You need to do one thing very well to succeed in the mortgage business, and large banks are learning that lesson the hard way. They have been focused on too many things, and as a result, they are experiencing disruption and are retreating from the mortgage business. While this isn't a good situation for the banks, it's a great opportunity for consumers, who can benefit from better and more affordable services from smaller independent companies, which aren't held back because of conflicts of interest or too little time to devote to mortgage borrowers.

Mortgage Brokers: One of the Last Professions that Still Provides Value

Buying or refinancing a home is the most important financial decision that a consumer will make, and it's easy to feel uneasy or nervous in that situation. So naturally, mortgage borrowers want to work with a partner who makes them feel comfortable and can find them the best rates and terms for their specific situation. Banks that have 20 or more lines of business aren't able to devote the time needed to deliver this personalized service. If a company is good at a lot of things, it can't be great at anything. And because they have their own in-house mortgage lending businesses, banks don't have the incentive to search far and wide to find the best value for borrowers.

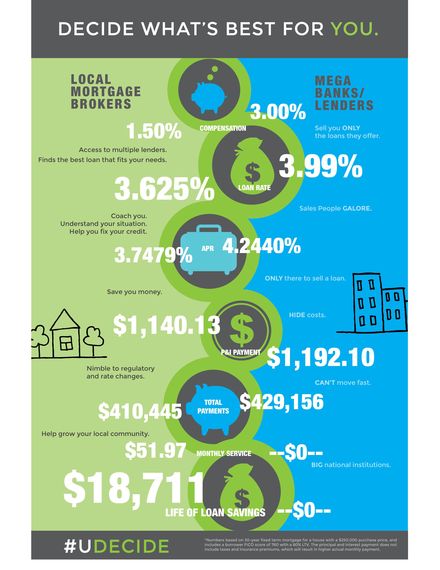

Unlike banks, mortgage brokers are great at one thing--finding the loans that truly provide the best value for individual consumers. That is why they are such a big threat to banks' lending businesses. Independent mortgage brokers are local professionals in your community whose primary focus is finding the best mortgage program and terms for homebuyers, and for homeowners looking to refinance. Independent brokers have access to hundreds of lenders, giving them the ability to shop around to find the best terms and conditions based on each individual consumer's specific needs and wants.

Unfortunately, mortgage brokers have been wrongly stereotyped as a notch below car salesmen - merely "middle men" who upcharge mortgage transactions so they can get a bigger cut. But that's not true. After the financial crisis of 2008-2009, regulation was introduced to the mortgage industry that has held all mortgage companies to a higher level of accountability, which now makes it even more obvious to choose a mortgage broker. New rules have made it so that brokers can no longer make more money by using a specific lender to close loans; they make the same amount of money on each transaction, regardless of lender. This gives borrowers complete assurance that brokers are 100% aligned with their goals, which is a huge win for consumers across the country.

Banks Feel the Heat, and Get Out of the Kitchen

A growing number of large banks have left the mortgage business since the financial crisis, and those who haven't already exited continue to scale down their exposure. In his letter to shareholders in JPMorgan Chase's most recent annual report, Chairman and CEO Jamie Dimon answered the question, "Why are you still in the mortgage business?" His response began:

That is a valid question. The mortgage business can be volatile and has experienced increasingly lower returns as new regulations add both sizable costs and higher capital requirements. In addition, it is not just the cost of the new rules in origination and servicing, it is the enormous complexity of those new requirements that can lead to problems and errors. It is now virtually impossible not to make some mistakes--and as you know, the price for making an error is very high.

Dimon wrote that JPMorgan would remain in the mortgage business, but had reduced its number of mortgage products from 37 to 15, and would finish rolling out a new system for mortgage originations. He also wrote that JPMorgan has "dramatically reduced" its Federal Housing Administration (FHA) originations.

In response to this ongoing trend among large banks, mortgage brokers have decided to work with wholesale lenders because they offer more affordable and flexible mortgage terms as a benefit to consumers. Since mortgage brokers only focus on finding the ideal mortgages for their clients, they also have the flexibility to streamline the loan-shopping and approval processes in ways that banks can't, while ensuring that their clients remain compliant with changing regulations.

A Goldmine for Homebuyers & Homeowners

The biggest financial institutions are getting hit by disruptors on all sides because they try to deliver too many different services to consumers. It's hard to be great at one thing when you're focused on so many different things. This challenge for banks has created a potential goldmine for consumers, who can now choose from a wide variety of smaller, independent competitors--mortgage brokers and the smaller lenders they leverage--to identify the mortgage solution that is best-suited to their goals and budgets. Mortgage brokers are helping Americans achieve the dream of homeownership by matching loan products with individual consumers' specific needs.

In today's era of historically low interest rates, consumers should take a close look at the mortgage brokers and alternative lending options that are disrupting banks in the mortgage sector. If you are looking to buy a house, or have a 30-year fixed rate mortgage with an interest rate above 4%, you should contact a local mortgage broker to see if they can help you achieve your goals the easiest way possible.