The Internet is the global system of interconnected mainframe, personal, and wireless "computer" networks that use the Internet protocol suite (TCP/IP) to link billions of devices worldwide (from Wikipedia). It is also known, more technically, as the meta‐platform or 3D system for the whole information process. It has made information transaction much cheaper (almost free), faster, and easier for almost all kinds of information. Here, the "computer" is a basic operating system for processing information. Without it, there is no Internet at all.

Do we also have a system like the Internet in the real world or supply chain process? That is, a meta‐ platform or 3D system for the entire real world or supply chain process? No, not even a single one in the whole world yet.

Many companies have developed various kinds of platforms, systems, and networks in the supply chain process over the Modern information Age. However, almost all of them have developed those platforms, systems, and networks, simply by networking already existing supply chain functions. Nobody has tried to develop something like a "computer", that is, a basic operating system for processing physical goods movement, in the supply chain process.

As you may know, because customers are widely dispersed, it is very difficult, expensive and time consuming for individual suppliers to construct their own marketing and supply chain networks to supply all potential customers in the market. Worse, those networks had to be individually constructed by networking existing supply chain functions. What happened in the market then?

In this situation, each individual supply chain function such as supplier, distributor, wholesaler, and retailer unavoidably had to maximize the efficiency of its own function and participate in a whole supply chain network with high efficiency. As a result, an intensified "efficiency‐oriented" competition‐driven relationship among existing supply chain functions has been firmly established in the market.

Due to the superior position of big supply chain functions (companies) such as Wal‐Mart and Amazon in efficiency and capability, the businesses of small‐ and medium‐size supply chain functions (SMEs) have weakened and eventually failed, and accordingly many jobs in those supply chain functions have disappeared. Actually, jobs have been killed on a large scale in almost all industries of the economy over recent decades. Job creation in the market as a whole has also suffered as demand fell. This was a hidden but critical flaw that I have discovered in the existing supply chain process.

It is known that more than 95% of employer firms in the United States are small‐ and medium‐size companies. (99.7% of employer firms in the United States have fewer than 500 workers, and 89.8% less than 20 workers, according to the US Data.) Most of them, without streamlined supply chain networks, are still using conventional supply chain models with 3 or 4 separate transactions. On the other hand, most big companies have developed advanced supply chain models with 1 or 2 transactions, becoming more streamlined supply chain networks.

There have been many factors that changed the economic environment and affected the level of consumer spending in the Modern Information Age. Among them, two major factors for jobs have come to pass in the supply side of the market: (1) Increased IT efficiency in robotics, various software applications, and electronic transaction systems and (2) Increased offshoring and outsourcing to lower labor cost countries. These changes have killed a lot of jobs onshore in the U.S., and our economic experts have already recognized this. However, unfortunately, they have not seriously considered the increasingly unfair conditions for competition between big companies and SMEs in the supply chain process.

More seriously, it seems that a vicious cycle for jobs has already emerged between the supply side and the existing supply chain process.

As a result, those negative employment conditions eventually led to the weakening of the self‐ generation and recovery capability of the market, and this has operated as a force to lower the level of consumer spending over time. This has become a persistent cause of recurring recession.

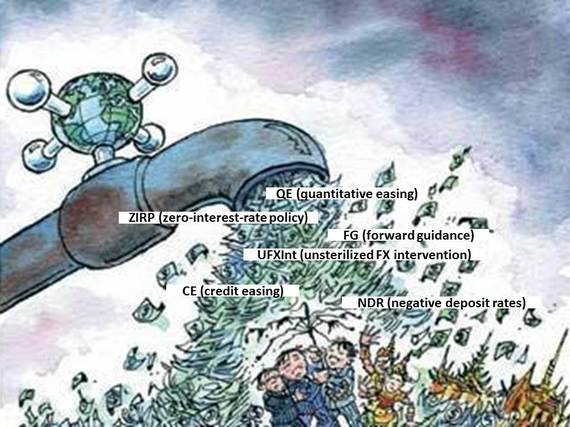

In this situation, it seems that our governments had no other choice than to adopt various excessive expansionary economic policies, stimulative economic plans, and even many unconventional monetary policies including QE (quantitative easing) and CE (credit easing) to avoid economic malaise. That is, they expected to use them as a force to keep the level of consumer spending high. But, unfortunately, they were effective only temporarily and even produced various abnormalities as side effects in the market. These contained a huge risk to the level of consumer spending and of forcing the economy into sudden recession. It seems the economy fell into a liquidity trap.

Why did this happen? Why did the economy have to fall into a liquidity trap?

Very strangely, it seems no economist has considered seriously the changed supply chain microenvironment as a factor that changed the macroeconomic environment and affected the level of consumer spending in his/her ruminations about the economy. The supply chain process is just like a human blood vessel in the market, and I believe it has suffered from something like arteriosclerosis, that is, a supply chain arteriosclerosis. Further, this supply chain arteriosclerosis has created the liquidity trap.

In this severely efficiency‐oriented competitive situation with a congested level of consumer spending, even big companies couldn't use the supplied money to expand their businesses, and SMEs also couldn't use it for adding more debt. Actually, the supplied money should have just stayed in the financial sector and increased various kinds of bubbles in the market. Naturally, a deflationary environment has also been established in the economy as a whole. The supplied money couldn't be used effectively to increase the level of consumer spending.

Isn't there any way to heal the supply chain arteriosclerosis and escape the current liquidity trap?

I believe there is a way: Why don't we develop something like the Internet in the real world supply chain process, or inter‐supply chain network (ISCN)? Less abstractly, by developing something like a "computer," that is, a basic supply chain operating system?

If this Internet‐like open supply chain process platform (or infrastructure) is developed and implemented in the market, I believe the current increasingly unfair conditions for competition between big companies and SMEs in the supply chain would be instantly solved by breaking the current vicious cycle for jobs between the supply side and the existing supply chain process. It will also make supply chain transactions much cheaper, faster, and easier for almost all kinds, sizes, and prices of products, just as the Internet did in information. Moreover, the current job‐killing spree in the supply side and supply chain process side will just stop, and, at the same time, numerous new businesses and jobs could emerge on the basis of this Internet‐like open supply chain process platform (or infrastructure) in almost all sectors of the market. Then, the current narrowly efficiency‐oriented competitive situation would smoothly change into a more effectiveness‐oriented competitive situation, the current supply chain arteriosclerosis heal, and the liquidity trap dissolve in increased consumer spending. Finally, policies will function smoothly again, and the economy would be revitalized.

I believe this is the only powerful way out of the current worldwide economic recession. Or we could just lumber on toward the cliffs of oligopoly and eventual monopoly, oblivious to the pernicious decay of supply chain infrastructure.