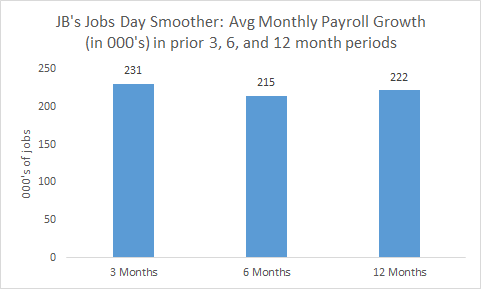

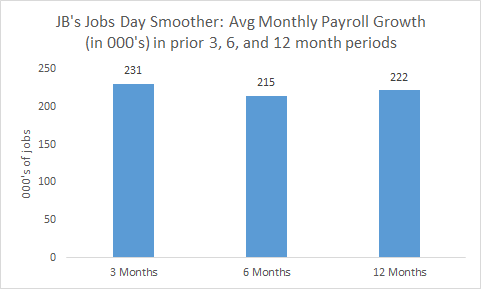

Job growth slowed in January, as the nation's employers added 151,000 net new jobs, compared to over 250,000 in each of the prior three months. However, while slower job growth may be a function of recent market volatility and slower growth abroad, it is far too soon to draw any such conclusions from one month's data. As my monthly smoother shows, average employment gains are solidly over 200,000 in recent months, and if this underlying trend persists, the labor market will continue its steady trek towards full employment.

Unemployment ticked down slightly to 4.9 percent, and for the "right reasons" -- i.e., more people got jobs as opposed to more people gave up looking. Average hourly wages were up 2.5% over the last year -- that's an acceleration over the 2% pace that prevailed earlier in the recovery, signaling that the tightening job market may finally be giving workers a bit more in the way of bargaining power, something they've lacked for a very long time. I return to this critically important point below.

The average work week ticked up a bit as well, and 60 percent of private sector industries added jobs, including an unexpected pop in factory jobs, up 29,000 last month, the sector's strongest month since November of 2014.

In other words, despite the slowdown in payroll gains, today's report should be considered yet another entry in a series of quite positive jobs reports.

Remember, these are sampled data, and the monthly confidence interval in payroll gains is 100,000, meaning that the true monthly number of net jobs added is likely between 50,000 and 250,000. That's why it's useful to smooth out the monthly bips and bops using JB's patented smoother, shown below. Over the past three months, the average monthly gain has been about 230K, and the other bars show this has been around the trend growth rate for the past year or so.

