Many of the demands advanced at the 1963 March on Washington led to considerable gains for African Americans. However, with respect to the wealth -- the area that impacts economic mobility the most -- African Americans are actually losing ground.

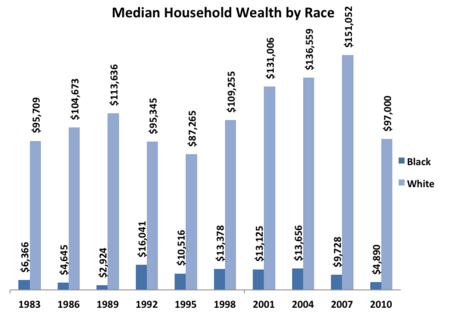

The divide in wealth, defined as a household's debt subtracted from owned assets, has widened substantially over the past several decades. Middle- and high-income African Americans saw their levels of wealth stagnate or decrease, while middle- and high-income whites' wealth increased. And during the Great Recession, African Americans lost disproportionately more of their assets and now only have 5 percent the wealth of whites.

Source: Federal Reserve Board, Survey of Consumer Finances (2011)

According to Thomas Shapiro, author of The Hidden Cost of Being African American, wealth is the primary force of inequality over the last 50 years. Decades of direct discrimination and segregation have limited African Americans ability to accumulate wealth to transfer to their families at a rate comparable to White Americans.

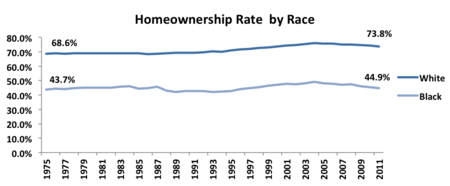

Source: Federal Reserve Board, Survey of Consumer Finances (2011)

And homeownership, the primary source of wealth, lies at the crux of these disparities. Between 1975 and 2011 the difference between black and white homeownership grew from 24.9 percent to 28.9 percent. Today almost 75 percent of white Americans own their home compared to less than 50 percent of black Americans.

Low wealth also means opportunities like stock ownership, home equity and pension coverage are less accessible to African Americans compared to white Americans. This makes it more difficult for blacks to build assets and mobility.

Some projections suggest it will take 634 years to reach black-white wealth equality. But, even this forecast is overly optimistic. With the recession, alongside other factors, it is likely to take even longer. We must (and can) do more to address the widening racial wealth divide. Otherwise, African Americans will never have the mobility necessary to achieve economic sustainability for themselves and future generations.

To close the racial wealth divide will require several major reforms. First since homeownership is the primary source of wealth for all Americans and over 70 percent of white Americans are homeowners with about 45 percent of African American homeowners, there must be a focus during the reform of the housing market to ensure that sustainable homeownership will be advanced in a manner that will bridge homeownership inequality. Second, ending the 50 years of African Americans unemployment rates twice that of white Americans is essential in strengthening wealth in the African American community. Federal policies that invest in full employment and greater progress in private and public sector racial inclusion is also essential. Finally, wealth inequality overall in the United States has been growing for the past 30 years which is a great hindrance to bridging racial economic inequality. Turning back to a more progressive tax structure and ending the current government practice of spending much of its investment in asset development in strengthening the wealth of the richest Americans all must be implemented.

This blog is the third entry in the series on economic equality 50 Years after the March on Washington. To see the previous post, click here.

Isabella Bronstein contributed to this series.