There's a spate of articles out today on the improving housing market, with reference to its positive impact on the overall economy.

The latest sign [of the housing recovery] emerged Tuesday as the Standard & Poor's Case-Shiller home price index posted the biggest gains in seven years. Housing prices rose in every one of the 20 cities tracked, continuing a trend that began three months ago. Similar strength has appeared in new and existing home sales and in building permits, as rising home prices are encouraging construction firms to accelerate building and hiring.

The broad-based housing improvements appear to be buoying consumer confidence and spending, countering fears earlier this year that many consumers would pull back in response to government austerity measures.

We'll see re: austerity -- the cuts and furloughs are slowly unfolding -- but there's no question that the housing market, once a huge anvil around the economy's neck, is now raising homeowners' wealth and facilitating stimulative refis into very low mortgage rates.

It's the last part -- about the low borrowing rates and especially about the Federal Reserve's role in pushing them down -- that I thought the articles overlooked a bit (excepting the WSJ one, which mentioned this point early on).

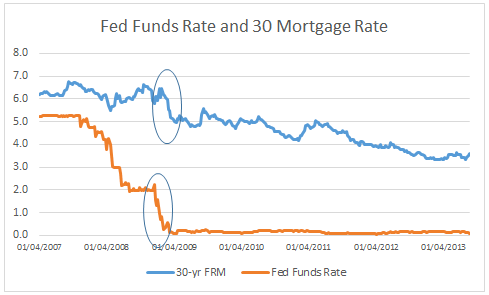

Sure, the housing market would have eventually recovered but absent the Fed's aggressive rate cutting, though their actions on the Federal Funds rate and their quantitative easing program, it would have taken a lot longer (note figure below, including ratcheting down in the circled parts). The Fed's QE program in particular, by scooping up billions in mortgage backed securities when the private MBS market had all but shut down, is particularly implicated in low mortgage rates and housing market's return to life.

I fear that many people's view of economic policy is that "nothing works" be it monetary or fiscal policy. Sometimes it doesn't and sometimes its consequences are unintended. But broadly speaking, such cynicism is dangerously wrong, and to counteract it we need to vigilantly recognize the linkages between policies and their outcomes.

Update: Wonkbook gets it (and thinks we should give Bernanke some fruit...):

Scott Sumner, an economist at Bentley University, has a different take. Congress might've hurt the economy this year but Federal Reserve Chairman Ben Bernanke has been working overtime to help it. "The Fed does monetary stimulus in late 2012, citing the need to offset the drag from fiscal austerity," he writes. "Then 2013 turns out to be a pretty decent year, no worse than 2012." Perhaps there's no mystery here at all. We just owe Bernanke a fruit basket.

This post originally appeared at Jared Bernstein's On The Economy blog.