By Elyssa Kirkham, Finance Writer

Unless you're tracking expenses carefully, it can be hard to tell whether your city's cost of living or your own spending habits are the cause of your financial troubles. Using the 50-30-20 budgeting rule, for example ― in which 50 percent of income covers necessities, 30 percent is for discretionary items and 20 percent is saved ― you can quickly determine whether your income is sufficient to cover expenses for living in your city. If it isn't, you might have to cut costs or maybe even move.

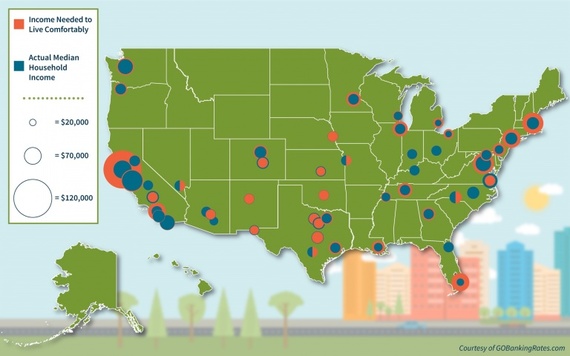

GOBankingRates conducted a cost-of-living comparison of the 50 most populous U.S. cities, surveying dollar amounts of living expenses including rent, groceries, utilities, transportation and healthcare. This total, which accounts for necessities, was then doubled to find how much money a single person needs to earn in that city to follow a 50-30-20 budget. This study also compares the total amount of income needed to the actual median household income in each city to see if differences in cost of living are matched by differences in pay.

Click through to see how much money you'd need to earn to live comfortably in the biggest cities across the U.S. The cities are listed in order of population from smallest to largest.

Bakersfield, Calif.: $43,425

- Income needed: $43,425

- 50 percent for necessities: $21,713

- 30 percent for discretionary spending: $13,028

- 20 percent for savings: $8,685

Based on the median household income of $56,842, Bakersfield, residents have an extra $13,416 more each year than what is needed to live comfortably.

Arlington, Texas: $46,904

- Income needed: $46,904

- 50 percent for necessities: $23,452

- 30 percent for discretionary spending: $14,071

- 20 percent for savings: $9,381

Arlington has a local median income of $53,055, which is $6,151 more than the income needed to live comfortably in this city.

New Orleans: $60,782

- Income needed: $60,782

- 50 percent for necessities: $30,391

- 30 percent for discretionary spending: $18,235

- 20 percent for savings: $12,156

The median household income in New Orleans is just $36,964, which is not much compared to the city's high cost of living. That income falls $23,818 short of the income needed to live well in The Big Easy.

Wichita, Kan.: $40,616

- Income needed: $40,616

- 50 percent for necessities: $20,308

- 30 percent for discretionary spending: $12,185

- 20 percent for savings: $8,123

The median income for a Wichita household is $45,907, which is enough to live well and have an extra $5,291 annually.

Cleveland: $42,589

- Income needed: $42,589

- 50 percent for necessities: $21,295

- 30 percent for discretionary spending: $12,777

- 20 percent for savings: $8,518

Cleveland offers low living costs but also has one of the lowest median household incomes among big cities at $26,179, which falls $16,410 short of the amount needed to live well in Cleveland.

Minneapolis: $64,170

- Income needed: $64,170

- 50 percent for necessities: $32,085

- 30 percent for discretionary spending: $19,251

- 20 percent for savings: $12,834

Minneapolis residents' median household income of $50,767 is decent but is still $13,403 less than the total annual income needed to live comfortably in this half of the Twin Cities.

Miami: $77,057

- Income needed: $77,057

- 50 percent for necessities: $38,529

- 30 percent for discretionary spending: $23,117

- 20 percent for savings: $15,411

The Miami median income of $30,858 is less than half, or $46,199 short, of the amount needed to live well in this city ― the biggest gap between actual and ideal incomes of any major city in this study.

