There is a lot of crazy stuff on the airwaves re: the Supreme Court's upholding of the Affordable Care Act.

The Inane "Is It a Tax?" Debate: Republicans are viciously attacking the ruling because it introduces a new "tax" on people who don't have coverage. As I and many others have stressed, this tax is a free-rider penalty. It is a PRF -- a personal responsibility fee -- for not saddling the rest of us with your health care costs, thereby imposing an implicit tax on the rest of us. And it hits 1-2% of the population.

You thought personal responsibility was supposed to be a conservative value? Not, apparently, when the dreaded tax word is invoked.

But, really, a pox on both houses here. Despite the fact that the Supreme Court ruling calls it a tax -- I mean, it doesn't just call it a tax, it says the reason we can do this is because Congress can tax -- Democrats are working overtime to not pronounce those dreaded three letters. Weirdly, they now have an ally in this Kabuki theater: Governor Romney!

I get it: silliness pervades in an election year... but really? Seriously?!? Taxes happen in societies -- according to a Supreme Court justice from a saner time, they're "the price we pay for a civilized society." And in this case, they're the price we pay to offset a negative externality by which the behavior of a small minority of citizens imposes a cost on everyone else.

To be ashamed to make that case is to cede the field to Norquist and co.

The Supreme Court Ruling's Impact on the Cost of the Affordable Care Act: Another unfortunate talking point evolved over the weekend that also makes no sense: based on changes to the law imposed by the SCOTUS, the ACA is now a "budget-buster." I heard Sen. Coburn make this argument on a Sunday show, and my conservative doppelganger Doug Holtz-Eakin made the point in a debate we had on Friday. Doug's argument was later picked up by the Washington Post... unfortunately because, as my CBPP colleague Paul Van de Water points out here, it's got to be wrong.

First, you should know that the CBO scored the ACA as slightly reducing the budget deficit in the first decade of its existence and reducing it a lot more in its second decade. So, what's changed in the SCOTUS ruling that would lead Republicans to make the claim that the law is no longer fully paid for?

The only change the SCOTUS made that has significant fiscal implications is making the Medicaid expansion optional for states. If no states take them up on that, the CBO cost estimate stands. But if states opt out, that means the law should cost less to implement, not more! This is a bad thing as I see it, because it means less coverage for the poor. But it saves money.

Clever Doug argues otherwise based on the following logic: It's true that people below 100% of poverty will now not benefit from the Medicaid extension in opt-out states. But those between 100-133% of poverty -- who would have been covered under the Medicaid expansion -- will now be eligible for the federal subsidies to buy insurance from the state exchanges, coverage which Paul Van de Water says "may be more costly than Medicaid."

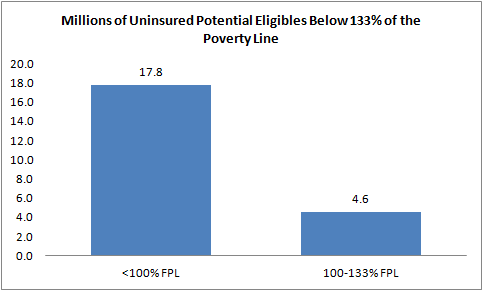

The problem for Doug, Sen. Coburn and others who are making this case is that there are about four times more people potentially eligible for Medicaid below 100% than between 100 and 133%. As the figure below -- from some very timely Urban Institute research -- reveals, there are 22.3 million uninsured poor and near-poor people who would be eligible for coverage under the Medicaid expansion. But about 80% of them -- 17.8 million -- are below 100% of poverty and therefore not eligible for subsidies. It's implausible that a much smaller group getting subsidies would cost more than a much larger group not getting on the Medicaid rolls.

Source: Urban Institute

In this regard, based on the SCOTUS ruling, the CBO cost estimate should now be considered an upper bound. It's the cost of the ACA if no states reject the Medicaid expansion.

This post originally appeared at Jared Bernstein's On The Economy blog.