By Steven Kelly

In recent years, and especially since the financial crisis of 2008, the world has been plagued by a shortage of safe assets. As it became clear that financial institutions and governments across the developed world that were perceived to be safe in the pre-crisis era were overexposed to toxic assets or no longer had an implicit backing from safe governments, the safe asset supply crashed. Trillions of dollars of safe assets such as the sovereign debt of highly-indebted Eurozone countries, financial company commercial paper, and housing debt were no longer viewed as safe. Investors have since piled into the long-term sovereign debt of the few countries still perceived as risk-free, such as the U.S. and Germany. The drop in safe asset supply combined with a post-crisis increase in investors' risk aversion has pushed safe yields to record lows, limiting the effects of central banks' stimulus programs.

To be sure, prices exist for the purpose of clearing markets; the historically high prices for safe assets do not, in themselves, imply there is a shortage. However, if there was a price ceiling on these assets, a distortion would be introduced into the market that would create the conditions for the possibility of a shortage. Presumably, if the price of long-term safe assets became too disjointed from the expected path of short-term interest rates--which have been stuck at their lower bound of 0% or slightly negative--investors with the access and freedom to invest essentially-limitless short-term safe asset (bank deposits, central bank reserves, etc.) could earn risk-free profits by shorting the long-term assets, thus capping their price and leaving the yield on safe assets above the market-clearing yield. This would encourage other investors to pile into these safe assets with excess risk-adjusted returns and out of risky assets that would do more to directly influence economic growth.

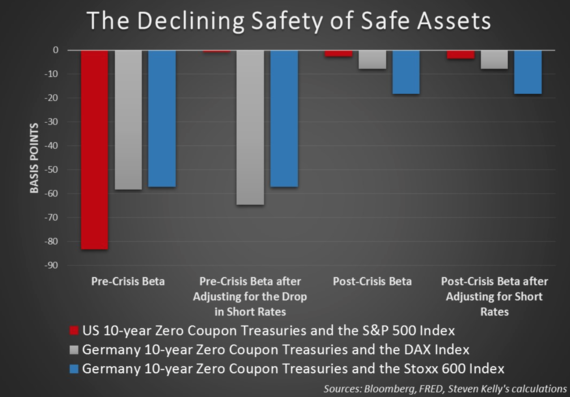

Has a price ceiling reduced the overall safety of the world's safest assets and left their yield artificially elevated? The data suggest yes. Historically, prices of long-term safe assets have been negatively correlated with risky assets--in other words, they had a "negative beta." That is, as part of a portfolio, these safe assets would provide insurance against a fall in value of more profitable--but riskier--assets. Before the end of 2008, when the U.S. Federal Reserve hit the zero lower bound (ZLB) of the short-term interest rate it had traditionally used to set monetary policy, an investor could expect a 10-year US Treasury to rise 84 basis points (0.84%) during a 1% fall in the S&P 500 stock index. Similarly, 10-year notes of the German government had a negative beta with Germany's DAX index and Europe's Stoxx 600 index of about 60 basis points. These negative betas have essentially disappeared since 2008.

For U.S. monetary policy, this should come as somewhat unsurprising. After accounting for the precipitous drop in the short-term risk free rate since the 1980s, the pre-crisis insurance value of the 10-year Treasury disappears. Thus, post-2008, when short rates and expectations of short rates into the near future have been pinned at or near their lower bound, long-term Treasuries have hit a price ceiling and become zero-beta assets like their short-term counterparts (T-bills, bank deposits, etc.). In Germany, even after accounting for the decline in short-term rates, long-term German bonds maintained their insurance value in the pre-crisis era; however, since then, their negative beta has cratered.

Though the safe asset market still isn't clearing, safety has become much more expensive, and many more safe assets are needed in a portfolio to achieve the same level of safety. Investors are getting less for more.

These data should inform monetary policy in a number of ways in the present and for future crises. In the Eurozone, the ECB's price growth mandate explicitly treats 2% as an inflation ceiling; in practice, the Fed has treated its 2% inflation target the same way. Raising the inflation target would help prevent either of these central banks from hitting the lower bound on nominal interest rates. By retaining the ability to cut rates, the ECB and the Fed would be able to keep safe assets from hitting their price ceiling. Relatedly, monetary policymakers could shift to a more symmetric treatment of their inflation targets. By signaling a willingness to let price growth rise above 2% to make up for the consistent undershooting of the inflation target, central banks could more effectively offer forward guidance--effectively cutting future short-term rates when they can no longer cut current ones.

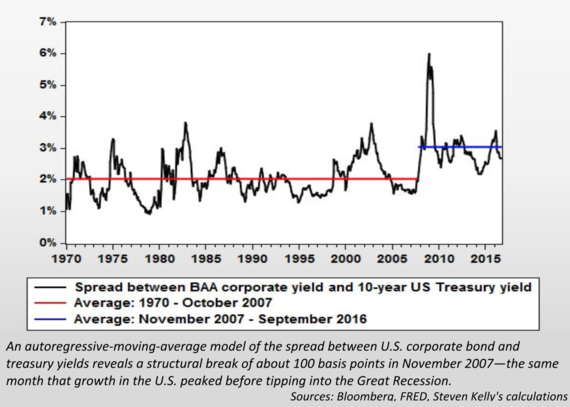

With central banks currently lacking the credibility to commit to any more meaningful forward guidance, the traditional government bond purchases of central banks' quantitative easing (QE) programs--by running up against safe asset price ceilings--have hit the limit of their effectiveness. This suggests QE stimulus measures should be directed more towards markets where risk aversion has contributed to higher credit spreads than are consistent with historical standards and underlying economic fundamentals--such as equities, asset-backed securities, or corporate debt (see below). This would be a more effective way for QE to avoid being neutralized by arbitrageurs and to positively impact economic growth in the real economy.

Finally, monetary policymakers should be considering the safe asset shortage in their rhetoric with respect to their balance sheet policies. Policymakers on both sides of the Atlantic have consistently reaffirmed that the post-crisis growth in the size of the central bank's balance sheet is only temporary and will be unwound. Demonstrating a greater appreciation for maintaining the size of the balance sheet for longer or forever would offer something in the way of forward guidance by signaling a commitment to a "lower for longer" path for short-term rates. This mechanism was on display in reverse during the 2013 "taper tantrum" when Fed-speak of tapering bond purchases led to a rapid upward repricing of expected future short rates.

Without any of these fixes, the economic woes of the developed world since the crisis and in the next crisis will continue to hold back economic vitality and political stability.