In his speech in Osawatomie, Kansas, last week, President Obama proclaimed that Republican economic policy -- trickle-down, supply-side, tax-cutting economics -- "doesn't work." It has been tried, he said, and it "has never worked." Is he right? Or is this just more political blather? To see, we need to go back to basics, back to Reaganomics.

Ronald Reagan swept into Washington touting the theory of "trickle-down" economics. The idea was simple: by reducing federal tax rates, government would leave more money in the market, which would bolster the economy, which would generate jobs and goods, which would increase total income, which would ultimately produce enough tax revenue to make up for the initial reduction in taxes. In a speech in February 1981, Reagan declared that his plan, labeled "voodoo economics" a year earlier by his eventual running mate, George H. W. Bush, would eliminate the nation's budget deficit and produce a surplus by 1984.

The Economic Recovery Tax Act of 1981 (known as the Kemp-Roth Act) cut $750 billion in federal tax revenue over five years. Individual income taxes were reduced across the board by 5% the first year and 10% the following two years. The top tax rate was lowered from 70% to 50%. The government also cut taxes on capital gains and inheritance. Five years later, Reagan's Tax Reform Act of 1986 reduced rates even further, lowering the maximum tax on the highest-earning individuals to only 28%, the lowest in more than half-a-century.

Although Kemp-Roth lowered nearly everyone's federal income tax burden, its chief beneficiaries were wealthy Americans and businesses. Thanks in great measure to reduced taxes on capital gains, the top 1% of American earners saw their incomes grow by 23% between 1980 and 1983. Real income for the poorest 20% of Americans, however, declined by almost 3%. Moreover, the bottom half of the population paid a higher share of total taxes in 1983 than it had pre-Reagan.

The tax reform plan that was designed to stimulate business and produce a substantial budget surplus instead drove the United States deeper into debt and triggered a recession. By mid-1982 unemployment stood at 9.7%. Businesses failed right and left, and Reagan's approval rating plunged to 35%. Instead of reducing the federal deficit, Reagan managed to do the impossible: he tripled the cumulative national debt of the United States in only eight years. Reaganomics did not work.

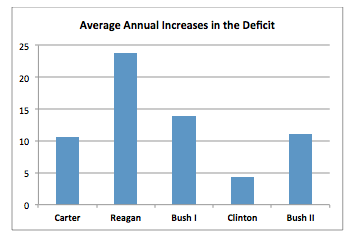

But that was only Reagan. The following chart shows the average annual increase in the deficit from 1977 to 2009 -- during the administrations of Carter, Reagan, Bush I, Clinton and Bush II. This chart enables a comparison of average annual increases in the deficit during the administrations of those presidents who embraced conservative economic theory (Reagan, Bush I and Bush II) and those who did not (Carter and Clinton).

The three presidents who embraced conservative economic theory all increased the deficit more than the two presidents who did not. Indeed, under Reagan, Bush I and Bush II, the deficit increased at an average annual rate of 16.8%, whereas under Carter and Clinton it increased at an average annual rate of only 6.5%.

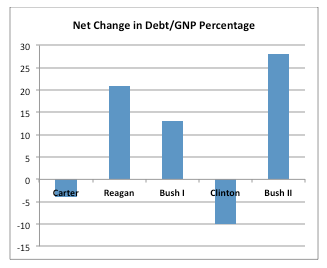

Another useful calculation is national debt as a percentage of gross domestic product (GDP). If the economy is growing, then a larger national debt isn't such a big deal. An investment banker, after all, can afford to carry a lot more debt than, say, a school teacher. So, what happened to the national debt/GDP percentage under Carter, Reagan, Bush I, Clinton and Bush II? The following chart shows how each of these five presidents fared on this measure. A negative number means that during his term the president reduced the debt/GDP percentage (which is good) and a positive number means that the president increased the debt/GDP percentage (which is bad).

Rather dramatically, it turns out that from 1977 to 2009 the three presidents who endorsed conservative economic theory all substantially increased the national debt to GDP percentage, whereas the two presidents who did not endorse that approach actually reduced the debt/GDP percentage. Indeed, on average, Reagan, Bush I and Bush together increased the percentage from 42% to 79% during their terms, whereas Carter and Clinton together reduced the national debt/GDP percentage from 53% to 48%.

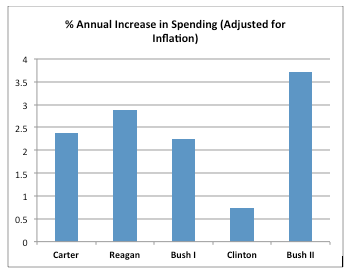

Republicans today claim that we should trust them to cut government spending. But how well have the devotees of conservative economic policies done in this regard? Consider the following chart, which shows the average annual increase in spending, adjusted for inflation, by each of the five presidents between 1977 and 2009:

Once again, conservative economic policy doesn't look so good. Reagan, Bush I and Bush II increased government spending (adjusted for inflation) during their terms by an average of 3.13% annually, whereas Carter and Clinton increased government spending (adjusted for inflation) during their terms by an average of only 1.28% annually.

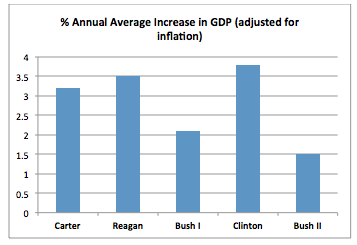

One final calculation is important: average annual increase in GDP. An important component of conservative economic policy is the claim that by cutting taxes the government can energize the economy. How well does this work? The following chart compares average annual increases in GDP (adjusted for inflation) from 1977 to 2009:

Reagan, Bush I and Bush II increased GDP (adjusted for inflation) by an annual average of 2.4%, whereas Carter and Clinton increased GDP (adjusted for inflation) by an annual average of 3.6%.

For all these reasons, President Obama was right: conservative economic theory "doesn't work." Let's not be fooled again.

This piece was co-authored with Jane Dailey, Associate Professor in the Department of History and the Law School at The University of Chicago.