Very interesting piece in today's NYT on how more inflation would actually be helpful right about now. That's probably counter-intuitive to a lot of readers so let me elaborate.

To be clear, none of us would be calling for faster price growth were it not for the fact that inflation is really low. This chart from the NYT piece plots the price measure that the Federal Reserve watches most closely -- the core PCE -- which was last seen growing at around 1.2 percent, technically termed bupkis by seasoned inflation watchers. This is clearly a function of weak demand, hardly any wage pressures, and no pricing power by firms.

But if such persistently low inflation is a symptom of weak growth, it's not exactly obvious that faster inflation itself would lead to improved growth rates. Isn't this mistaking an outcome variable for an input variable?

In fact, there are various ways in which higher inflation can help at a time like this. Most importantly, it lowers the real rate of interest. True, interest rates are low right now -- the one controlled by the Fed is about zero. But last I checked, if you look at historical relationships between economic variables and interest rates, we actually need borrowing rates to be less than zero, and that's where higher inflation comes in.

The real interest rate is the actual, or nominal rate, minus the rate of inflation. So the only way to jam the real rate down to where it needs to be -- i.e., in negative territory -- is through higher inflation. That could motivate investors to undertake new projects, from factory expansions to a home loan for an addition on your house.

Second, higher inflation reduces debt burdens (since debts are typically repaid in nominal dollars) and, as a few retailers point out in the piece, it also increases profit margins.

I'm quoted in there as supporting all of the above points, but still being worried about the impact of higher prices on real wages. So let me say a bit more about that.

On net, faster inflation would help shake the macro-economy out of its slog so I'm for it. But it's not costless. It hurts those on fixed incomes, hurts creditors (the flipside of helping debtors), and risks unmooring well-anchored inflationary expectations (though these days most of us are more worried about deflation than spiraling inflation).

And, all else equal, it would also reduce real wages. Most recently, the hourly pay of mid-wage workers has been growing at around 2 percent per year with inflation running at about 1.5 percent, so slight real wage gains. Take inflation up a point and unless nominal wages accelerate as well, we're now talking about real wage losses.

However, all else is almost never equal. Let's reflect for a second on how wages are determined. For macro-types like economist Larry Ball, with whom I discussed this and who thinks deeply about such things, the growth in nominal wages is simply the growth real wages plus inflation. Real wage growth is itself a function of real things, like productivity growth and/or bargaining power, and inflation, at least in the long run, is determined by the Fed.

So in this formulation, higher inflation just leads to higher nominal wage growth -- real wages are not much affected.

Others argue that with faster inflation, firms can adjust to weaker demand not by reducing nominal wages, something they typically avoid (sticky nominal wages), but by allowing real wages to fall. In this view, higher inflation allows for an adjustment that's unavailable at low inflation. In fact, it's similar to the zero-lower-bound (ZLB) problem that higher inflation solves on the real interest rate side, but in the wage case the ZLB is replace by the fact that firms don't like to lower nominal wage rates.

As my quote in the NYT piece suggested, I worry that higher inflation could at least temporarily lower real wages, though I still think its benefits would outweigh its costs right now. Moreover, when we're talking about how macro maps onto micro these days, we can't ignore distributional outcomes. Dynamics that look good from an average perspective don't necessarily look that way from the low- or middle-end of the wage spectrum.

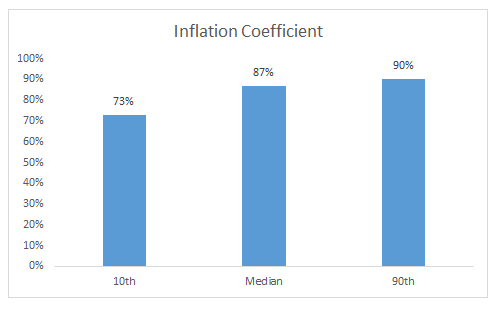

A quick look at such relations over time is revealing. Using annual data (because my distributional wage data are annual), I regressed the change in nominal wages on the change in the core PCE deflator (lagged one period) and the unemployment rate. The figure below shows the inflation coefficient (statistically significant in each case) for the 10, 50 (median), and 90 percentile wage.

As Ball suggested, nominal wages do grow faster when inflation is faster, but less so for lower wages.* So while I'm solidly in the camp that higher inflation would help right now, I still want to keep an eye on its real impact on wages at different percentiles. Low-wage workers are particularly vulnerable to this "solution."

Source: See text. My calculations using data from BEA, BLS, and EPI for nominal wage data.

*BTW, you're right to worry that the coefficients on inflation are less than one, suggesting a real loss, but a Wald test suggests they're actually statistically indistinguishable from one; the same test also rejects the hypothesis that the coefficients are the same.

This post originally appeared at Jared Bernstein's On The Economy blog.