The decision about when to start Social Security is a bit like waking up one morning and finding an envelope filled with thousands of dollars sitting at your front door. Although you knew it would eventually be delivered, you never really thought much about it because it always seemed like a long way off. What should you do? Spending it seems like a fun idea. Or, should you resist temptation and invest it for a few years?

It's a rather weighty decision -- if you make what turns out to be the wrong choice, it can literally impact your lifestyle for as long as you live. And, like the majority of Americans, you essentially have one chance to get this right.

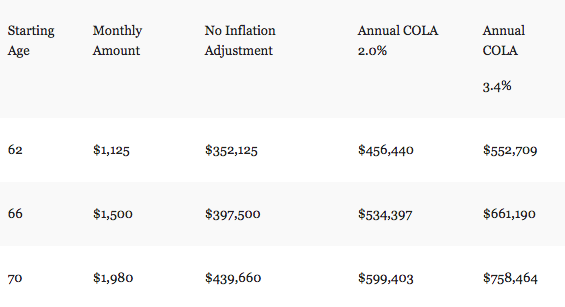

Consider an example: This year Joan turns 62, the earliest age to file for Social Security. By registering at www.ssa.gov, she found out that her benefit at "Full Retirement Age" (age 66 in her case) is estimated to be $1,500/month. If she begins taking Social Security at 62, however, her monthly benefit will be reduced by 25 percent to $1,125. This is a permanent reduction in her monthly benefit and therefore can impact Joan for the rest of her life. On the other hand, if Joan waits until the month she turns 70 to start Social Security (the latest age you want to file as benefits no longer increase after that) she'll receive $1,980/month.

Of course, delaying the start of Social Security is not always a viable option, especially if you have already retired and need income. But -- assuming she is able to -- what if Joan works for just four more years until she is 66, her Full Retirement Age (FRA)?

In that case, Social Security would pay her $18,000/year instead of the $13,500/year she would receive if she started at 62. In percentage terms, Joan would be getting a 33 percent raise by waiting four years.

Instead of thinking about your Social Security benefit in terms of a monthly amount, consider the cumulative income you might receive for the rest of your life. For example, by age 88, Joan could receive $350,000 or more, depending upon the age she files. That's a lot of money!

The hypothetical example below illustrates Joan's lifetime income from Social Security two ways -- with and without including an annual 2 percent cost of living adjustment (COLA) for inflation. Look how the age she chooses to claim Social Security could impact her lifetime benefit:

Hypothetical Illustration

Cumulative Income to Age 88

Given the significant amount of money they could be leaving on the table, why do 61 percent of retirees start their Social Security benefits before they are FRA, with 37 percent beginning at age 62?

The answer to this question often comes down to a few reasons:

1. They need the money: A no-brainer. If you need the income, by all means, start Social Security. That's what it's for!

2. They don't understand the financial hit they'll take: Lack of understanding about Social Security benefits is unfortunate, but easily remedied. There is a wealth of information, including benefit calculators, on the Social Security website. A financial advisor can also help you explore your options.

3. They're afraid Social Security is "going broke" and figure they'd better get it while they can: Understandable, given the fact that the media and politicians have suggested Social Security is "running out of money" and "a Ponzi scheme." In my view, the truth is, it really would not take much to put Social Security on a firm financial footing for the next 75 years.

4. They do not view Social Security as an "asset": The majority of Americans think of Social Security as, essentially, a monthly governmental I.O.U. The problem is, this mindset leads you to underestimate the true potential lifetime value of Social Security and, as a result, make potentially poor decisions about when and how to claim it. While there can be no guarantee that the future program will operate as it has in the past, Social Security is, in fact, a unique retirement asset: a government-sponsored, inflation-adjusted lifetime retirement income. There is not a single financial product you can buy today that exactly replicates this.

When you see Social Security in terms of the benefit you may receive over the rest of your life instead of simply a monthly check, you will think more carefully about when to start your benefit. It is truly a critical part of your retirement income plan, and something you should speak to your financial advisor about.

Notes: This article is provided for general information purposes only and should not be construed as investment, tax, or legal advice, or as a solicitation to buy or sell any specific securities product. We strongly advise you to consult with the appropriate financial, legal or tax advisors about your specific circumstances and individual goals as Social Security claiming decisions can be complex and personal.

1. The average monthly Social Security benefit for January 2015 is $1,328 or $15,936/year. This figure changes monthly. See more here.

2. Assumption: Joan is born on January 2, 1953. Calculations were computed using the Franklin Templeton Social Security Optimizer Tool. Unless stated otherwise, amounts are estimates based on certain assumptions, are hypothetical and not guarantees of actual results and do not reflect the impact of taxes.

3. Assumption: Joan continues to earn at her current income level until age 70.

4. According to Social Security, if you live to the average life expectancy for someone your age, you will receive about the same amount in lifetime benefits no matter whether you choose to start receiving benefits at age 62, full retirement age, age 70 or any age in between. However, monthly benefit amounts can differ substantially based on your retirement age. SSA Publication No. 05-10147 January 2014.

5. COLA is used to counteract the effects of inflation. The COLA increase for 2015 is 1.7 percent. The average annual COLA over the past 25 years is 3.4 percent. See more here.

6. This chart is hypothetical, based on certain assumptions, and for illustrative purposes only. Individual Social Security benefits will vary. Taxes have not been taken into account.

7. See

Table 6.A4.