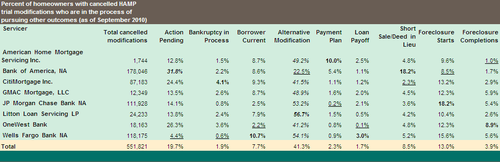

A couple weeks ago, we wrote about some new Treasury data that found that most borrowers whose HAMP modifications were canceled have not yet lost their homes. We decided to dig a little deeper into the data and look at what individual servicers are doing with borrowers they did not approve for a permanent modification (click for larger chart):

(Source: US Department of the Treasury)

Legend:

Bold: Servicer with highest occurrence of that outcome

Underline: Servicer with lowest occurrence of that outcome

Italic: Most common outcome within that servicer

The data seem to raise more questions than it answers, given that each borrower's situation is unique and it's hard to generalize about which outcomes are the most desirable without knowing more details about their terms. Some observations and questions:

- By and large, servicers are putting borrowers who do not qualify for permanent HAMP modifications into alternative, proprietary modifications. For the top eight servicers, over 41 percent of homeowners with cancelled HAMP modifications were put into alternative modifications. However, unlike HAMP, we don't know what the terms of these modifications are or whether they will be sustainable in the long run. The OCC and OTS's Mortgage Metrics report gives us some clues. The regulators examined what percentage of modifications completed by institutions they regulate eventually defaulted again within six months. Of HAMP modifications made in the fourth quarter of 2009, 10.8 percent had defaulted; in contrast, 22.4 percent of proprietary modifications made in the same period defaulted.

So why do proprietary modifications re-default at a higher rate than HAMP modifications? Are homeowners who did not receive HAMP modifications in worse economic condition than those who did receive HAMP modifications? Are proprietary modifications less advantageous for homeowners, therefore making re-default more likely? Or perhaps it's some combination of the above and borrowers in worse economic condition are being put into less advantageous modifications? Without knowing the reasons that servicers canceled HAMP modifications and the features of the proprietary modifications, it is difficult to know whether homeowners are being helped or hurt.

It would be interesting to know what BofA is doing differently than other servicers. Since servicers' appetite for short sales seems weak, it is a fair assumption to say that most of the 18 percent of canceled modifications that become deeds-in-lieu or short sales are likely deeds-in-lieu. Is BofA letting homeowners stay in these properties as opposed to making them leave immediately? For homeowners who want to stay in their property, is BofA pursuing other alternative modification strategies?

Readers, do you have any thoughts on why proprietary modifications are defaulting twice as often as HAMP modifications? Or why Bank of America's numbers are so anomalous? We welcome your theories in the comments.

This post was coauthored by Katie Buitrago.