Some facts about the impact of Japan's aggressive stimulus program to inject $1.4 trillion into the economy over the next two years:

-- Real GDP up: 3.5% in Q1, beating expectations (which hasn't happened much there for a long while...)

-- Equities up: the Nikkei is up 88% from its 2012 low; bank stocks have about doubled;

-- Yen down about 16% against the dollar; 26% from its 2012 high;

-- Government bond yields up (?!): the 10-year JGB (Japanese government bond), while still below 1%, has doubled since the stimulus was announced in early April.

It's that last one that should catch your attention. It's unusual, potentially problematic, and bears close watching. As Bloomberg noted today:

The biggest surge in government debt yields in five years threatens to undermine the BOJ's stimulus, with companies... pulling bond sales amid the tumult. The prospects of a growth rebound and the emergence of inflation has contributed to sending the rate on 10-year bonds up more than a quarter percentage point in two weeks.

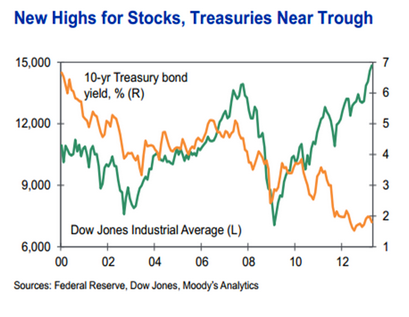

The American pattern for stocks and bond yields right now, shown towards the end of the figure below, is more like what you might expect in a period where the underlying economy is still weak and the central bank is pumping serious cash into the system ($85 bn/month in the U.S. case through "quantitative easing"). Equities are rallying on high corporate profits, low costs, and expectations of future growth, while Treasury yields are low in keeping with the Fed's monetary stimulus.

On the other hand, the climbing yields on JGBs is worrisome on three counts. First, the central bank wants a low and stable cost of borrowing to get investors back in the game. Second, higher yields on government bonds make it pricier to service the large stock of Japanese public debt, and third, reducing bond yields and volatility adds another ball to the juggling act in which Japan's economic officials are engaged.

The BOJ's governor, Haruhiko Kuroda, told the press he had it covered: the bank would conduct their bond purchases in a "flexible manner" to get the yields down and under control. OK, but that there is some fine tuning amidst a lot of moving parts. Perhaps what's happening with yields is no more than temporary hiccup, where the anticipation of growth and inflation are generating a whiff of something that hasn't been in the Japanese air for many a year: hope, confidence, and the sense that policy makers are truly committed to reflating the long moribund economy.

At any rate, stay tuned.

This post originally appeared at Jared Bernstein's On The Economy blog.