The pattern would be amusing if it wasn't so predictable, and ultimately, so disappointing to anyone who has been negatively impacted by the bursting of the real estate/asset bubble.

Our eager eyes turn to the newest piece of news, about home sales, home prices, a business that has anything to do with homes, expecting the proverbial green shoots, but time and time again, we just are disappointed. Home prices plunge. Spring market wilts. Shabby Chic, gone.

The reason for our disappointment is that instead of looking at the reality of the situation, we are in a state of continuing denial about what actually has happened and what might happen next.

For the last 25 years, the American economy has been inflated, re-inflated and over-inflated with a series of bubbles, the tech bubble, the housing bubble and a larger more dangerous full-asset bubble and now, as the largest and last of these bubbles burst before our eyes, it is virtually impossible for everyone to fully understand how large, powerful and pervasive the housing driven asset bubble was.

It is equally impossible for people to truly grasp that it was nothing more than a bubble and the prices for the houses, and the underlying economy and businesses that were relying on the housing market are gone and indeed will

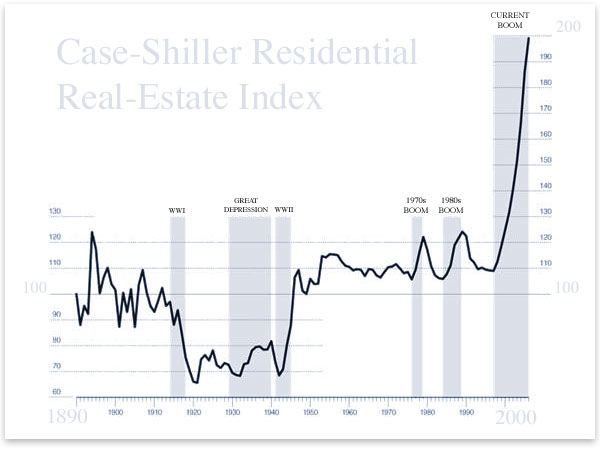

Let's look again at the long term housing bubble chart.

See the small peaks and valleys in past decades? Those valleys are ones that you recovered from. What we have is an unrecoverable bubble, prices will never, ever, ever go back to those levels in real dollar terms.

Ever.

Like ever, ever.

To make this point even clearer, let's look at another bubble.

Almost 10 years ago, the NASDAQ hit 5,000. Right now it is at 1,747. Almost 10 years later, it is worth a fraction of what it was at its peak.

Let's look at the biggest bubble of all time perhaps, the famous Tulip Bubble of four centuries ago. The prices of small patches of bulbs in current dollars was over $500,000. Insane? Sure. But at least with the tulip bubble and the tech bubble, the insanity was somewhat localized. Of course, when tulips lost 99.9% of the value, if you were local to that insanity, it hurt.

But the housing/asset bubble has created over the past decade a bubble that has permeated our entire culture.

The bubble from real estate fed bubbles in retail, in the service industry, in the jet ski industry, the travel industry, literally everything that people were going to spend that $100,000 they made in real estate, is now hurting, and will continue to hurt.

There are no green shoots, because there is no recovery when a bubble pops.

There is only gradual and slow, painful realization that it was a bubble. And now, it's gone.