With remarkable courage, European governments have managed to spend nearly two years attempting to resolve the crisis of over-indebted European countries, particularly Greece, only to come to the table with solutions that primarily concern banks! And most worrying, is the fact that said European governments will not put a single Euro of their money towards Greek debt restructuring!

At this stage, I am not able to estimate exactly how Greece's debt will decrease from 180% to 120% of GNP in 2020, nor am I able to guess where the 100 billion euro reduction of Greece's debt, is coming from.

Let's take a closer look.

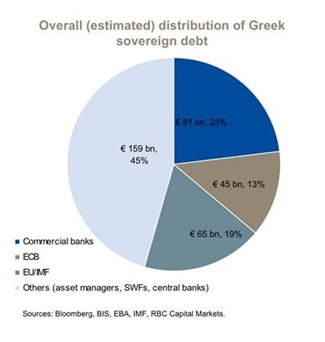

Europe decided that the banks will have to give up 50% of their claims.The fact that this loss is a direct result of their unwillingness to restructure Greek debt a year ago, does not seem to pose a moral or political problem in Europe. In addition, to avoid the default of Greece, the "gesture" of banks should be "voluntary." Banks have finally agreed to the "haircut" of 50% from the 21% decided upon on July 21 and not yet in place. We do not know the mechanism of this discount and it is difficult to speculate about the immediate impact it will have on Greek debt. Still, we must never forget the fact that European banks hold about 32 billion euros in sovereign debt. A 50% contribution will amount to 16 billion euros, an increase from the July agreement by less than 10 billion euros: not 100 billion!

The European Financial Stability Fund (EFSF) is to be increased to $1.4 trillion, which could mean a ratings drop for several countries of the Eurozone. It does not seem conceivable that France and Germany will accept an increase in their indirect debt by 200 billion and 270 billion euros respectively. It would be complete foolishness at a time when they themselves must enter a phase of austerity.

Europe will open to investors EFSF "outsiders": The mechanism would provide for the guarantee of the Member States. The simple notion that China might be part of that new fund is sending waves throughout Europe. Does Europe need the IMF and China to resolve a $500 billion problem?

In addition to this, The European Summit approved an obligation by the European banks to reach -- by the summer of 2012 -- a capital adequacy ratio of 9%, almost double their current average level. This is seven years before the requirements of Basel III. At a time when banks are fragile, accelerating their recapitalization schedule is beyond comprehension.

Fortunately, it will not be the taxpayer who will be asked to contribute to this recapitalization, but "the private sector." Who will that be? Shareholders who, after being deprived of 50% the value of the Greek debt, would move to subscribing to a capital increase? This is possible only if, in parallel, European banks reduce their size and scope in order to use it more sparingly their equity. They must stop their proprietary trading (following the "Volcker rule") as well as other exotic financing to focus on the core banking business. This is not a "bail-out" but a "lease-in."

We will need to wait a month for the details before forming a final opinion. Based on available information, I remain perplexed by so much noise and so little substance, and even more perplexed by the optimism that followed this announcement.