When Warren Buffet says corporate taxes are too low, we should listen. "It's a myth that American corporations are paying 35 percent or anything like it," Buffett said, referring to the top marginal corporate tax rate in a CNBC interview. "Corporate taxes are not strangling American competitiveness."

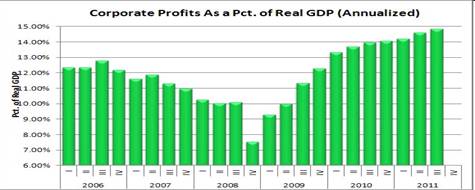

Corporate taxes are too low for several reasons. Firstly, they are doing little to improve our economy to warrant such favorable treatment. As Buffett said, his corporation pays less in taxes than his Secretary. Yet corporations have record profits, and hirings are at multiple year lows, while hoarding a record $2.3 million in cash.

What are they doing with their cash? Most large corporations are either boosting already record executive pay that disregards performance incentives, buying back their stocks to increase the value of their stock options, or looking for Merger and Acquisiton opportunities. There is very little investment in either plant or equipment for organic growth that would boost employment.

Graph: St. Louis Fed

Corporations are no longer the productive core of our economy, as economists such as Rutgers economic historian James Livingston points out -- in fact, haven't been for the last century. Rather they have used their economic clout to buy legislation that limits or eliminates regulations to control them, and even the Supreme Court, since the Citizens United ruling that allowed unlimited corporate contributions. Professor Livingston says:

"Between 1900 and 2000 real gross domestic product per capita (the output of goods and services per person) grew more than 600 percent. Meanwhile, net business investment declined 70 percent as a share of G.D.P. What's more, in 1900 almost all investment came from the private sector -- from companies, not from government -- whereas in 2000, most investment was either from government spending (out of tax revenues) or "residential investment," which means consumer spending on housing, rather than business expenditure on plants, equipment and labor."

Their power was at one time balanced by both government regulations and labor unions, the countervailing power pronounced by J.K. Galbraith in The Affluent Society. That was before they were able to systematically decimate labor unions. Corporate 'leadership' councils succeeded in eroding union bargaining and organizing rights, while lobbyists flooded Congress to write anti-union legislation. This is while 23 state legislatures to date have enacted Right-To-Work laws that are really right-to-not-pay union dues, even though union members enjoyed union benefits.

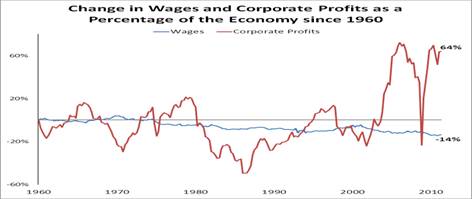

Corporations have become too powerful, in other words, overriding the balance of powers enshrined in our constitution and laws that limited the power of any one economic sector over American lives. The result has been successive asset bubbles since 2000, as well as record income inequality. It is now well-known that since the 1970s wealth has been shifted from workers -- mainly the 80 percent who are wage and salary earners -- to the 'rentiers'; major investors, as well as Wall Street and corporate executives who control most of the wealth. It is time to downsize their power, and raising the corporate tax rate is a good place to start.

We now know how this happened. This is well documented in such books as Jacob Hacker and Paul Pierson's Winner-Take-All Politics. It began in the 1970s, as Big Business began to organize to oppose what they saw as too much government -- in reality regulations (including tax codes) that restricted their profits. Their main tool is of course their lobbying largesse. Officially, say Hacker and Pierson, more than $3 billion per year is spent or donated to influence just federal legislation, a figure that has doubled over just the last decade.

Two of the most visible lobbying entities are the U.S. Chamber of Commerce that advocates abolishing corporate taxes altogether, as well as the National Federation of Independent Business representing small businesses, which tends to lobby against any government regulation of business. Both organizations' memberships doubled during the 1970s.

So corporate profits do not drive economic growth, says Livingston -- they're just restless sums of surplus capital, ready to flood speculative markets at home and abroad.

"In the 1920s, they inflated the stock market bubble, and then caused the Great Crash. Since the Reagan revolution, these superfluous profits have fed corporate mergers and takeovers, driven the dot-com craze, financed the "shadow banking" system of hedge funds and securitized investment vehicles, fueled monetary meltdowns in every hemisphere and inflated the housing bubble."

There is another way to level the playing field between workers and corporations. And would be to increase the incomes of employees, which have fallen for so many years. But that would require the roll back of the many anti-labor laws that have blossomed since the 1970s.

Graph: St. Louis Fed

But then is it any easier to close the tax loopholes that have allowed Warren Buffett's taxes to be lower than his secretary's? Raising corporate taxes -- or closing all the loopholes -- is a first step if we want to create a sustainable recovery, rather than more busted bubbles. The alternative is more economic uncertainty which will certainly cause a further decline in our global competitiveness.