Every time I think about the tax increase, I keep hearing a quote from the movie, The Princess Bride: "You fell victim to one of the classic blunders - The most famous of which is never get involved in a land war in Asia - but only slightly less well-known is this..." You don't raise taxes in a recession.

Yet, I can't see how investors will stop buying stocks and investing in entrepreneurial activities. I know the top 2% account for 30% of consumer purchasing. However, using this as an excuse is similar to the child that murders his parents and then pleads mercy as an orphan. As a friend said: "Clearly, the wealthy are not buying enough!" There is no evidence prior to the Bush cuts that anything was different.

The cuts were a gift; not a bad gift but a gift. I admit that joint filers earning $315,000 (i.e., after deductions $250,000) in New York City are NOT wealthy. I also realize that over time inflation and a modest amount of luck will increase the number of earners within the clutches of this dastardly tax increase. Still, NOT increasing taxes is just another form of deficit spending.

The following are fairly stable and slow-changing metrics that show the state of the economy today, not the future: (1) Consumer debt, (2) Long-term unemployment, and (3) Same-store sales.

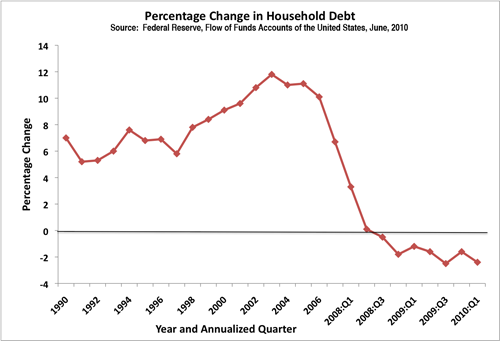

•We as a country have stopped over spending. We are an example of the economic conundrum that over underspending by consumers in a recession is bad. It's like paddling hard against the current. If you stop, the current will take you where you don't want to go. No spending, no new jobs (see Household Debt Graph).

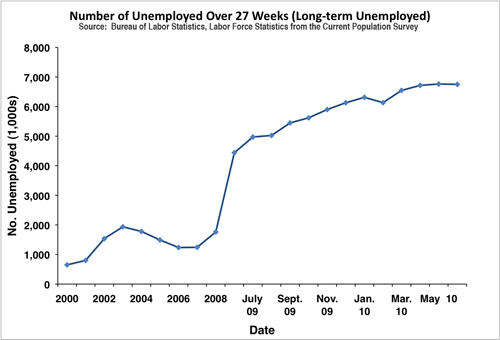

•Long-term unemployment (i.e., more than 27 weeks unemployed) is new for the US. Long-term unemployment, now almost equals the number of households without health insurance (see Long-term Unemployment Graph).

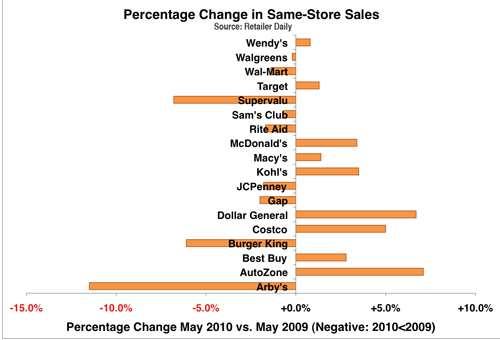

•The stock market tells us how US companies are doing in a global economy. Same-store sales are a good barometer of how they are doing in the US. US sales are flat. No growth and therefore no new employment. (See Same-Store Graph)

These stats are really why the Administration's plan bothers me. The Administration's plan is just plain negative. It is not a stimulus. The bottom 98% is not going to be invigorated and upbeat because Congress was smart enough to give them back what they already had. The top 2% will be upset and most assuredly some will be hurt.

The Administration caved on energy reform. This makes a tax hike the new number one priority. There is no question that taxes will increase in the future to pay for our deficit. We need tax reform in this country, but trying to Rube Goldberg reforms in a recession using the Bush Tax Cut as a template is sheer lunacy.

If we must go ahead with this debate, then the Administration and Congress needs to figure out how to lower taxes for the bottom 98% or anything else that makes this debate about stimulating the economy. The government will not use additional revenue in an efficient way. So far the stimulus package has created hypothetical jobs that can only be seen with sophisticated, and suspect, econometric models. Let's let the earners have a try.

Besides, the heck with the top 2%, let's pump up the bottom 98%. It's not punishment. It's economics. Just think of the hours of pleasure listening to Senators rail against a tax cut for the majority of voters.