The news out today told a story of Americans going back to their puritan fiscal roots.

Americans Pay Back Debts Most Since '52 as Jobless Spur Savings

(Bloomberg) -- For the first time since Harry S. Truman was in the White House, Americans are paying back their debts, a phenomenon that just might help keep interest rates low as the Treasury sells a record $2 trillion of bonds and rising unemployment increases U.S. savings.

The stable rock of the American citizen, repairing his balance sheet so that the Great American Economy can recharge with a clean slate, healthy and ready to take on the world. American Capitalism in action, continuing to work in the same way it has worked for hundreds of years.

At least that is what the first paragraph implies. Once you scratch the surface the story isn't nearly so pretty.

For instance, let's look at the second paragraph of this story.

While the proportion of consumers without jobs rose to 9.5 percent last month, household borrowing fell to 128 percent of the average family's after-tax income in the first quarter from a record 133 percent in the same period a year earlier, according to data compiled by Bloomberg. The total debt of individuals, nonfinancial companies and federal, state and local governments grew at a 4.3 percent pace at the start of the year, down from a peak of 9.9 percent in the fourth quarter of 2005, Goldman Sachs Group Inc. estimated.

Uh, if total debt is increasing then how is the country supposedly paying down its debts?

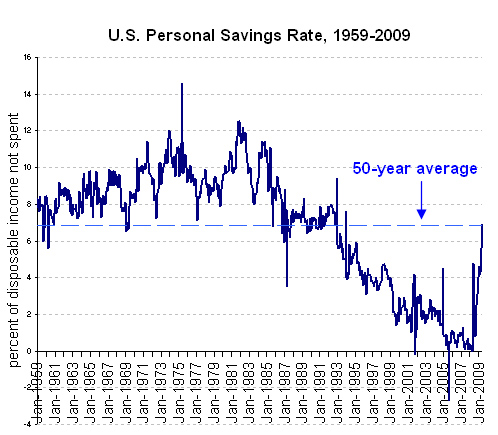

Let's ignore that question for now, and look deeper at the Commerce Department numbers. Their claim is that the savings rate is 6.9% in May, the highest since 1993.

It sounds impressive until you put it into perspective, by looking at where we are coming from. For instance, in 2007 Americans saved $57.4 Billion. At the same time they gambled away $92.3 Billion. That's a far cry from our puritan roots.

Americans are being forced to save now because their net worth has taken a brutal double-punch from the housing bubble bust and stock market crash.

But have Americans really started saving at a 6.9% rate? Let's look at how the Commerce Department puts together their numbers.

The Commerce Department measures total personal income, then deducts personal spending to arrive at what was saved.

...

That's what happened in May: One-time federal stimulus payments of $250 each to retirees and others receiving government aid -- so-called transfer income -- drove total personal income up 1.4% from April, while spending rose a modest 0.3%.

That boosted what the government calculates was left in people's pockets. Savings as a percentage of total disposable income jumped to 6.9% from 5.6% in April.

That one-time event merely moved private debt to public debt. The debt didn't actually get paid off.

Of course that isn't the only way that the numbers are skewed.

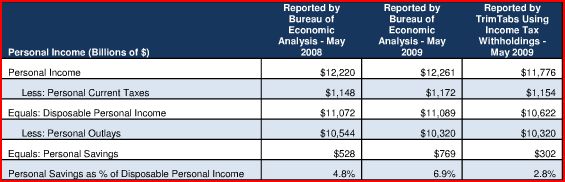

Trimtabs broke the numbers down to more basic elements.

Our analysis based on real-time income tax deposits indicates the real savings rate is a paltry 0.9%. Consumers are in much worse shape than government statistics suggest and have little money left over to repair their tattered balance sheets.

Trimtabs attacks the Commerce Department's most basic assumptions about wages and salaries.

the BEA is overstating income from wages and salaries and income from non-wage sources, which inflates the savings rate. Income tax deposits to the U.S. Treasury, which are reported in the Daily Treasury Statement (DTS), show the economy is contracting much faster than the BEA is reporting. Using this real-time data, we estimate the savings rate was only 2.8% in May.

Trimtabs also subtracts both the short-term "Make Work Pay" tax credit, and the $250 one-time stimulus payment earlier this year, thus we arrive at a 0.9% savings rate.

Trimtabs criticizes the BEA for using the Quarterly Census of Employment and Wages (QCEW), which is based on quarterly tax reports. The problem being that many employers pay unemployment taxes on only a small portion of their workers' salaries, and many of these payments are made at the beginning of the year.