Raleigh, NC: $55,537

- Income needed: $55,537

- 50 percent for necessities: $27,769

- 30 percent for discretionary spending: $16,661

- 20 percent for savings: $11,107

Based on Raleigh's median income of $54,581, locals actually earn incomes on par with what is needed to live comfortably. They are short just $80 each month ($956 a year).

Colorado Springs, Colo.: $44,512

- Income needed: $44,512

- 50 percent for necessities: $22,256

- 30 percent for discretionary spending: $13,354

- 20 percent for savings: $8,902

Colorado Springs' median household income is $54,228, which allows locals to more than live comfortably with an extra $9,716 a year.

Omaha, Neb.: $45,560

- Income needed: $45,560

- 50 percent for necessities: $22,780

- 30 percent for discretionary spending: $13,668

- 20 percent for savings: $9,112

Most residents of Omaha can live comfortably on the median household income of $48,751, which is $3,191 more than the income needed to cover needs, wants and savings.

Virginia Beach, Va.: $50,929

- Income needed: $50,929

- 50 percent for necessities: $25,465

- 30 percent for discretionary spending: $15,279

- 20 percent for savings: $10,186

Low costs of living make it easy to live on Virginia Beach's median income of $67,001. This amount is $16,072 more than what is needed to live comfortably ― the equivalent of an extra $1,340 a month ― which is the biggest surplus of any major U.S. city in this study.

Atlanta: $60,285

- Income needed: $60,285

- 50 percent for necessities: $30,143

- 30 percent for discretionary spending: $18,086

- 20 percent for savings: $12,057

With a median household income of $46,439 in Atlanta, workers in this city have $13,846 less than they need each year to live well.

Mesa, Ariz.: $42,654

- Income needed: $42,654

- 50 percent for necessities: $21,327

- 30 percent for discretionary spending: $12,796

- 20 percent for savings: $8,531

Mesa residents earning the local median income of $48,259 have an extra $5,605 a year.

Kansas City, Mo.: $45,311

- Income needed: $45,311

- 50 percent for necessities: $22,656

- 30 percent for discretionary spending: $13,593

- 20 percent for savings: $9,062

The income needed to live well in Kansas City is on par with the city's median income of $45,376, with about $65 extra in locals' wallets.

Long Beach, Calif.: $58,560

- Income needed: $58,560

- 50 percent for necessities: $29,280

- 30 percent for discretionary spending: $17,568

- 20 percent for savings: $11,712

Long Beach residents need to earn $5,616 more a year than the $52,944 median income to live comfortably in the city.

Sacramento, Calif.: $53,736

- Income needed: $53,736

- 50 percent for necessities: $26,868

- 30 percent for discretionary spending: $16,121

- 20 percent for savings: $10,747

The median income in Sacramento, $50,013, is just $3,723 short of the amount needed to afford living comfortably in the city.

Fresno, Calif.: $42,496

- Income needed: $42,496

- 50 percent for necessities: $21,248

- 30 percent for discretionary spending: $12,749

- 20 percent for savings: $8,499

Fresno's $41,455 median income is just $1,041 short of the income needed to live well in this city.

Tucson, Ariz.: $39,966

- Income needed: $39,966

- 50 percent for necessities: $19,983

- 30 percent for discretionary spending: $11,990

- 20 percent for savings: $7,993

With the lowest total needed to cover necessities out of the 50 biggest U.S. cities, Tucson residents can likely make do on the $37,149 median income, which is just $2,817 short of the amount needed to live well there.

Albuquerque, NM: $43,895

- Income needed: $43,895

- 50 percent for necessities: $21,947

- 30 percent for discretionary spending: $13,168

- 20 percent for savings: $8,779

The median income in Albuquerque is $47,413, which gives residents almost $300 extra a month ($3,518 a year) beyond the amount needed to comfortably follow a 50-30-20 budget.

