Co-authored by Virginia Reno

Patience is a virtue. In the case of Social Security, it can also translate to a higher retirement benefit.

Up to 76 percent higher.

A new toolkit, When to Take Social Security: It Pays to Wait , released today by the National Academy of Social Insurance explains how, if you can, waiting to take Social Security retirement benefits will increase your monthly benefit by as much as 76 percent.

How important will Social Security be to you?

If you're like most Americans, it will be really important.

The latest Survey of Consumer Finances found that 7 in 10 householders age 55 to 64 had less than $100,000 in retirement accounts in 2010. They include 4 in 10 who had no retirement accounts at all and 3 in 10 whose account balances were less than $100,000.

Considering Americans are living longer, those are scary numbers.

While Social Security retirement benefits are modest -- an average of $1,296 a month in January 2014 -- they are the most important retirement asset most Americans have. And it's one you most likely have paid into all your working life.

What's the alternative? Let's compare the cost of a private option to the benefits of Social Security.

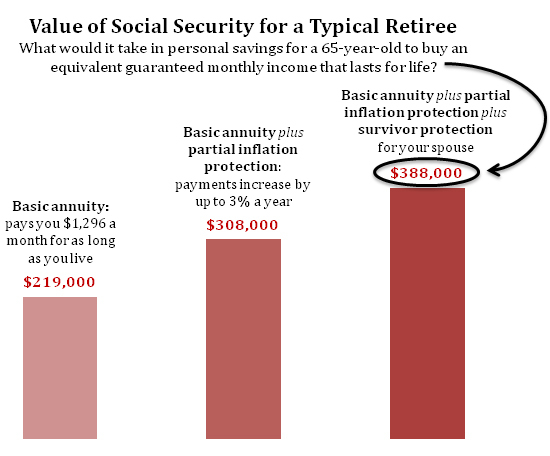

At age 65 you could buy a guaranteed monthly income equal to the average Social Security benefit. To buy an annuity -- a private insurance policy that would pay $1,296 a month starting at 65 for the rest of your life -- you would need to pay the insurance company about $219,000 in cash up front.

If you wanted partial protection against inflation -- a guarantee that your payment would increase by up to 3 percent per year for the rest of your life -- the up-front price would increase to $308,000.

If you also wanted to ensure that payments would continue for your 65-year-old spouse after you die, for as long as your spouse lives, the up-front price would rise to $388,000.

This week is America Saves Week and the Academy joins more than 1,000 organizations nationwide to educate Americans about how to boost their financial security.

The new toolkit is designed to help. When to Take Social Security: It Pays to Wait includes a three-minute video , a one-page fact sheet and a colorful 16-page brief all designed to help you make the best decision for you and those you love.

That's right, those you love. If you're married, you have two lives to plan for -- and chances are, either you or your spouse will live past age 85 or 90. If you're the higher earner, waiting to take Social Security means providing a higher survivor benefit for your spouse if she or he outlives you.

Remember, if you need Social Security to make ends meet, take it -- you've earned it.

But if you can wait, even a year or two, your monthly benefit will be higher -- for the rest of your life. Patience is a virtue -- and a benefit.

Virginia P. Reno is Vice President for Income Security Policy at the National Academy of Social Insurance (www.nasi.org), a non-profit, nonpartisan organization made up of the nation's leading experts on social insurance.

Video Powered by Bank of America: