Payrolls were up 211,000 last month and the unemployment rate held steady at 5%, giving the Federal Reserve little reason to rethink their chartered course to commence interest-rate liftoff later this month. The prior two months' job gains were revised up 35,000, with October's gains now registered at 298,000, the strongest month so far this year. While soft spots remain in the job market -- see "watchlist" below -- and we are not at full employment, we are clearly on that path, as payrolls have settled into a steady growth groove, slightly north of 200,000 per month.

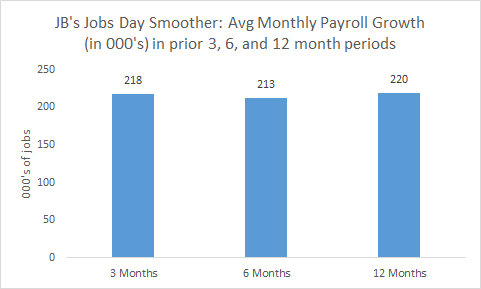

The JB Jobs Smoother, which takes averages of job gains over 3, 6, and 12 months to iron out some of the monthly noise, shows gains between a narrow range of 210 and 220 thousand per month over these intervals. That's fast enough job growth to continue to draw the remaining slack out of the job market. (Nerds: yes, I'm mixing surveys. The payroll numbers in the smoother come from the survey of establishments while the unemployment rate comes from the survey of households. But they generally move together.)

Variables on the watchlist:

While employers have been creating jobs at a steady clip, there are still soft spots in the job market. Here are the variables you want to watch if, like me, you're still concerned that there's some distance between here and full employment.

Underemployment, or U6: This more comprehensive measure of labor under-utilization is now one of the most important variables to watch as it is more representative of remaining slack then the official rate. It clocked in at 9.9% in November, a tick up from last month, but still well above my preferred guesstimate of U6*-the underemployment rate commensurate with full employment, which I'd put around 8.5%.

Part-time for economic reasons: This metric is the main difference between the official jobless rate and U6 and at 6.1 million (about 4% of the labor force), it remains elevated (i.e., that's the number of people with part-time jobs who want full-time jobs). There were about 320,000 more involuntary part-timers last month, though the variable is still on a downward trend, 765,000 below last November's level.

Labor force participation: It ticked up a point, to 62.5% but is still 3.5 percentage points below its 66% peak way back before the downturn. Maybe 2 of those points can be ascribed to retiring boomers, but that leaves 1.5% of the labor force -- over 2 million people -- missing in action, i.e., not counted in the jobless rate because they're not looking for work (some are picked up in U6 but most probably aren't).

Wage growth: It's up 2.3% over the past year, a tick down from last month's 2.5% pace, but it's fair to say at this point that nominal wage growth has picked up a bit, as we'd expect given the tightening job market. That's a good thing-no cause for alarm! We want faster wage growth, and there's certainly little evidence it's bleeding into prices, which remain stagnant. Weekly hours ticked down slightly, so weekly earnings fell a bit in November and are up 2% over the past year.

Manufacturing: The sector continues to be visibly hurt by impact of the strong dollar on the competitiveness of our exports. Factory employment ticked down slightly, by 1,000, but over 2015 thus far, average manufacturing job gains have been 1,500 per month, compared to about 18,000 last year through November. Note that raising interest rates at the Fed will slightly strengthen the dollar in international markets, exacerbating this problem.

On the plus side, construction has picked up in recent months, up 46,000 last month and 259,000 over the year so far.

I'll have more to say about the Fed later, but at this point, were they not to raise, it would be downright weird, odd, and inconsistent with forward guidance (telegraphing their important punches). Even while I do not see much rationale for an increase, especially given elevated underemployment and the stark lack of inflationary pressures, given their recent messaging, a non-liftoff in December would suggest the economy is a lot worse than they thought in some secret way they've been keeping from us. Such a negative surprise would be ill-advised.

Presuming that they won't want to go there, it's now all about the "path to normalization:" how fast they raise. I know she hears way too much unsolicited advice from way too many people, but if I'm Chair Yellen, my message to the hawks is: "OK, you got your rate liftoff even though the data weren't really there for it. Now back the @&$! off and let's go back to being data-driven about future increases."