If revenues are to be in the budget package that the president and Congressional leadership are now negotiating -- and be in there, they must -- they will almost surely come from cutting tax expenditures. Those are the one trillion worth of tax revenues forgone each year due to tax breaks for various activities in the code.

Politicians of both parties recognize that many of these tax breaks are loopholes, as seen in the vote a few weeks ago to end the $6 billion annual tax subsidy for ethanol, which garnered 34 R's in the Senate.

There's even a little list going around town of tax expenditures that might get cut in the deal, including oil and gas subsidies, favorable tax treatment for inventories (why should the tax code favor inventories?... like I said, loopholes), and other cats and dogs (corporate jets!).

The thing is, back in April, when President Obama set out his budget guidelines for this aspect of the talks, he said he wanted a cool trillion in revenues, out of deal that reduced deficits over 12 years by $4 trillion.

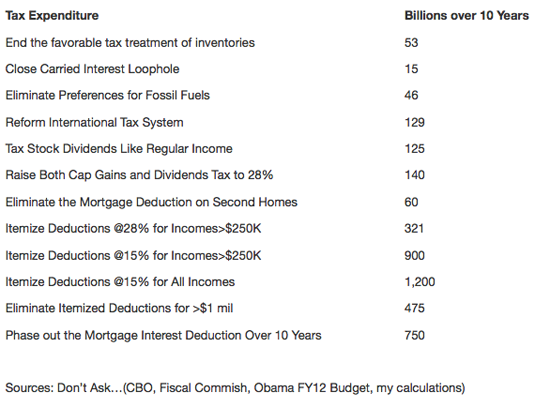

So, connecting all these dots, it seemed like a good idea to think about various ways to get to a trillion in savings through cutting tax expenditures. Here's a menu, with rough cuts of the savings over 10 years.

As noted, these are rough estimates from a variety of sources but they're ballpark. You can't tote up the whole list without double counting, because reducing itemized deductions covers all of the other individual components in the table. But the point is we could theoretically get to $1 trillion in savings over 10 years in lots of ways, and many of these are obviously dialable.

We could raise $1.2 trillion by only allowing people to itemize deductions at a 15% rate instead of the top rate they face. This would obviously be a big deal -- most of this stuff would be a big deal -- but as my CBPP colleague Chuck Marr points out, in terms of fairness, why should a wealthier person get bigger breaks for their deductions than a middle-class person. And don't conservatives like flat taxes?

I'm not endorsing all of these. Economists legitimately worry that the mortgage interest deduction distorts prices in the housing market, but it remains a bedrock tax break to a lot of middle-class families (44% of the value of deductions goes to families with incomes less than $100K), and you actually couldn't get rid of that distortion without whacking home prices, something you'd kinda want to avoid right now.

Others should be a slam dunk. The so-called "carried interest" loophole allows hedge fund managers to pay the capital gains rate (now 15%) on their earnings, so they end up paying a lower rate than a middle-income school teacher.

The point is we could stick to tax expenditures and hit the $1 trillion in revenue the President wisely laid out at the beginning of this process. I'm not saying we will. Just sayin' we could.

This post originally appeared at Jared Bernstein's On The Economy blog.