With 10 ways to get rich and stay rich.

Athletes and lottery winners, or anyone else who finds a pot of gold without getting the money smarts necessary to keep it, very often find themselves broke. We've heard about the most spectacular falls -- such as Mike Tyson and Kareem Abdul Jabbar - but, unfortunately, this sad outcome is far from rare. In an article from February 22, 2013, Mint.com released an infographic declaring that 78 percent of NFL players are broke within 5 years of retirement - despite earning more in a year than most of us make in a lifetime.

FINRA just reissued an Investor Alert on promissory notes that relates directly to this problem. The latest victims of this familiar Ponzi Scheme were current and former NFL and NBA players who invested $19.4 million with a bankrupt shyster. Restitution in the amount of $13.7 million has been ordered. That might sound like a decent outcome, however, the athletes are unlikely to see all of that money. Getting that judgment costs legal fees, so the amount actually returned to the athletes could be pennies or dimes on the dollar.

Just yesterday, I was having lunch at Elway's in Denver, Colorado (yes, the John Elway, Bronco quarterback), when a drunk guy (who was clearly not an athlete) stumbled in with a wad of hundred dollar bills in his fist. He blurted out, "I've never had this much money in my life!" Of course, I, and the business people in the booths next to me, shared a concerned glance, knowing that he wouldn't have it for very long. In fact, he tossed a bill at me just for being beautiful (and for sitting in the right spot, I guess), as he shot back his whiskey and guzzled a pint of domestic ale.

For some people, it's not just money, or their home and possessions, that they lose. Far too many suicides and homicides are money-related. A few years back, in Santa Monica, California, a young football player, who had just been cut from his NFL team, drove his brand new Escalade into a tree. Those who loved him most, and even those, like me, who never knew him, wish that $80,000+ SUV could have been traded in for a new lease on his young life.

These are preventable problems. When a little information and education can solve the issue, that's the easiest, and the most permanent, cure.

Here's a 10-Point Checklist to Ensure that You Walk on the Path of Prosperity

(no matter what your income is)

1. Have a 10-Year Game Plan.

2. Live Within a Thrive Budget.

3. Know What You Own.

4. Learn the Basics.

5. Take Ownership.

6. Keep Players in Their Position.

7. Win, Don't Whine (or Sue).

8. Own Your Home.

9. Protect 10% of Income from Financial Predators.

10. Know Your Exit Strategy. Get Educated.

And here are examples and details on each point.

1. Have a 10-Year Game Plan. The average career of a NFL player who makes the roster is only six years; the average career of NFL players in general (including those who get cut) is only three and a half years (source: NFL.com). Yet, the minute that first check hits their account, many start spending like a millionaire. A 3-year jackpot game plan has a high probability of landing you in bankruptcy court. A game plan that makes sense before, during and after your heyday could set you up for a rich, fulfilling lifetime, using your talents as a team player as a great springboard.

2. Live Within a Thrive Budget. If athletes were operating according to the Thrive Budget, and limiting their basic needs expenditures to just 50 percent of their income (or less), they would be protecting 10 percent of their income in tax-protected, financial predator proof protected accounts (401Ks, IRAs, health savings accounts, trusts, foundations, etc.). 10 percent would be set aside for education (offering a fantastic game plan for life post-pro sports and a Plan B for continuing your education, if you get cut from the team). 10 percent would go to charity (tax deductible + the ability to build up a solid, diverse team of friends outside of sports). Fun, R&R, splashy cars, fancy clothes, expensive jewelry and fly-by-night friends would be limited to 20 percent of the annual income. (That's still a lot of dough to be able to blow.) Smart energy users can even save up to 90 percent on their electric bill. All kinds of freedom await you when you get money smart about allocating your income in a sustainable way, and stop making everyone else rich.

3. Know What You Own. Money managers, like doctors, can be dedicated and talented, or lazy and detrimental. Unlike doctors, money managers do not have to go through a decade of schooling to get licensed. As Kareem Abdul Jabbar writes, "I chose my financial manager, who I later discovered had no financial training, because a number of other athletes I knew were using him." So, don't buy into the sales line that money managers are "surgeons" of your money, without checking to see how much education they really have. The only way that you can ensure you have a good plan for investing your money is to truly know, and understand, the risks and rewards of what you own.

