Do you remember the Heritage Foundation's recent report on immigration, the one that falsely claimed the cost of comprehensive reform would cost taxpayers trillions? The one written by a disgraced "senior policy analyst" who previously argued that there are inherent IQ differences between races and that "low-IQ immigrants" should be kept out of the country?

Now America's leading conservative think tank has issued a report on health care premiums under the Affordable Care Act (ACA) and it bears a strong resemblance to the immigration study -- it's garbage.

The Heritage study says health insurance premiums will skyrocket for people who buy coverage through the ACA online marketplace. But that's not true, and it neatly illustrates how politicians and groups obsessed with nullifying President Obama's signature legislative accomplishment will say or do anything to make their case.

The Heritage analysis is deceptive because it does not factor in the substantial premium subsidies most consumers will receive to help them pay for their insurance. Heritage simply pretends these subsidies, in the form of tax credits, do not exist. Leaving out the most important factor in this equation is precisely how the "Heritage Health Insurance Microsimulation Model " reached a conclusion that supports the political agenda of Republican extremists who can think of no domestic policy other than attacking the ACA.

Unlike Heritage, consumers won't pretend the tax credits don't exist. The premium subsidies are a big reason ACA coverage will be affordable. For example, while the premium for a particular plan may be $241 a month, the cost to the consumer after applying the tax credit may be only $143 a month. That's a huge difference.

Thanks to the tax credits, health insurance that would otherwise be out of reach can now fit within a family's budget. In fact, nearly six in 10 uninsured Americans will be able to get insurance for less than $100 a month in the Health Insurance Marketplace. Of the 7 million people expected to enroll in 2014, 6 million will qualify for subsidies.

For the benefit of the researchers at Heritage, here's how the tax credit system works: Individuals and families purchasing insurance on the ACA marketplaces will be eligible for premium subsidies on a sliding scale if their income is less than 400 percent of the federal poverty level ($94,200 for a family of four in 2013 and $45,960 for an individual). Fully 67 percent of Americans have incomes in this category. These tax credits are instantaneous and are paid by the government directly to the insurance company, thereby reducing the cost of the premium. Individuals who qualify for subsidies in the marketplace therefore actually pay significantly less than the "sticker price" premium.

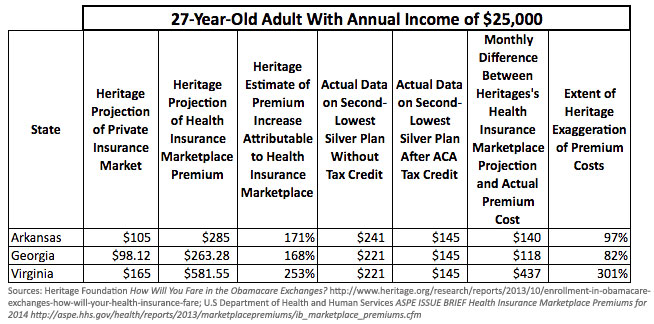

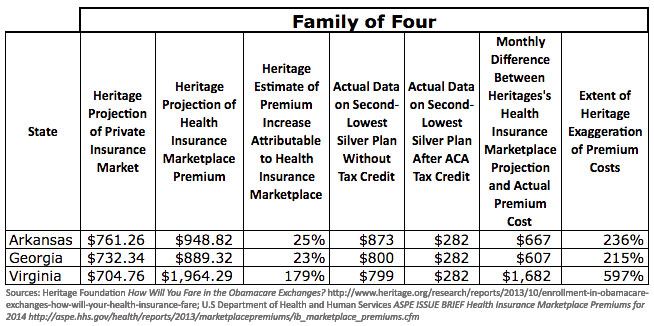

Because the Heritage Foundation uses numbers that misrepresent the facts, let's look at numbers that show the truth. As it happens, HHS has released data that tracks Heritage's calculations for a 27-year-old individual and for a family of four. This data is compared with Heritage's estimates for the three states where Heritage claimed the greatest increase in premiums: Arkansas, Georgia and Virginia. The charts say it all.

This post is based on material originally published Oct. 18 in the Health Care for America Now blog.