Source: BLS, my calculations

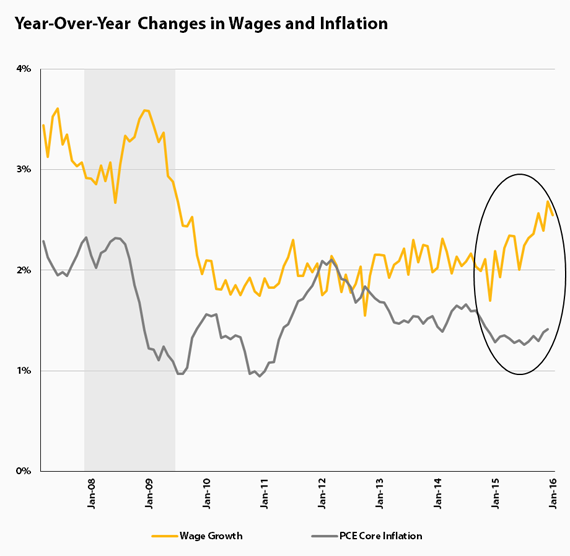

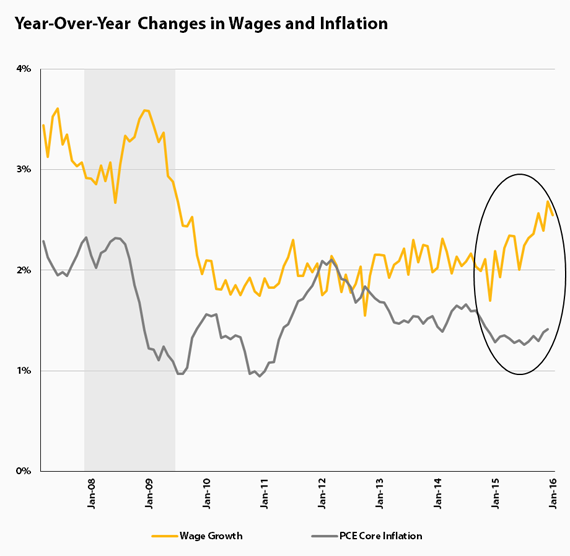

Now, on to this month's Rorschach test. Focus on the hourly wage growth line (orange?-I'm color blind!) in the figure below (I'll get to the other line in a moment). That circled bit at the end shows the acceleration I referred to earlier, and it is very much what I and other fans of tight labor markets have predicted (and longed for!) for quite a while now (this is the average wage, but, importantly, production worker wage growth is following a similar pattern).

Sources: BLS, BEA

Do you see that uptick and think, "Great -- we're getting closer to full employment and that means that the benefits of growth might have a chance to be more broadly shared! USA! USA!"? To be clear, we're not yet at full employment. The underemployment rate (U-6) has been stuck at 9.9%; my estimate is that it needs to be 8.5% before we're there.

Or do you look at the line and say, "Janet, slam on the breaks!"? IE, as wages growth faster, you worry they'll bleed into prices and the Fed better act now to preempt that possibility.

If that's where you're coming from, and I sincerely hope it's not -- remember: periods of full employment have been the big exception over the past 40 years -- then look at the other line, which plots PCE core inflation, the Fed's preferred metric of price pressures. It is not showing any commensurate acceleration. True, the Fed needs to look around the next corner in this regard, but if anything, expectations are deflationary, in no small part due to the headwinds from the strong dollar and sharply slower growth in emerging economies.

Such headwinds remind us that there are unquestionably economic jitters out there in the world that bear close watching. But the US job market continues to truck along, adding over 200,000 jobs per month on average over the past year, helping to push the unemployment rate closer to full employment, and, most importantly, providing workers with a bit of the bargaining power they need to finally claim their fair share of the growth they're helping to produce.

This post originally appeared at Jared Bernstein's On The Economy blog.

Our 2024 Coverage Needs You

It's Another Trump-Biden Showdown — And We Need Your Help

The Future Of Democracy Is At Stake

Our 2024 Coverage Needs You

Your Loyalty Means The World To Us

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

The 2024 election is heating up, and women's rights, health care, voting rights, and the very future of democracy are all at stake. Donald Trump will face Joe Biden in the most consequential vote of our time. And HuffPost will be there, covering every twist and turn. America's future hangs in the balance. Would you consider contributing to support our journalism and keep it free for all during this critical season?

HuffPost believes news should be accessible to everyone, regardless of their ability to pay for it. We rely on readers like you to help fund our work. Any contribution you can make — even as little as $2 — goes directly toward supporting the impactful journalism that we will continue to produce this year. Thank you for being part of our story.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

It's official: Donald Trump will face Joe Biden this fall in the presidential election. As we face the most consequential presidential election of our time, HuffPost is committed to bringing you up-to-date, accurate news about the 2024 race. While other outlets have retreated behind paywalls, you can trust our news will stay free.

But we can't do it without your help. Reader funding is one of the key ways we support our newsroom. Would you consider making a donation to help fund our news during this critical time? Your contributions are vital to supporting a free press.

Contribute as little as $2 to keep our journalism free and accessible to all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. Would you consider becoming a regular HuffPost contributor?

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. If circumstances have changed since you last contributed, we hope you'll consider contributing to HuffPost once more.

Already contributed? Log in to hide these messages.