a trillion dollars in other people's compounding, cantilevered investments. Makes one wonder, at the very least, about the precise true value of the Nobel Prize."

Weschler's footnote goes on to cite this New York Times story headlined "WHEN THEORY MET REALITY: Teachings of Two Nobelists Also Proved Their Undoing." Read it. It's interesting.

The Times story, which is from way back in 1998, offers innumerable cringe moments for us, the readers of the future. It's hard, for example, to be living through our ongoing mortgage mess and not wince at the sentences describing the practical application of the economists' Nobel-winning insights:

"In the process of devising this strategy, the economists demonstrated how to put a market price on options, futures and other derivatives. Once traders had that knowledge, they began aggressively trading stock options on the Chicago Board Options Exchange, and began creating hundreds of other derivative securities, like those backed by the stream of payments from home loans."

Did you catch that bit at the end?

"... derivative securities, like those backed by the stream of payments from home loans."

1998.

1998!

1998!!!

As the 1998 Times story itself concludes, "What (the Nobel laureates) are learning firsthand is just how humbling markets can be. It is a lesson that investors repeatedly learn but always manage to forget."

How true. How exasperatingly true.

As I suggest in my title above ...

So here's a proposal. It may be a bad one. Consider the source. I did not receive a Nobel Prize in economics. I did not, in fact, receive an A -- or even a B -- for the only economics class I took in college.

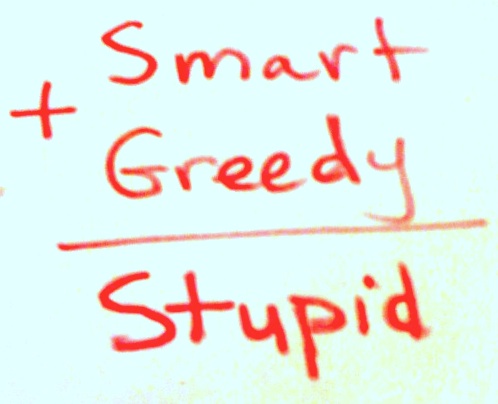

So I'm just asking. How about a new tax just for this? How about a smart-plus-greedy-equals-stupid tax?

Tax the profits of banks, hedge funds, financial services companies, etc. (when such profits exist). Tax the bonuses of their executives (because those bonuses always exist). This will generate some revenue. But we won't spend it. We'll just tuck it away. We will save it for the absolutely inevitable moment in the not-so-distant future when Wall Street will forget the lessons of 2008; when smart, greedy people will again push past the boundaries of good sense; when the mighty will again come begging for a bailout. Maybe, just maybe, we will collect enough in smart-plus-greedy-equals-stupid taxes to be able to bail them out with their own money.

Insurance, basically. Forced insurance.

This may all be nonsense. If so, ignore it.

If not, let's flesh out the details with someone who finished Econ 1 with something better than a C. Honestly, I at least need to finish reading Boggs and The Ascent of Money before I can be trusted to set policy for an entire economy.

Give me a week.

Huffington Post blogger David Quigg lives in Seattle. Click here to visit the blog where he's gradually posting his entire first novel. Click here for an archive of his previous HuffPost work. And finally, as now required by law, his Twitter feed.