All the hullabaloo regarding Thomas Piketty's master economic work, Capital in the 21st Century has overlooked its real importance. Economics is finally becoming a science, rather than just social science based more on theories and formulas (such as mathematical models), than empirical research until now.

T. Piketty and friends have collected two centuries of economic data -- such as tax returns -- to verify what was suspected but not known. That returns to the owners of capital have historically exceeded that of labor -- i.e., wages and salaries -- by a margin of 5 percent, vs. just 1.5 percent per year for employees. In other words, the returns on capital have historically grown faster than overall economic growth, which determines the growth rate of employees' salaries.

Even Piketty's prescription to level the playing field, a tax on capital, is but one solution. Nobelist Robert Shiller expounds something much more feasible in his book, The New Financial Order, Risk in the 21st Century. He proposes futures' markets that trade in everything from salaries to national GDP growth. It means putting the financial markets in the business of insuring against failure.

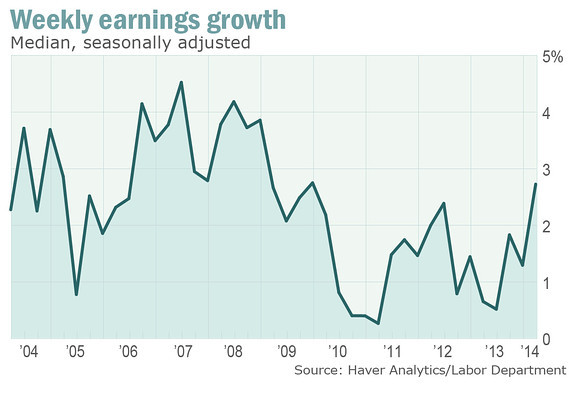

Graph: WSJ Marketwatch

The 2.7 percent median wage growth in the first quarter was the strongest since the fourth quarter of 2009, when wages grew 2.8 percent. Importantly, the wage growth was faster than the 1.4 percent increase in seasonally adjusted consumer prices over the same period. Without adjusting for seasonality, median weekly wages were $796 in the first quarter.

It is important that wages are rising faster than inflation for the first time in 4 years. It means consumer purchasing power is increasing again. Household incomes have actually been stagnant for more than 30 years, only keeping up with inflation, so that most consumers had enough income for necessities.

Year-on-year, overall CPI inflation was 1.5 percent in March, compared to 1.1 percent in February (seasonally adjusted). The core rate increased 1.6 percent year-on-year, matching the rate for February. For March, not seasonally adjusted year-ago percent changes for total and core CPI were 1.5 percent and 1.7 percent, respectively.

Consumer price inflation firmed in March, but it was for just one month -- not yet setting a trend. Within the Fed, the hawks likely will point to the stronger numbers while the doves will say it is too early to say that inflation is up to the 2 percent goal. This means driving is cheaper and eating is more expensive.

But Janet Yellen has been saying that interest rates will stay down much longer, even if inflation rises above their 2 percent target. And that can only hearten consumers and homebuyers who don't want the Federal Reserve raising rates until they see a real jobs recovery and sustained wage increases.

Harlan Green © 2014