Employers added workers at a much faster-than-expected clip last month, as payroll gains 321,000, the largest monthly gain since January 2012. Upward revisions to the prior two months added another 44,000, while the unemployment rate held steady at 5.8 percent. Even wage growth, which has been a critical missing piece of the recovery, got at least a monthly bump, up 0.4 percent, though the more relevant year-over-year growth rate remains stuck at around two percent (2.1 percent, Nov'13 - Nov '14), where it has been since 2010.

While any one month's results from these "high-frequency" data should be taken with a grain of salt (see the "JB smoother" below), I saw no obvious anomalies in the payroll data. Job growth was robust across industries, with almost 70 percent of private industries expanding, the highest level for this metric since 1998. Businesses added 86K, retail was up 50K, and manufacturing, a key sector that had been a laggard in recent months, added 28K, mostly in the higher paying durable goods sector.

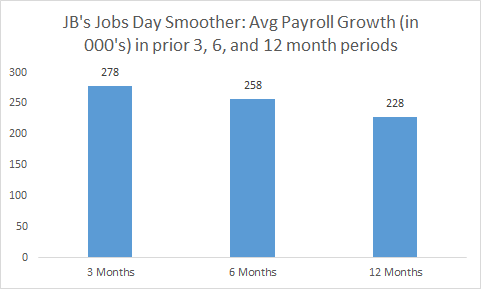

Smoothing out monthly ups-and-downs, this month's JB smoother©, which averages monthly gains over 3, 6, and 12 months, shows a nice acceleration in payroll gains. Over the past three months, net job growth is up 278,000 per month. Over the past year, this measure is up 228,000, showing an acceleration of 50,000 jobs per month.

[BTW, in deference to this simple way of smoothing out monthly noise, the BLS announced that in coming months it will add three-month averaging of monthly payroll gains to its summary table. Good for them!]

In another sign of improving labor market demand, average weekly hours ticked up a tenth, matching pre-recession levels. The unemployment rate, which comes from a survey of households (as opposed to business establishments, like the data discussed above) held steady at 5.8 percent (it actually ticked up a touch, from 5.76 percent to 5.82 percent, but who's counting?).

But the key takeaways here are:

- Unlike the more reliable payroll survey, employment was unchanged in the household survey.

- In a solid sign for the job market recovery, the labor force participation rate continues to hold steady, at 62.8 percent last month -- after falling sharply through the recession and recovery, this important measure of labor utilization has been flat now for over a year.

- While the numbers of long-term unemployed and involuntary part-timers remains high, especially more than five-years into an economic expansion, they both fell last month, continuing a downward trend.

Finally, turning to the wage story, as noted, average hourly wages got a nice $0.09 (0.4 percent) bump in November, but that just made up some lost ground from recent monthly stagnation. Thus, the year-over-year measure is still stuck around two percent, where it's been since around 2010. With topline inflation last seen rising at 1.7 percent percent, this translates into quite modest real gains for the buying power of the hourly wage.

But with the added weekly hours, weekly earnings are up 2.4 percent, year-over-year, the highest growth rate in a year. Here again, however, real gains still equate to less than one percent, and they're coming from more work at stagnant real earnings. The punchline of all this is that the job market appears to be solidly on the mend. Yet slack remains, and this is most clearly seen in the wage data.

As I'll get to later in the day, recent developments in the relationship between slack and wage growth suggest that it will take more than falling unemployment and strong payroll gains to offset the historically low bargaining power of most American workers. For the benefits of growth to really show up in paychecks, we need to not only get to truly full employment, but to stay there for a good long while! That exclamation point is so they can hear me all the way over at the Fed building on Constitution Ave.

This post originally appeared at Jared Bernstein's On The Economy blog.

Our 2024 Coverage Needs You

It's Another Trump-Biden Showdown — And We Need Your Help

The Future Of Democracy Is At Stake

Our 2024 Coverage Needs You

Your Loyalty Means The World To Us

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

The 2024 election is heating up, and women's rights, health care, voting rights, and the very future of democracy are all at stake. Donald Trump will face Joe Biden in the most consequential vote of our time. And HuffPost will be there, covering every twist and turn. America's future hangs in the balance. Would you consider contributing to support our journalism and keep it free for all during this critical season?

HuffPost believes news should be accessible to everyone, regardless of their ability to pay for it. We rely on readers like you to help fund our work. Any contribution you can make — even as little as $2 — goes directly toward supporting the impactful journalism that we will continue to produce this year. Thank you for being part of our story.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

It's official: Donald Trump will face Joe Biden this fall in the presidential election. As we face the most consequential presidential election of our time, HuffPost is committed to bringing you up-to-date, accurate news about the 2024 race. While other outlets have retreated behind paywalls, you can trust our news will stay free.

But we can't do it without your help. Reader funding is one of the key ways we support our newsroom. Would you consider making a donation to help fund our news during this critical time? Your contributions are vital to supporting a free press.

Contribute as little as $2 to keep our journalism free and accessible to all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. Would you consider becoming a regular HuffPost contributor?

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. If circumstances have changed since you last contributed, we hope you'll consider contributing to HuffPost once more.

Already contributed? Log in to hide these messages.