Fannie Mae (FNMA), or Federal National Mortgage Association, reported a record profit for 2012, a good reason to save the mortgage giant from dissolution, as the banking industry in particular has lobbied for. The government-sponsored enterprise had net income of $17.2 billion for 2012, outpacing profits at S&P 500 companies such as Wal-Mart Stores Inc. (WMT), General Electric Co. and Berkshire Hathaway Inc. (BRK/A).

Fannie Mae's net income for 2012 compared with a loss of $16.9 billion in 2011, the company said in a statement. Profits totaled $7.6 billion for the three months ended Dec. 31 after accounting for a $4.2 billion dividend payment to the Treasury Department for the government's stake. So it can begin to payoff the $188 billion borrowed from the U.S. Treasury to keep the mortgage industry -- and housing -- afloat.

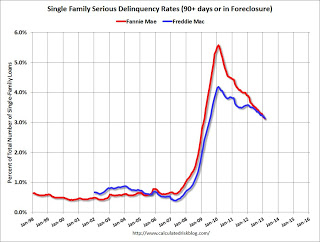

There is another reason to save Fannie Mae and Freddie Mac from complete dissolution. Their underwriting standards are the highest and have resulted in the lowest default rates of all mortgages. Fannie Mae reported that the Single-Family Serious Delinquency rate declined in February to 3.13 percent from 3.18 percent in January. The serious delinquency rate is down from 3.82 percent in February 2012, and this is the lowest level since February 2009. Its serious delinquency rate peaked in February 2010 at 5.59 percent.

Graph: Calculated Risk

Fannie Mae serious delinquencies averaged below 1 percent until 2008 and the housing bubble bust. Whereas the average delinquency rate for all Private Label Mortgages was 6.8 percent, as many of them are the so-called liar loans that didn't require either income for asset verification.

Earlier Freddie Mac (FHLMC), or Federal Home Loan Mortgage Corporation, the other GSE under government conservatorship, reported that the Single-Family serious delinquency rate declined in February to 3.15 percent from 3.20 percent in January. Freddie's rate is down from 3.57 percent in February 2012, and this is the lowest level since July 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20 percent.

Banks have been lobbying for years to either downsize or abolish the government-owned GSEs, as we said. But that would be throwing out the baby with the bathwater. For it was sub-prime lending that created the housing bubble with it minimal or nonexistent qualifying criteria, such as the 'stated income', or 'no income' verification requirements of so-called Option ARMs that allowed minimal payments for the first 4 years, before payments rose enough to begin to pay down principal balance.

Their argument has been that Fannie and Freddie are taking business away from private banking. They have claimed that the "implicit" government guarantee against default of the GSEs has given them a profit edge. But without Fannie and Freddie, there would be no viable housing market. We know this because of what banks did in the 1980s, when then Fed Chairman Paul Volcker raised interest rates into double digits.

Banks then withdrew almost completely from mortgage lending, so the GSEs stepped in by creating a secondary market that packaged and sold mortgages to investors -- whether to Wall Street, or Main Street pension funds. That enabled the real estate industry to recover from the 1981 and 1983 Reagan recessions.

So the banking industry has been very fickle when it comes to mortgage lending. In fact, the sub-prime fiasco resulted from over-leveraged banks taking advantage of soaring housing prices at the same time that financial markets were deregulating. Banks created the so-called shadow banking system outside of any regulatory oversight, which is responsible for much of the shadow housing inventory still on their books -- an estimated five million homes either delinquent or with negative equity in their homes in danger of foreclosure.

There is in fact good reason for banks to lend again with interest rates still at record lows and housing prices beginning to rise again. A mortgage banking industry has grown around the secondary market, and as long as banks will adhere to the same gold standard underwriting as Fannie and Freddie, there is no reason they shouldn't be generating record profits, as well.