Milwaukee: $43,281

- Income needed: $43,281

- 50 percent for necessities: $21,641

- 30 percent for discretionary spending: $12,984

- 20 percent for savings: $8,656

Milwaukee households earn a median $35,489 annual income, which is $7,792 less than what's needed to live comfortably in this city.

Louisville, Ky.: $46,831

- Income needed: $46,831

- 50 percent for necessities: $23,415

- 30 percent for discretionary spending: $14,049

- 20 percent for savings: $9,366

Falling $2,025 short of the amount needed to live well in Louisville, the median income of $44,806 puts locals slightly behind financially.

Las Vegas: $50,453

- Income needed: $50,453

- 50 percent for necessities: $25,227

- 30 percent for discretionary spending: $15,136

- 20 percent for savings: $10,091

Las Vegas residents earn a median income of $50,903, which is $450 more than the amount needed to live well there, showing this city offers earning opportunities that match local living costs.

Portland, Ore.: $60,195

- Income needed: $60,195

- 50 percent for necessities: $30,097

- 30 percent for discretionary spending: $18,058

- 20 percent for savings: $12,039

Based on the Portland median household income of $53,230, residents' earnings fall $6,965 short each year of what's needed to live comfortably.

Oklahoma City: $44,180

- Income needed: $44,180

- 50 percent for necessities: $22,090

- 30 percent for discretionary spending: $13,254

- 20 percent for savings: $8,836

Oklahoma City has a median income of $47,004, which results in a $2,824 cushion beyond the amount needed to live comfortably.

Baltimore: $53,897

- Income needed: $53,897

- 50 percent for necessities: $26,949

- 30 percent for discretionary spending: $16,169

- 20 percent for savings: $10,779

The median household income in Baltimore is $41,819, but the city's high cost of living requires $12,078 more than that for a person to live comfortably according to a 50-30-20 budget.

Nashville, Tenn.: $61,015

- Income needed: $61,015

- 50 percent for necessities: $30,508

- 30 percent for discretionary spending: $18,305

- 20 percent for savings: $12,203

The typical Nashville household earns the median income of $46,758, which is $14,257 less than the amount needed to live comfortably in Music City.

Boston: $84,422

- Income needed: $84,422

- 50 percent for necessities: $42,211

- 30 percent for discretionary spending: $25,327

- 20 percent for savings: $16,884

Boston's high cost of living isn't easy to cover on the typical local income. The city's $54,485 median income falls $29,937 short of the amount needed to live comfortably there.

Memphis, Tenn.: $44,180

- Income needed: $44,180

- 50 percent for necessities: $22,090

- 30 percent for discretionary spending: $13,254

- 20 percent for savings: $8,836

Memphis has a median income of $37,099, which is $7,081 less than the total annual income a resident of the city needs to earn to be financially comfortable.

Washington, DC: $83,104

- Income needed: $83,104

- 50 percent for necessities: $41,552

- 30 percent for discretionary spending: $24,931

- 20 percent for savings: $16,621

Based on the District's median income of $69,235, locals' earnings are $13,869 below the amount needed to live well in the nation's capital, a deficit of $1,156 a month.

Denver: $62,842

- Income needed: $62,842

- 50 percent for necessities: $31,421

- 30 percent for discretionary spending: $18,853

- 20 percent for savings: $12,568

Denver's median household income of $51,800 is $11,042 behind the amount needed to live comfortably, which means many Denver residents could struggle financially without sticking to a tight budget.

Seattle: $72,092

- Income needed: $72,092

- 50 percent for necessities: $36,046

- 30 percent for discretionary spending: $21,628

- 20 percent for savings: $14,418

Residents of Seattle earn a median household income of $67,365, which is $4,727 less less than the income needed to cover necessities, savings and additional expenses.

El Paso, Texas: $40,227

- Income needed: $40,227

- 50 percent for necessities: $20,113

- 30 percent for discretionary spending: $12,068

- 20 percent for savings: $8,045

Low costs of living make it easier for El Paso residents to make ends meet with the $42,037 median income, which is $1,810 more than the income needed to follow a 50-30-20 budget in the city.

