Everyone piled on when the May employment numbers came out last week. "This is horrible," said Ian Shepherdson, chief economist at High Frequency Economics, in reaction to the May employment numbers. The Dow Jones industrial average fell 275 points, its worst day of the year, and for the first time was down for 2012. But what if the pessimists are wrong in jumping so quickly to such conclusions?

The report showed the economy slowing, as the unemployment rate rose to 8.2 percent in May from 8.1 percent the prior month. But that was because 642,000 more began looking for work in the Household Survey that includes the self-employed. In fact, there were 422,000 jobs added in the same Household Survey when seasonally adjusted.

And payroll jobs in the separate Establishment Survey (i.e., nonfarm payrolls only) rose only 69,000, following increases of 143,000 in March and 77,000 in April. But that was because 718,000 additional hires were subtracted in the seasonal adjustment, and governments lost another 13,000 jobs.

We have been here before. Last summer's scare came when the Bureau of Labor Management had to revise from 0 to 57,000 jobs created in August, and added an additional 42,000 payroll jobs in July when revised. This is because of the so-called seasonal adjustments. They are an attempt to figure out what is above or below the normal seasonal hiring rate for that time of year, as we have said in the past. Students usually flood the jobs market during summers increasing payrolls, for instance. So it is not an exact science, needless to say.

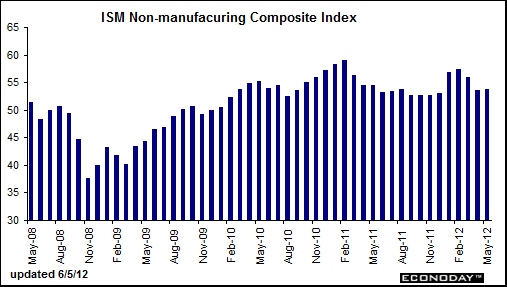

Meanwhile, both the industrial and service sectors are expanding robustly, and the Institute for Supply Management (ISM) surveys say they will hire more workers. The ISM non-manufacturing overall composite activity component, though held down by slowing employment growth, still came in slightly higher than expected at 53.7. New orders rose 2 points to 55.5 to indicate accelerating monthly growth. Monthly growth in backlogs is the same as in April, at 53.0 which is a solid rate for this reading, said Econoday.

Graph: Econoday

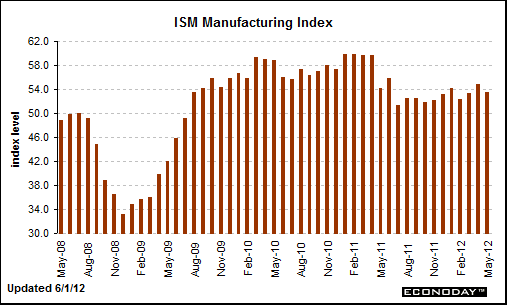

Even better news was the ISM Manufacturing Survey. The ISM's new order index is also up nearly 2 points to 60.1 for the strongest rate of monthly growth since April last year. New orders will trigger wider activity in the months ahead. For May, production growth slowed but remains healthy while employment growth in the factory sector is steady and healthy. Inventories are coming down even as new orders pick up, a combination that points to the need for inventory building which is a solid positive for hiring as well.

Graph: Econoday

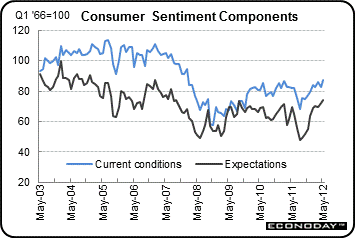

Lastly, the recent sell-off in the stock market and rising problems in Europe are not rattling the U.S. consumer whose sentiment is clearly stronger than it has ever been during the recovery. The U. of Michigan consumer sentiment index jumped to 79.3, up nearly 3 points from April and up 1.5 points from the mid-month reading. This last comparison, which puts the index at an implied 80.8 over the past two weeks, indicates that the rise in optimism is now picking up intensity, according to Econoday.

Graph: Econoday

But does all this mean more jobs? Both ISM surveys showed a slight drop in those planning to hire more workers, but both employment components of the surveys were still above 50 percent, meaning the majority of supply managers reported increased hiring.

So because the seasonally adjusted numbers are notoriously inexact, we cannot be sure that an economic slowdown is even happening. It could be the seasonal fluctuations that are normal for any business cycle.