4. Learn the Basics. You don't have to build your own home to know how many bedrooms, bathrooms and square footage you need. You don't have to select every fund, in order to ensure that you are diversified and have enough safe in your nest egg. Learn the basics. Otherwise the money manager, just like the home builder, could be giving you far more than you need -- just for the commissions and fees they receive.

5. Take Ownership. If someone loses your dough in a bad investment, it's your money, not theirs, that disappears. As Joe Moglia, the chairman of TD AMERITRADE always says, "No one cares about your money more than you do." Your future, which is seeded from the investments of today, depends on you.

6. Keep Players in Their Position. CPAs are tax specialists. Options trading pros are not trained to protect you and keep you safe. Brokers have both restrictions and incentives on what they can and can't sell you. You don't have to get a Ph.D. in economics to simply understand that you don't want your linebacker running downfield for the Hail Mary pass, or your CPA (who is hired to minimize your tax burden) trying to pick which investments offer the best Return on Investment (ROI). Your agent may be great at negotiating higher salaries, without knowing the first thing about building casinos in Atlantic City, or whether or not his buddy has enough experience to manage your estate.

7. Win, Don't Whine (or Sue). Trying to sue your way to victory is another sure way to bankruptcy. Lawyers are expensive. Make it your job to put together a winning 10-year budgeting and investing plan, with qualified financial partners who are committed to working together and doing an outstanding job, and stick to it. If you get cut from your position, or lose your job, act quickly to realign your game plan with the new reality, so that you can create a tomorrow that makes sense. Before you sue anyone, or hire attorneys for any reason, do a forensic analysis of what you stand to gain, versus the price of the pursuit. The best return on investment occurs as a result of great planning, rather than suing someone to gain back losses.

8. Own Your Home. Interest rates are at an all-time low. If your 10-year plan includes staying in the same city, then chances are that buying a home you can afford is a great investment -- provided you don't purchase your home at too high of a price. Why? In many cities, it is as cheap (or cheaper) to buy than it is to rent. You get to write off the amount you pay in interest, offering a great reduction in your tax burden. And you have the potential to earn capital gains on the home itself. Make sure that your home purchase fits into the 50 percent to survive portion of your Thrive Budget. (You'll also need transportation, heat, food, clothing, insurance and to pay taxes, etc. to survive.) Over the past 30 years, real estate has increased in value 5.74 percent every year, on average (including the most recent real estate bust).

9. Protect 10 percent of Income from Financial Predators. According to Marion Jones, the Olympic all-star who declared bankruptcy in 2007, she lost a lot of her money on lawyers. "Bills, attorney bills, a lot of different things to maintain the lifestyle," she said in bankruptcy court, explaining why she was down to her last $2000. Survivor winner Richard Hatch went to jail for tax evasion. Living is expensive. The minute you hit the jackpot, you get very popular with Uncle Sam (taxes), the debt collector (credit cards), the utility company (all those late night raves), the cell phone company (get a better data plan), the bank, the county tax collector, money managers, attorneys, unscrupulous scam artists (who trip on your front porch), fair weather friends and more. That is why it is important to protect your money first, no matter what, in IRAs, HSAs and 401Ks because that money is yours to keep forever -- no matter what. No one can sue you to take it away. This is another call to get money smart, so that you can employ all of the legal ways of reducing taxes, compounding gains, protecting your assets and limiting your financial exposure.

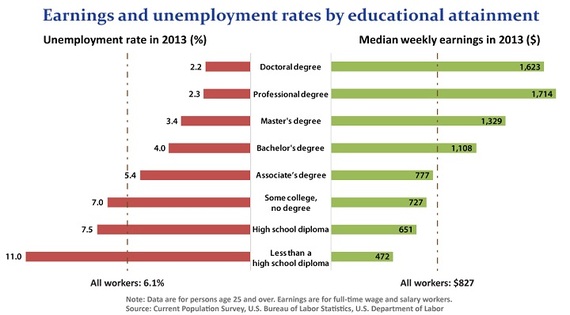

10. Know Your Exit Strategy. Get Educated. Athletes are not the only professionals who need an Act 2 in their career. Most of us are switching jobs every eight years these days. No matter how secure you feel in your job, keep up your commitment to lifelong learning and that 10 percent of your budget that supports it. Education is the highest correlating factor with income. The more you know; the more you earn and the less likely you are to be unemployed in the years ahead. The more you know about financial literacy, the easier it will be to protect your assets, compound your gains and avoid crippling (or bankrupting) losses.