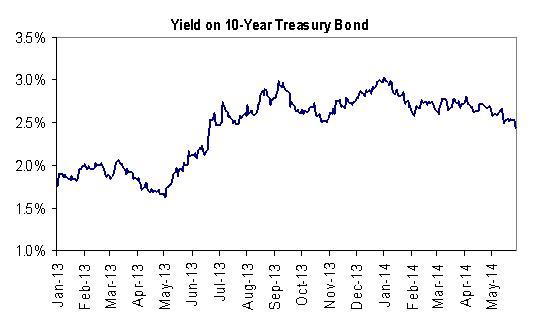

An aggressive rally in the Treasury market this morning has resulted in the lowest 10-year Treasury yield since June of last year. Nearly everyone is looking for an explanation as to why longer-term interest rates continue to fall in the face of reduced Fed support and better economic data. So what is going on? We don't claim to have all the answers, but we'll try to shine some light on an issue that is causing much consternation throughout the financial world.

The Fed's "Quantitative Easing" Program

The Federal Reserve has been supporting Treasury bond prices (and suppressing yields) for the past several years by buying large quantities of bonds each month in an effort to increase investment and consumption, and force investors into riskier assets (thereby creating disposable wealth). During the latter stages of the Fed's so-called "Quantitative Easing" program, we have consistently voiced our opinion that the Fed is now creating risks far greater than the incremental benefits of QE. It is true that ultra-low interest rates have supported housing price increases and have led to skyrocketing stock prices. In fact, household net worth has increased by $25 trillion from the financial-crisis lows (first quarter of 2009). However, these gains in net worth have overwhelmingly accrued to the well-to-do while low- to moderate-income folks continue to suffer from poor employment opportunities, stagnant incomes, inadequate retirement savings, and rising costs for everything from food and energy to health care and education. Moreover, there are many smart people who believe that asset bubbles may be forming as a direct result of the Fed's actions. But I digress.

Source: Bloomberg

Fed Taper = Lower Demand

More confident in the economy's direction, the Fed began the process of winding down its "QE" program late last year by "tapering" the dollar amount of purchases over a scheduled period of a year or more. The pace of Fed bond purchasing is now about half of what it was at its height, and most expect the Fed to completely discontinue incremental bond purchases by the end of the year. As the Fed has reduced its purchases of (and demand for) long-term Treasury bonds, nearly everyone had thought that the prices on these bonds would fall (and yields rise). Basic economics tells us that if demand declines, prices will fall as a consequence. But exactly the opposite occurred. Long-term bond prices have increased (and yields decreased) since the Fed initiated the taper in late 2013.

Stronger Economic Growth

Another factor contributing to the consensus opinion that interest rates will rise has been an expected acceleration in economic growth. Notwithstanding the weather-induced 0.1% GDP growth reported for the first quarter of the year, much (but not all) of the economic data we have received in recent months has actually been a little better. Job creation is up and unemployment down (although we are in the camp that believes the labor market remains weak); consumer confidence has improved; manufacturing has picked up; consumer and business credit is expanding; housing and stock prices are up; and the 1Q economic stagnation was chalked up to poor weather. In general, if economic growth is expected to accelerate, interest rates should rise as well. The reason for this is fairly straightforward. Increased demand for goods and services should lead to price increases. Inflation is one component of "nominal" interest rates. The other component is called the "real" rate of interest, and it is determined by the demand for money. As economic growth accelerates, the demand for money should increase as people become more confident in making spending and investment decisions. Therefore, higher inflation expectations and higher demand for money should lead to higher interest rates in a strengthening economy... but they haven't.

Inflation

Some of those who believe the Fed will stay firmly engaged in its monetary support and keep interest rates low (perhaps even reversing the taper) have pointed to decreasing levels of inflation, or disinflation. These economists believe the Fed is loathe to repeat the experience of Japan, in which deflation caused decades of economic stagnation. So when some of the key gauges of inflation became very low earlier this year, some concern developed among economists. However, more recent data suggest the disinflation may have stabilized or even reversed, and the Fed continues to say that the deflation will prove to be transitory. The evidence supporting the Fed includes recent increases in wages and rents and higher April readings for PPI and CPI. However, significant slack in the labor and manufacturing sectors continues to pose a threat. (For our part, we continue to believe the Fed should take into consideration asset prices (stocks and housing) and food & energy prices when formulating monetary policy).

So What is Causing the Decrease in Interest Rates

- One of the most plausible could be that there is simply a supply shortage. The federal government is not issuing nearly as much new debt as it had been when it was running trillion-dollar deficits, and issuance of corporates and mortgage-backed securities is down as well. Lower interest rates could simply be reflecting the fact that there is a scarcity of fixed-income product right now.

- Another explanation could be that investors worldwide are seeking a safe-haven place to stash their cash. As growth in emerging markets (read: China) slows and Europe and Japan continue to battle their own issues, these investors might be operating under the mantra that "return of investment" is more important than "return on investment". Moreover, buying assets denominated in US dollars can be an effective way for foreign investors to protect against home currency depreciation.

- In a similar vein, many investors may simply not believe that the economy is out of the woods. While we realize this is a circular argument, many investors may be insulating themselves from a possible recession by buying Treasuries. These investors may point to the declines in long-term Treasury yields as strong evidence that economic growth is about to slow dramatically. Therefore, the strength in bond prices (and decrease in yields) may be self-reinforcing, to a certain extent. The lower yields go, the more they fall.

Peace,

Michael