Detroit: $42,772

- Income needed: $42,772

- 50 percent for necessities: $21,386

- 30 percent for discretionary spending: $12,832

- 20 percent for savings: $8,554

Detroit has the lowest median income of the 50 cities on this list at $26,095, which results in a gap of $16,677 between actual income and the amount needed to live well in this city.

Charlotte, NC: $53,842

- Income needed: $53,842

- 50 percent for necessities: $26,921

- 30 percent for discretionary spending: $16,152

- 20 percent for savings: $10,768

Most Charlotte locals can live well on the median household income of $53,274, which is only $568 short of the amount needed to be financially comfortable in this city.

Fort Worth, Texas: $51,759

- Income needed: $51,759

- 50 percent for necessities: $25,879

- 30 percent for discretionary spending:$15,528

- 20 percent for savings: $10,352

Fort Worth is another city where the median income ― $52,492 ― is close to the ideal income needed to live well in the city ― just $733 a year short.

Columbus, Ohio: $45,466

- Income needed: $45,466

- 50 percent for necessities: $22,733

- 30 percent for discretionary spending: $13,640

- 20 percent for savings: $9,093

Columbus residents earning the local median income of $44,774 are only $692 short of the annual amount needed to comfortably cover needs, wants and savings.

Indianapolis: $46,016

- Income needed: $46,016

- 50 percent for necessities: $23,008

- 30 percent for discretionary spending: $13,805

- 20 percent for savings: $9,203

The median income in Indianapolis ― $42,076 ― is $3,940 less than the salary needed to comfortably afford living in the city.

San Francisco: $119,570

- Income needed: $119,570

- 50 percent for necessities: $59,785

- 30 percent for discretionary spending: $35,871

- 20 percent for savings: $23,914

San Francisco residents face one of the of the biggest gaps between their actual incomes and ideal incomes needed to live in the city, with the $78,378 median income falling $41,192 short of the income needed to follow the 50-30-20 budget.

Keep Reading: 6 Basic Bills You Should Always Negotiate

Jacksonville, Fla.: $49,842

- Income needed: $49,842

- 50 percent for necessities: $24,921

- 30 percent for discretionary spending: $14,953

- 20 percent for savings: $9,969

Falling $3,074 short of the amount needed to live comfortably, the Jacksonville median income of $46,768 means locals' budgets can get a little tight.

Austin, Texas: $53,225

- Income needed: $53,225

- 50 percent for necessities: $26,612

- 30 percent for discretionary spending: $15,967

- 20 percent for savings: $10,645

Most residents of Austin can live comfortably on the city's median income, which at $55,216 is $1,991 above the salary needed to follow the 50-30-20 rule.

San Jose, Calif.: $89,734

- Income needed: $89,734

- 50 percent for necessities: $44,867

- 30 percent for discretionary spending: $26,920

- 20 percent for savings: $17,947

With a high cost of living, San Jose's median income of $83,787 is $5,947 less than the amount needed to live comfortably.

Dallas: $55,651

- Income needed: $55,651

- 50 percent for necessities: $27,826

- 30 percent for discretionary spending: $16,695

- 20 percent for savings: $11,130

The median income in Dallas ― $43,359 ― is a substantial $12,292 less than the ideal income needed to live comfortably there.

San Diego: $69,307

- Income needed: $69,307

- 50 percent for necessities: $34,654

- 30 percent for discretionary spending: $20,792

- 20 percent for savings: $13,861

San Diego residents earn a median of $65,753, which is $3,554 less than what they need to earn to comfortably manage their finances with a 50-30-20 budget.

San Antonio: $46,238

- Income needed: $46,238

- 50 percent for necessities: $23,119

- 30 percent for discretionary spending: $13,872

- 20 percent for savings: $9,248

With a median household income of $46,317 in San Antonio, residents make $79 extra a year above the ideal salary to live well in this city. Such a small difference indicates that San Antonio's earning opportunities are well-matched to the city's cost of living.

