Wealth ought to come from the creation of value. That is, by designing and selling a better shovel, you make it easier for farmers to dig irrigation trenches which increases their yield. With your shovel, their output goes from 100 to 200 units a year, and so you, as shovel-maker get to benefit from a proportion of that 100 increase. It's "worth" giving you a cut, since your shovel added the value to their output. That, more or less, is the basis of capitalism. As time goes by, technology and methods improve, adding value, meaning we get more widget output per unit of resource input, and wealth increases.

There's another way to make wealth though, which is easier: by cutting costs, or essentially extracting value. Cutting staff, for instance. That means you spend less money per shovel, meaning profits increase, for a while anyway. Sometimes, though, that just fattens your bottom-line for a time, but strips out value from your enterprise, rather than adding it.

The third way to make wealth is to borrow lots of money. The problem is, eventually you have to pay it back.

Value creation should be a long-term and sustainable wealth-generation technique; value extraction is a short-term, unsustainable wealth-generation technique. Borrowing to make wealth is essential, but there are limits to how well this works. Borrowing too much is never a good thing. When too much borrowing is pervasive, it creates bubbles that eventually burst.

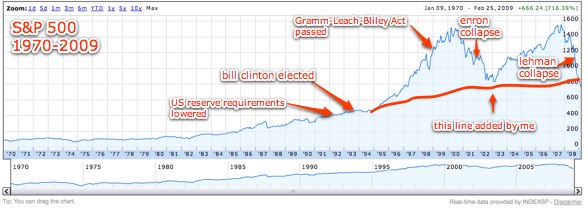

I've been thinking about value vs wealth in the context of the global economic meltdown. I don't have any answers at all but I am struck by the shape of the stock market curves for the past 40 years. Below is the S&P 500, between 1970 and 2009, a good proxy for the value of the economy.

It looks to me like there was a historically stable amount of value creation, reflected in the indexes, that for some reason in 1993/94 started to go a bit nuts. Two things drive it, I believe: low interest rates, meaning cheap debt flooding the market with money - corporate, personal, housing, financial; and increased global trade, namely with China, which kept prices and inflation low.

And it seems, based on this graph, that the wealth of the past 10-15 years was illusory, and that in fact the markets have dropped back to where they "should" be.

So the question is, what happened in 1993/94 that spurred such huge increases in stock asset valuation?

One answer comes from Niall Ferguson, in this fabulous (and scary) interview in the Toronto Globe and Mail:

"Monetary policy evolved in a peculiar way in the 1990s towards de facto or de jure targeting of inflation, an increasingly narrow concept of inflation - core CPI. I thought it was a mistake at the time because it seemed to me crazy to ignore asset prices. Why differentiate? What's the difference between pricing a loaf and pricing a house? Why do we care about one and not the other? In fact, we should probably care more about the price of a house than the price of a loaf, certainly in developed societies. I think there was a flaw in the theory there, that essentially you could call the Jackson Hole consensus. When the central bankers got together at Jackson Hole, the view that emerged from the debate in the late 90s was, we shouldn't really pay attention to asset prices in the setting of monetary policy." [more...]

Seems like they might have been wrong.