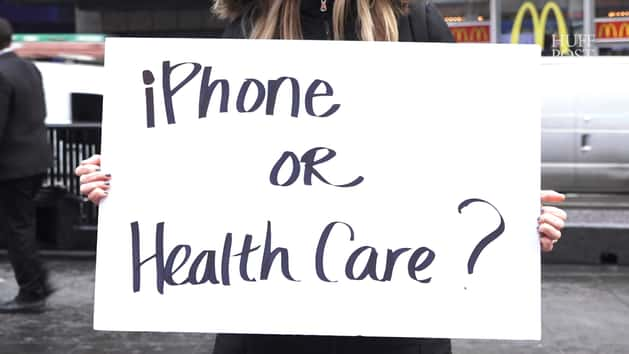

Rep. Jason Chaffetz (R-Utah) was widely mocked on Tuesday after suggesting that Americans who struggle to afford health care should sacrifice “getting that new iPhone” and instead choose to “invest in health care.”

What Chaffetz’s remark overlooks is that a cellphone bill is just one of a typical household’s monthly expenses, many of which cost as much as or more than health care. Many Americans may struggle to pay these expenses should the House Republicans’ Affordable Care Act replacement plan, which offers less assistance to low-income people, become law.

Under the current health care law, a standard health plan for a 40-year-old nonsmoker costs around $4,400 a year without financial help, or $2,485 if they qualify for aid. That’s comparable to what the average household spends on things like housing, transportation and food each year. Should premiums rise under the new plan, these are the real things that low-income families may have to sacrifice to afford coverage.

According to the Bureau of Labor Statistics, the average household earning between $15,000 and $29,999 a year spends $30,974 annually ― which means they are already spending more than they are earning. If health care costs rise, these families will likely look to make cuts in their existing expenditures or face falling further into debt.

Here’s a look at where those cuts may have to come from:

Housing

Households earning between $15,000 and $29,999 spent an average of $6,840 on rent or mortgage payments in 2015, according to the BLS data. Utilities and other housing-related costs drive expenses even higher. The average household in that income bracket spent $2,953 on utilities in 2015, and an additional $1,395 on furnishings, housekeeping supplies and other home goods.

Americans at all income levels spent an average of $10,742 annually on housing. Depending on where one lives, housing costs can be much, much higher. In California, for example, median rent as of January was $2,400 a month, or $28,800 annually. And energy costs can vary greatly by location, topping $150 a month in states like Connecticut and Hawaii, according to the U.S. Energy Information Administration.

On average, Americans spend about 30 percent of their annual household income on housing and related expenses.

Transportation

After housing, the next biggest expense for most people is transportation, including car payments and gas. The vast majority of American households own at least one car, so although some people are able to save significantly by using public transit, most Americans are spending 16 percent to 19 percent of their annual income on transportation.

According to an Experian report released in 2015, the average monthly payment for a new car was $483 a month, or $5,796 annually; owners of used cars paid $361 a month, or $4,332 annually. Leased cars, meanwhile, cost on average $394 a month, or $4,728 annually. (These figures are the average of all income levels, not just low-income households.)

On top of that, households earning below $30,000 spent an average of $1,291 on gas and oil in 2015.

When adding on insurance, maintenance, tires, registration and other costs, the average total cost of car ownership in 2015 rose to $8,698 a year, according to a study from AAA.

Food and groceries

Households earning between $15,000 and $29,999 spent an average of $4,394 on food in 2015. More than half of that was spent on groceries consumed at home.

Households in that income bracket also spent $995 on clothing and shoes.

Student loans and other debt

Debt is a major expense in many American households. A 2015 NerdWallet study found that the average U.S. household owed $16,748 in credit card debt and $49,905 in student loans. It also found that households pay an average of $1,292 in credit card interest annually.

For younger Americans, student loans come at a significant annual cost. While loan rates vary depending on the amount owed and the length of the loan, many new graduates are paying over $300 a month, or at least $3,600 annually.