Phoenix: $48,876

- Income needed: $48,876

- 50 percent for necessities: $24,438

- 30 percent for discretionary spending: $14,663

- 20 percent for savings: $9,775

Phoenix has a local median income of $46,881, which is just $1,995 less than the income needed to live comfortably in the city.

Philadelphia: $59,384

- Income needed: $59,384

- 50 percent for necessities: $29,692

- 30 percent for discretionary spending: $17,815

- 20 percent for savings: $11,877

The typical Philadelphia household earns an income of $37,460, which falls $21,924 short of the ideal income required to match the city's high cost of living.

Houston: $60,795

- Income needed: $60,795

- 50 percent for necessities: $30,397

- 30 percent for discretionary spending: $18,238

- 20 percent for savings: $12,159

The median household income in Houston is just $45,728, which is not enough to match the high cost of living in the city, resulting in a gap of $15,067 between the median income and the ideal income to live comfortably.

Chicago: $68,671

- Income needed: $68,671

- 50 percent for necessities: $34,335

- 30 percent for discretionary spending: $20,601

- 20 percent for savings: $13,734

Chicago's median household income of $47,831 covers necessities but puts residents' earnings $20,840 behind the income needed to comfortably cover needs, wants and savings in the Windy City.

Los Angeles: $74,371

- Income needed: $74,371

- 50 percent for necessities: $37,185

- 30 percent for discretionary spending: $22,311

- 20 percent for savings: $14,874

Los Angeles residents face high costs of living, which means living comfortably requires a higher income ― $24,689 higher than the city's median income of $49,682.

New York: $87,446

- Income needed: $87,446

- 50 percent for necessities: $43,723

- 30 percent for discretionary spending: $26,234

- 20 percent for savings: $17,489

The country's most populous city also has some of the highest living costs, which means much of the $52,737 median household income covers necessities only. Based on a 50-30-20 budget, the median income in New York is $34,709 less than the amount needed to sufficiently cover needs, wants and savings.

What It Costs to Live in the 50 Most Populous U.S. Cities

Here are the 50 most populous cities surveyed by GOBankingRates. The chart compares the income needed to live comfortably in each city to each city's actual median household income. The cities are listed in order according to the difference between the income needed and the median income, from the biggest surplus ― where it's easiest to live comfortably ― to the biggest deficit, which is where living comfortably according to a 50-30-20 budget is most difficult.

Methodology: GOBankingRates surveyed monthly living expenses in the 50 most populous U.S. cities according to U.S. Census Bureau estimates. This cost-of-living comparison included the following factors for a single person: (1) housing, using the median rent for a one-bedroom apartment in each city, sourced from Zillow's January 2016 rental index; (2) groceries, using the recommended amount reported by cost-of-living database Numbeo.com for each city, sourced March 9, 2016; (3) utilities for a 915-square-foot apartment in each city, according to cost estimates from Numbeo.com, sourced March 9, 2016; (4) transportation costs according to the Economic Policy Institute's Family Budget Calculator for each city or its nearest metropolitan area; and (5) health insurance premiums as estimated at the state level for 2013 by the Kaiser Family Foundation.

Monthly costs were totaled and multiplied by 12 to get the annual dollar cost of necessities in each city. This dollar amount for necessities was then doubled to find the actual annual income needed to live comfortably in the city, assuming a person is following the 50-30-20 budgeting guideline, which requires an income double the cost of necessities. This study also compared the amount of income needed in each city to each city's actual median household income according to 2014 U.S. Census Bureau data. The amount of money specified for savings is equal to 20 percent of the total income needed, and the amount specified for discretionary spending is equal to 30 percent of the total income needed.

This article, How Much Money You Need to Live Comfortably in the 50 Biggest Cities, originally appeared on GOBankingRates.com.

More from GOBankingRates: