All eyes are on Europe to see how it responds to the crisis in Greece. This provides a valuable opportunity for the Eurozone countries to act with solidarity especially since Greece is not asking for money from Germany but rather its political support. The Eurozone's sixteen countries are bound by a written pact, a common currency and central bank but above all a pact a solidarity.

The relationship between Germany and Greece has never been an easy one. Let's face it: the styles of management between the two countries couldn't be more different. Throw in the historical remnants of the of the Second World War and the influence of Turkey and the relationship gets even more complicated.

The reality is that Germany is the economic backbone of Europe and it is also the mainstay of the Euro holding the other Eurozone countries together. Germany's role will become increasingly more important given that Greece could be just the first chapter in a story of more challenges to the Euro.

Angela Merkel's challenge now is to manage German public opinion while helping Greece alter its behaviors. However if she does not accomplish this, the other Eurozone countries will not act. It is even more complicated given that much of Greece's debt is in the hands of European banks and default on this debt brings even more strain on these already battered banks. Disengagement with Greece is not an option. This leaves Germany and Greece only one path - forward.

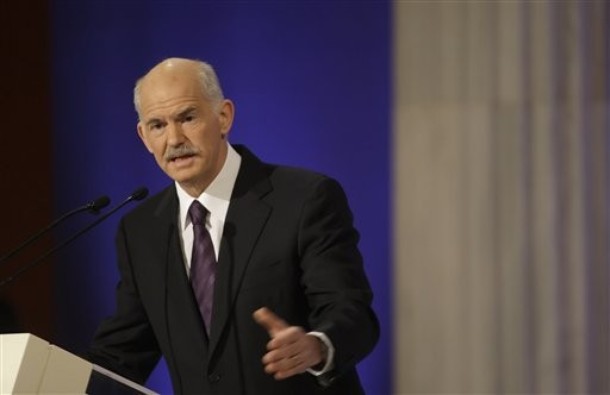

Prime Minister George Papandreou committed to additional spending cuts in Brussels and is now visiting the leaders of Germany and France and then on to the U.S. A natural advocate of Greece's large public sector, Mr. Papandreou now needs to balance between Greece's unions while trying to increase taxes in the private sector, reduce military spending, and maintain public opinion. Selling austerity to its citizens is far from easy.

On the market front, the $ 7 billion issue launched yesterday was well received. However it only represents a stabilization of the market perception: at 6.25%, Greece pays twice as much as Germany. Since only a few shorters try to spread the unrealistic rumor that Greece might be in default, the 3% spread is definitely a good remuneration for investors and the highest paid by Greece.

With Greek workers on a general strike today, we will need more that such an issue to see the spreads paid by Greece being reduced and its CDS rate go below 300 basis points.

I hope with all my heart that the political might that Greece needs will come from its meetings in Germany and that France will follow suit on Sunday. I also hope that investors who have speculated on the defeat of the Euro and Europe will pay a maximum price for their folly. The way Europe solves the crisis in Greece will determine the future of the Euro. Europe cannot afford to fail.