With the passage of the Dodd-Frank Act, consumers will now have a Consumer Financial Protection Bureau to monitor and regulate potentially abusive financial products. It will be equally important, however, to ensure that all communities have equitable access to responsible and fairly priced products and to eliminate the bad ones.

The Community Reinvestment Act (CRA) has been an effective tool to encourage the provision of affordable financial services, but it must be updated to reflect the realities of today's rapidly-changing financial landscape.

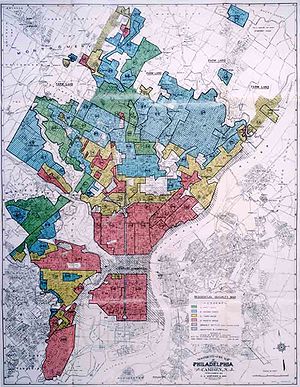

The Community Reinvestment Act, enacted in 1977, was designed to end the practice of redlining, where banks would literally draw a red line around low-income communities and communities of color on maps to indicate neighborhoods where they would not invest (see map). These neighborhoods could not get access to credit like mortgages and small business loans, perpetuating a cycle of disinvestment, disrepair, and job loss. CRA requires that banks meet the credit needs of low- and moderate-income people and communities, not just wealthy neighborhoods. CRA has provided many benefits to low- and moderate-income communities, but the recession and a changing financial industry have eroded some of these gains.

Regulators are in the process of re-examining CRA through a series of hearings throughout the country. We will be recommending key changes that must be made to CRA at the August 12 hearing at the Federal Reserve Bank of Chicago. Over the next two weeks, we'll take in-depth looks at what needs to be modernized in CRA. Today, we'll examine why CRA assessment areas must be broadened to reflect how financial institutions actually do business in the Internet age.

Currently, the CRA does not require banks to serve the financial needs of low-wealth people in all of the communities where they actually lend--only where they have bank branch locations. New types of financial institutions, such as online banks, have emerged. Others, such as insurance companies and credit card banks, have expanded to provide other products and services (insurance companies are not currently covered by CRA, but we recommend that CRA obligations be extended to them). In light of these new and changing delivery channels, the existing designation of these CRA assessment areas based on branch location is insufficient and does not capture the complete market presence of a financial institution for the purpose of determining that institution's reinvestment activity.

Large online banks gather deposits and make mortgage loans across the country, but have a physical presence only where their headquarters are located. Insurance companies selling financial products currently have a community reinvestment obligation only where they are headquartered, even though many have thousands of agents across the country who sell and service those products. Credit card banks may have a headquarters in Delaware or South Dakota, but provide personal and business credit lines throughout the country.

There is also evidence that financial institutions regulated by the CRA have different lending patterns inside and outside of their assessment areas. In seven metropolitan areas examined by Woodstock Institute and a collaboration of similar organizations, CRA-regulated institutions lending outside of their CRA assessment areas had a much higher percentage of higher-cost loans than they did when lending within their assessment areas. In five of the areas examined, depositories acting outside of their assessment areas had higher rates of higher-cost loan originations in low- and moderate-income tracts than independent mortgage firms had.

It makes sense: if you were in a hurry and knew you could be arrested for speeding only on east-west streets, wouldn't you do all your speeding on north-south streets? In the same way, banks know they can avoid scrutiny under CRA by keeping much of their worst lending practices outside of their assessment area or by originating loans online or through brokers and affiliates.

To ensure that all of these types of financial institutions are meeting the credit needs of their entire market area, including low-wealth communities and communities of color, the CRA assessment areas must be changed to reflect how these financial institutions do business. Assessment areas should be defined as any state, metropolitan area or rural county where that institution maintains retail offices or is represented by an agent or has at least a 0.5 percent market share in housing-related loans, securities, insurance, or any other financial instrument designated as CRA-eligible for the purposes of establishing an assessment area.

This post was co-authored by Tom Feltner and Katie Buitrago.