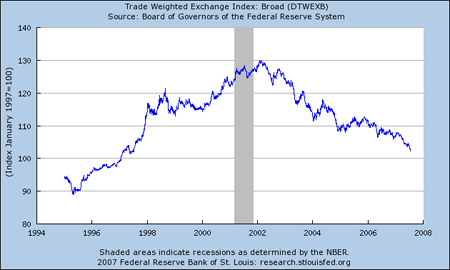

The dollar has been dropping in value since the beginning of 2002. While some of this drop is the result of specific economic policies -- like the record low interest rates of 2002 to mid-2004 -- some of the drop is also systemic - meaning there are fundamental problems which are hurting the dollar's value. As a result of these combined events, the dollar continues to drop.

First, let's take a look at exactly what we are dealing with. Here is a chart from the St. Louis Federal Reserve of the trade-weighted dollar index.

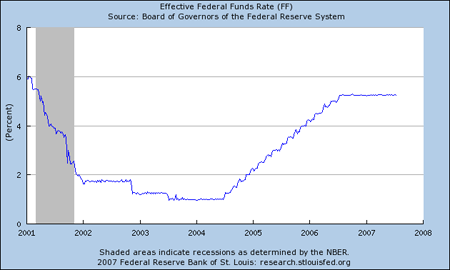

For the early part of the drop - roughly 2002 - mid-2004 - interest rates contributed to the drop. Low interest rates make a currency less attractive because forex traders will "park" some of their currency holdings in the host county's interest bearing accounts. Low interest rates mean forex traders will get less money for their investment. Here is a chart of the effective federal funds rate since 2001.

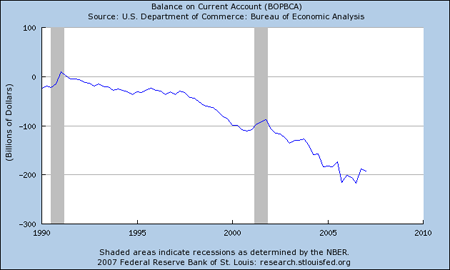

However, interest rates started to increase in mid-2004 and the dollar continued to drop. One of the primary reasons for this is the international trade deficit which the US runs with the rest of the world. Here is a chart from the St. Louis Federal Reserve of the US' balance of payments. Notice the balance really started to deteriorate as this expansion started.

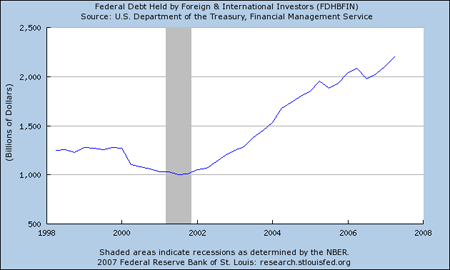

There is also the issue of "dollar fatigue". Simply put, there are already a ton of dollar denominated assets floating around the world. According to the Treasury Department there were 2.2 trillion dollars of US government debt securities in international hands on March 30, 2007. According to the monthly reports of foreign bond holdings:

Asia: Japan had $639 billion in April 2006 and $614 in April 2007. Over the same period, China's totals were $321 and $414. However, China had a big build-up from April to September 2006 and since then has been in a relative holding pattern.

The UK has decreased it's holdings from $166 billion to $144 billion from April 2006 to April 2007.

Oil exporters increased their holdings from $99 billion to $113 billion from April 2006 to April 2007.

In short, the 4 largest buyers of Treasury debt appear to be near their near-term limit. Now, that could change. China is still accumulating massive foreign reserves. But they could just as easily move into euro denominated bonds to diversify their holdings.

Here is a chart from the St. Louis Federal Reserve of total foreign held US debt. Notice the total amount of foreign held debt has doubled and then some since 2002.

The rise of the Euro is another reason for the dollar's decline. The Euro has been around for about 10 years now. Over that time, it has become a clear competitor with the dollar as an international currency. Central banks around the world are now adding euros to their reserves at the expense of the dollar. From the central banks perspective, this is sound risk management policy. Having a pool of diverse currencies limits the negative impact of one currency's devaluation from lowering the overall value of a central banks currency reserves. In addition, as central banks have diversified into euros they have sold dollars. This has lowered the dollars value, making euros more attractive. In other words, diversification from the dollar to euros has created something like a negative feedback loop that negatively impacts the dollar's overall value.

There is also the issue of the slowing US economy. While Europe, China, India and Russia are all growing, the US has hit a soft patch of growth. While this will eventually fade in time, it's still a reason for investors to shun the dollar in favor of currencies in faster growing economies.

Finally, there is the issue of whether a decreasing dollar will help to decrease the international trade deficit. The answer to this is maybe not. A paper by the New York Federal Reserve argues a decreasing dollar won't have much of an impact on the trade deficit. The main issue is a smaller percentage of the dollar's decrease moves into the domestic economy because of import pricing strategies

So, several factors are responsible for the dollar's drop. While record low interest rates started the ball rolling from 2002 to mid-2004, a host of other systemic factors have added to the decline since 2004. These factors include the US' trade deficit, the US' slow growth and the rise of the euro. Because these other factors are difficult to change it's doubtful the dollar's decline will end anytime soon.