In 2007, as oil prices on Earth topped $140 per barrel, JPL's Cassini mission discovered vast lakes of hydrocarbons on the surface of Titan, the largest moon of Saturn.

Scientists estimate that the surface of Titan could harbor resources hundreds of times greater than all the coal, gas, and oil on Earth. But as NASA planners look hard for the billions of dollars for a mission to return a few ounces of rock from Mars, the notion of fetching supertanker quantities from even-farther-out Titan seems completely absurd.

There is another place in our Solar System with oil, although not in the titanic quantities of Titan. The temperature is around freezing. The pressure is like putting the weight of a car on every square inch of your body. The surroundings are extremely corrosive. Humans don't go there: we obviously can't survive, so we send robots. It does not require a rocket to reach this hostile, alien world, but it is dangerous and expensive. I'm talking about the bottom of the ocean in the Gulf of Mexico, where the Deepwater Horizon blow out continues.

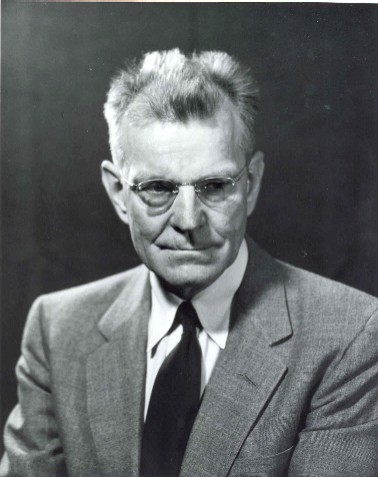

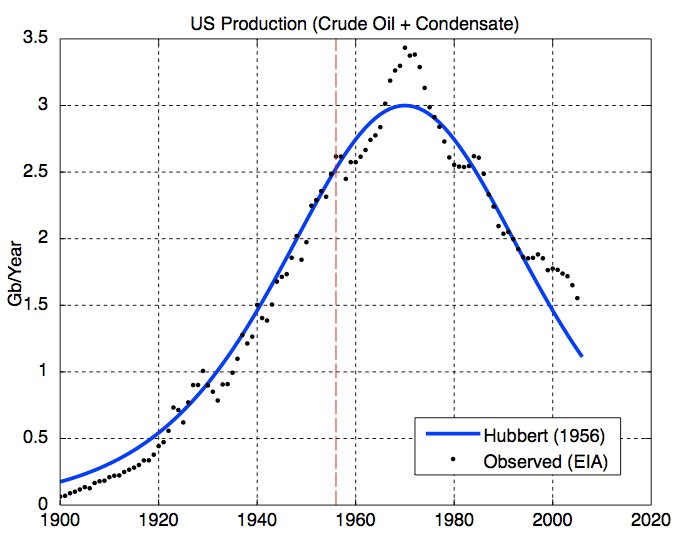

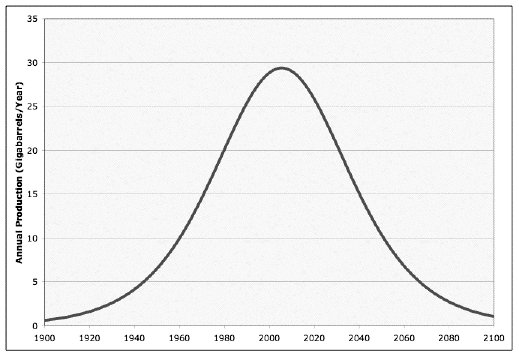

What motivated people to go to such a remote and hostile place to look for oil? The answer is a phenomenon called "Peak Oil." In a 1956 paper, Shell Oil geologist M. King Hubbert extrapolated from the rates of exploration and exploitation that oil production in the USA would peak around 1971, and decline thereafter.

Since the "Hubbert Peak," USA oil production is down to less than 40% of the top years. We have not run out of oil, but the oil that is easy to find and cheap to produce is long gone. We mostly made up the shortfall in demand by importing oil from other parts of the world. But remaining domestic oil exploitation and production pushed into more remote, more difficult, more expensive, and more risky areas.

Few people realize that the Deepwater Horizon blow out occurred at one of over 3,800 wells drilled in the Gulf in the last 30 years. Collectively, these wells provide about one-third of USA domestic oil production.

In our addiction to oil, we tolerate enormous risks. As events sadly show on the Gulf Coast, we do not have technology to deal with massive oil spills after they happen. We recovered Only 8% of the oil spilled from the Exxon Valdez, in conditions much more favorable than the Gulf. We are dealing with the current disaster with essentially the same inadequate tools, and much more challenging conditions of geography, water temperature, and weather.

Mounting evidence shows that in its rush to get a well into production a little sooner, BP took too many short-cuts in prevention technology and procedure. They bypassed or curtailed standard inspections and tests on the blow out preventer (BOP), and possibly used one not sufficient for its challenging environment. This much we know even before formal investigation results.

Society's addiction to oil pushed BP into alien, dangerous territory. Perhaps it also pushed them into taking risks they knew, or should have known, to be fool-hardy. But that is the consequence and face of Peak Oil.

The USA is now almost 40 years past its Hubbert Peak. Unfortunately, the Hubbert Peak for the entire world just happened.

Soon the world will follow the USA in pushing oil exploration and production into areas of higher and higher risk. Without more care, Deepwater Horizon disasters will occur more frequently around the globe.

The USA can import oil from the rest of the world. But the world, as a practical matter, can't import oil from beyond Earth. Yes, it's out there, on Titan, in quantities that would make a BP CEO or a Saudi sheik ... well, pick your own metaphor. But only at a cost that, gram for gram, would exceed the price people pay for diamonds. By the way, diamonds, which consist of pure carbon, can burn.

There is a silver lining to the foul cloud of oil forming under the Gulf of Mexico and lapping at our beautiful, precious, and fragile shores. World Peak Oil means that oil prices are headed inevitably upward - even without delays and new restrictions on drilling in the Gulf that seem more likely as political fallout from the Deepwater Horizon blow out.

Alternate energy sources perform competitively against oil at $60 to $100 per barrel. We saw oil prices spike at over $140 per barrel in 2007, then sink as the world-wide mega-recession (mini-depression?) set in, moderating demand for energy. Economic recovery will drive more demand for energy, which will drive higher prices, which in turn will drive a massive shift in investment from black energy to green energy. It's a lot cheaper to invest in technologies like wind, solar, and biofuel that are proven on Earth than to pursue the sirens of Titan.