Interesting piece in the New York Times today about how many people benefit from some form of government spending on "entitlement" programs, and how they feel about it.

I'll have more to say about this next week, but for now, just a few points, since I posted on this same issue just a few days ago, reaching what might seems like an opposite conclusion.

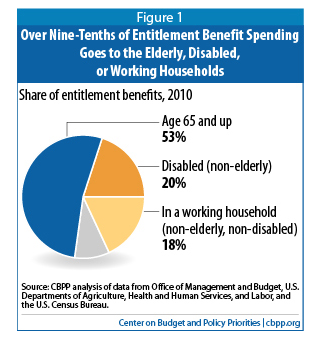

EG, in that post-based on an important new CBPP analysis -- I stressed the finding that only 9 percent of entitlement spending goes to folks who are non-elderly, non-disabled, or not working very much (see figure below). How does this square with an article that points this out:

Almost half of all Americans lived in households that received government benefits in 2010, according to the Census Bureau. The share climbed from 37.7 percent in 1998 to 44.5 percent in 2006, before the recession, to 48.5 percent in 2010.

The answer is that almost every example of a beneficiary of a government program in the Times article fits into to one of those benefit-receiving slices in the pie chart-they are either elderly, disabled, or working.

Also, some of the statistics need adjusting -- to truly understand how much entitlement spending has really gone up, you've got to take into account:

- The Great Recession: Both the tax system and the safety net are still countercyclical (though less than they used to be). This means we spend more on things like food stamps and unemployment benefits in recessions and we collect less in tax revenue as well. Both of these dynamics are very much in play right now and so, sure, we're spending a lot more than we're taking in. That will improve when the economy recovers, though we won't be out of the woods -- over the longer term, we need to collect more revenue and slow the growth of health care spending.

- Adjusting for Age: With more seniors, we're going to spend more on retirement and health benefits, even holding policy constant. This doesn't contradict the article, but it's important to recognize what part of increased entitlement spending is due to demographic change and what part is due to policy decisions.

- Inefficient Health Care Spending: It's not just that we spend a lot on health care for retirees and the poor through Medicare and Medicaid. It's that we do so quite inefficiently relative to other advanced economies that provide more comprehensive public coverage for a lot less per capita with at least comparable outcomes -- and the private side of the health care system generates even faster cost growth. So again, less a policy choice here than a unique problem we have to fix no matter where we end up on questions re government programs in our lives.

I'll try to make those adjustments (or find them somewhere) but the article is still an important piece of work that once again asks what I've come to think of as the 2012 question: What is the proper role of government?

With our aging demographics, middle-class wage stagnation and job losses -- which play an important role in this piece-increasing inequality, macroeconomic booms and busts, it seems axiomatic to many of us that we need an amply funded federal government. Market failures -- not just recessions, but the inability of markets in advanced economies to provide ample social insurance as effectively as the public sector, the need to provide for the disabled, the safety net, and wage subsidies like the EITC for those who need to support children but don't earn enough to do so -- clearly abound.

Yet, people like those in this piece struggle with what to them seems like a contradiction: they want to think of themselves as self-sufficient and independent, yet when pushed, most recognize that they need the help... to me, at least, it seemed like most grasped -- begrudgingly in some cases -- the logic of the role for government when markets fail.

Moreover, their ambivalence is amplified by deeply misleading politicians, like the local Congressman in there, spouting guilt-inducing nonsense about debt burdens. Yes, we face a fiscal challenge. And yes, we can solve it with known policies that are fair and reasonable -- they're just off limits due to dysfunctional politics.

I've said it before, but at the end of the day, as much as the YOYOs claim otherwise, we're all in this together.

More to come on this... it's one of the most important things for us all to be talking about.