It should be obvious from the horrid Bureau of Labor Statistics unemployment report for June -- just 18,000 net nonfarm payroll jobs added and the unemployment rate up to 9.2 percent -- that we are still in some sort of a disinflationary spiral. Yes, I said disinflation, which means the rate of inflation is falling, not rising as the holders of debt would have us believe. And because employers find it difficult to raise their prices, they won't create more jobs.

And that is the Federal Reserve's greatest fear. So we will probably see a "QE3" round of Fed stimulus this fall. There is just not enough demand, folks, to create any sustained hiring, and the Fed is now the only entity willing to provide more stimulus, with Obama and Congress locked into downsizing government further.

What is the Fed so fearful of? A Japanese-style deflation that has plagued Japan since its twin real estate and stock bubbles burst in 2000. What the Fed stimulus may look like is still up in the air. It can, of course, buy more Treasury bonds, but interest rates are already at record lows. Bernanke has hinted that the Fed can begin to reinvest the monies from maturing securities back into the market. It can also buy more mortgage-backed securities in a bid to boost the housing market, where prices are still at rock bottom.

Nobelist Paul Krugman noted this in his latest blog, "Let me emphasize that last point. My bottom line on the inflation-deflation issue has always been to look at wages; you can't have a wage-price spiral if wages ain't spiraling. And they aren't, to say the least."

We are in fact facing the opposite problem of the 1970s: a wage-price disinflationary spiral, at the moment, although most economists won't call it such. Wages and salary earners that make up 80 percent of our workforce haven't seen a real wage increase since the 1970s.

The last wage-price inflationary spiral occurred in the 1970s, with inflation spiking at some 14 percent. We saw a brief spike of the Consumer Price Index to slightly above 3 percent earlier this year, though it was above 5 percent at the height of the bubble. Still, to most wage and salary earners it feels like inflation, because their real incomes have stagnated since the 1970s, which means they have not risen in relation to inflation. Real stagnant wages plus rising energy and food prices smells like inflation to those who with limited incomes.

At last, we are seeing the effects of the supply-side revolution of the 1980s to date: the "reverse Robin Hood" effect mentioned by Reagan Budget Director David Stockman in a past blog. It was a revolution that said "government is the problem," when it wasn't governments that caused inflation in the 1970s. Its major causes were rising oil prices from the formation of the OPEC oil cartel and two oil embargos as the Vietnam War was winding down.

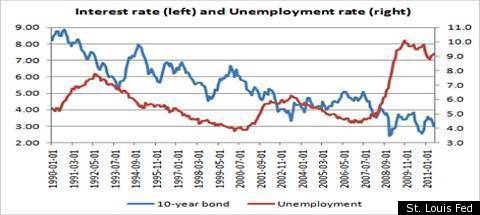

Another sign that we are fighting falling prices are the rock-bottom interest rates. Interest rates rise in tandem with inflation, and conversely fall with declining prices. The 10-year Treasury bond just dropped below 3 percent again. This St. Louis Fed graph highlighted by Krugman charts the relationship of interest rates with jobs.

"It's important to realize, by the way, that stagnant wages are NOT good for recovery; all they do is ensure that the burden of debt relative to income remains high, keeping demand and employment down," wrote Krugman. "The situation cries out for aggressively expansionary monetary and fiscal policy. Instead, however, all the political push is in the opposite direction."

The supply-side revolution was, and still is, a cover for cutting taxes. So-called Reaganomics didn't cut government spending, yet they sought to suppress the wages and salaries of the middle class in a number of ways. Tax exemptions allow U.S. corporations to shelter their overseas profits from U.S. taxes until repatriated, for starters, thus encouraging them to export jobs overseas. And now Republicans are attempting to take away the collective bargaining rights of government unionized employees, such as teachers, just as they did for private industry in the 1980s and 90s.

All of this suppresses household incomes without lessening household debt. So we are approaching a level of income inequality close to that of Mexico and other so-called Third World countries. Any long-term solution to our budget deficit has to recognize that fact. Unless real incomes begin to rise again, there is no chance of paying off our debts -- neither our private nor public debts.

© Harlan Green, 2011