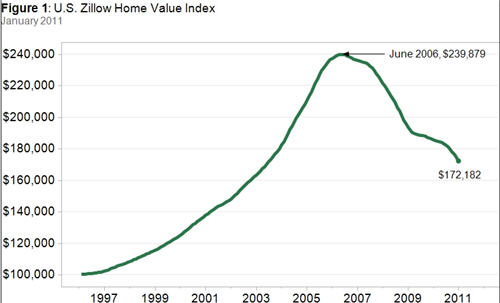

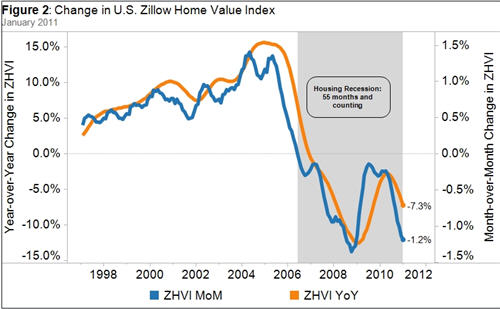

The pace of home value declines further accelerated in January with monthly home value depreciation reaching 1.2 percent and annual depreciation hitting 7.3 percent. This rate of monthly depreciation is the highest seen in the national index since December 2008 (see Figure 2). The median home value nationally in January was $172,182, down 28.2 percent from its peak in June 2006 (see Figure 1).

Of the 131 metropolitan regions with a Zillow Home Value Index in January, 124 metros experienced year-over-year declines in home values (95 percent), four metros saw annual increases (3 percent), and three metros were flat from year-ago levels (2 percent). The markets experiencing the largest annual declines in home values included Ocala, Pueblo, Mobile, Flagstaff, Atlanta, Spokane, and Detroit.

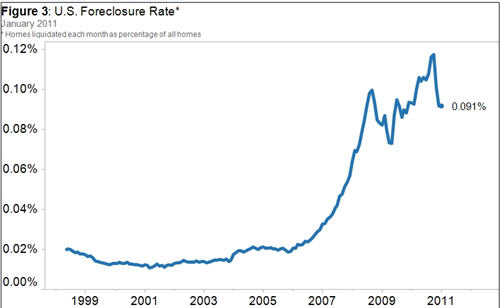

The rate of foreclosure liquidations remained steady in January at 0.091 percent, indicating that 9.1 homes out of every 10,000 were liquidated in the month (see Figure 3). The foreclosure liquidation metric peaked in October at 0.12 percent, and the recent declines are attributable to delays and lengthened processing times resulting from the fall 2010 "robo-signing" controversies. It's unclear right now whether this new lower level represents a more permanent peak processing capacity of a slower overall foreclosure process or a transitory low point because of the temporary moratoriums, in which case we should expect the liquidation rate to continue its upward march that was interrupted by the moratoriums.

We continue to believe that these high depreciation rates are death throes of the 55-month-long housing recession visited upon us at this time because of the full expiration of the federal home buyer tax credits. Further, we believe we'll start to see some stabilization and then reduction in the depreciation rates in the spring numbers ahead of an eventual bottom nationally later this year. Downside risks to this forecast are numerous, but probably the single most important downside risk is that the continued elevated foreclosure rates are not fully offset by higher demand introduced by declining unemployment and a higher post-recession household formation rate. If not, then supply will continue to substantially outpace demand in the housing market, thus keeping depreciation forces in play and delaying the eventual bottom. At this point, however, our best synthesis of the various data points continues to suggest a real estate bottom later this year.