The spin around the release of the president's fiscal year 2017 budget proposals is that it is a "vision statement" of a progressive president no longer bound by any pretense of legislative viability.

Given that, what do we actually learn by looking at the budget? First, the White House pretends to care about the fiscal outlook as the budget top-line keeps future deficits below 3 percent of Gross Domestic Product (GDP) and stabilizes the debt at roughly 75 percent of GDP. But that pretense has been in every Obama budget and the fiscal outlook remains dire.

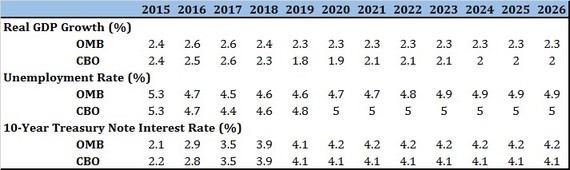

It has to be rapid economic growth. Compared to the Congressional Budget Office January projections economic growth averages 0.25 percentage points faster over the 10-year budget window in the OMB economic assumptions. That might not seem like much, but it will reduce the deficit by over $800 billion over 10 years -- hardly chump change. It also assumes that unemployment stabilizes at a lower level. Unfortunately, this also has been a fixture of every budget, and economic growth remains problematic.

Next, the budget requires taxes -- lots of taxes. The president's unhinged willingness to tax anything jumps out to the tune of $4.5 trillion more in taxes over the 10 years. That stunning tax increase produces revenue at 20 percent of GDP -- about 2 full percentage points higher than historic norms. That's also not new; its just $1 trillion higher than the last budget.

The centerpiece of the tax proposals is a $10 per barrel oil "fee." Of course, the tax would lead to an increase in gasoline prices; the only question is how much. Most analysts suggest that it will be in the range of $0.25 per gallon. From this perspective, one question is why the administration did not simply propose a 25-cent increase in the federal gasoline tax to fund its infrastructure initiatives. Doing it at the retail level is closer to the traditional user-fee model for the highway trust fund, although the rise of electric and hybrid cars weakens the link between gasoline use and highway wear and tear.

But there will be broader impacts as well, since the tax will raise the retail prices of jet fuel, heating oil, diesel fuel and others. It will interfere with global petroleum markets. While it appears that imported oil will also be subject to a $10 tax, it does not appear that the tax would be rebated on exports. If so, then having finally won long-overdue ability to export oil, U.S. producers will immediately be at a disadvantage on global markets.

In introducing the proposal, the administration argued that is was a fair quid pro quo for permitting oil exports and that, with oil prices low, now is a good time to introduce a tax. The latter is simply an inappropriate managing of prices (something the administration has tried before), while the former simply doesn't make sense. Oil companies should not have to "pay" for policy that is beneficial for the economy as a whole.

Finally, the only point of juicing economic growth and festooning the economy with tax proposals is to permit as much more spending as possible. Again, we've seen this movie before.

As it turns out, the vision is not surprising -- tax, regulate and spend -- nor is it new, and neither is it responsive to the fact that tax, regulate and spend has produced poor growth for 7 years.