Using the DTS instead of the QCEW, personal income would have fallen 3.6% y-o-y in May, rather than the 0.3% that the BEA reported.

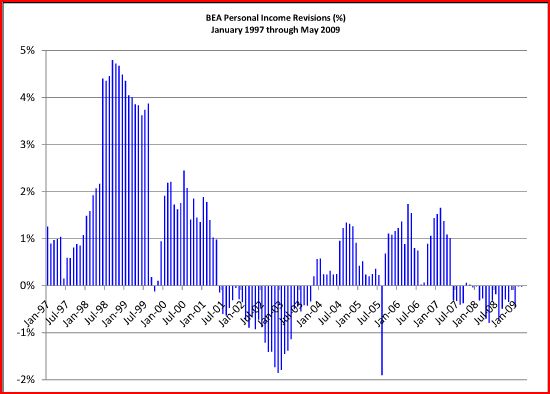

That's not to say that the BEA doesn't go back and revise their reports so they are more accurate. They just do after the numbers no longer have much meaning.

Once you look at real-time data, rather than BEA projections based on past quarterly data, the Green Shoots numbers wither and die.

Forecasts of positive economic growth by Q4 2009 are wishful thinking. Our real-time indicators show declines in wages and salaries are accelerating. Adjusting for the "Making Work Pay" tax credit, wages plunged 6.2% y-o-y in the past four weeks, worse than the 4.8% y-o-y decline in May and the 5.8% y-o-y decline in June.

...

July 4 was on Saturday this year and on Friday last year. Even with the boost from this additional withholding day, withholdings fell an adjusted 6.2% y-o-y in the past four weeks. "Other" taxes plunged 32.7% y-o-y in the past four weeks after falling 35.6% y-o-y in Q2 2009. Corporate income taxes fell 32.2% y-o-y in the past four weeks after dropping 36.7% y-o-y in Q2 2009. Incomes are dropping much faster than government statistics are measuring.

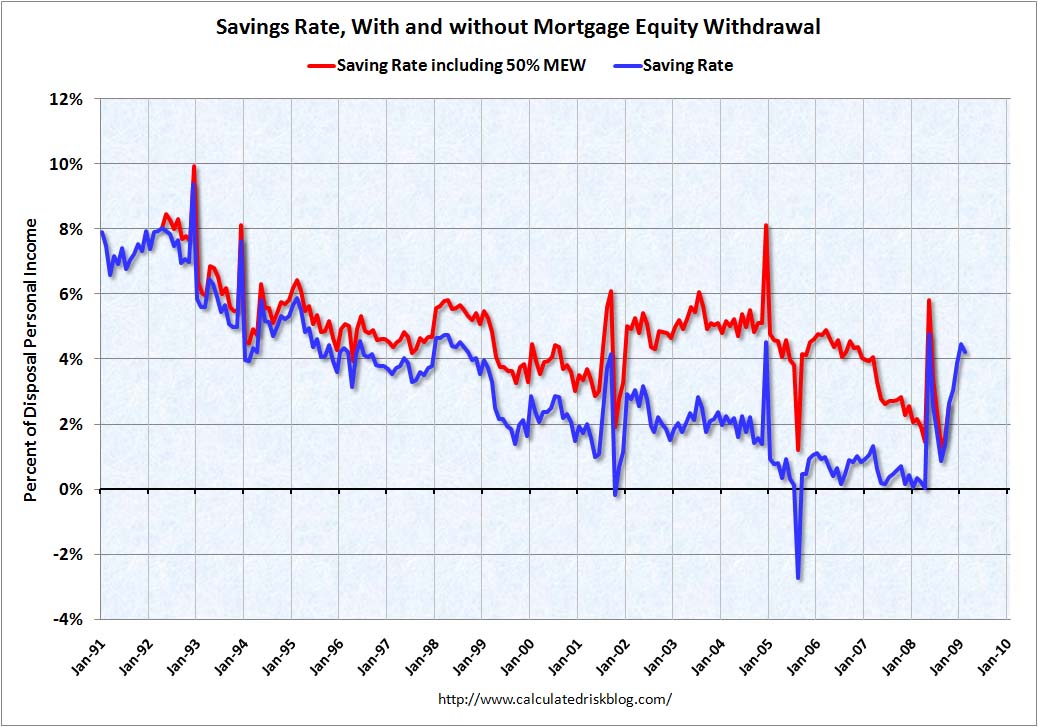

So why do BEA numbers showing a phantom, rising savings rate? The reason is largely due to the bursting of the housing bubble, which has cut off home equity withdraws.