Lots of focus on the Federal Reserve's announcement yesterday to twist again (here's Greg Ip's take at The Economist). Twist 2 is another dose of so-called unconventional monetary stimulus. In this case, they swap out some of their holdings of short-term debt for longer-term debt, intended to lower interest rates at the long end of the yield curve.

I'll say a bit more about the impact of this in a later post -- as Fed chair Ben Bernanke himself intimated, I'm not sure lower long term interest help much right now. It's not the cost of capital, or the amount of cash reserves investors have on hand, that's holding back the recovery. It's lack of consumer demand.

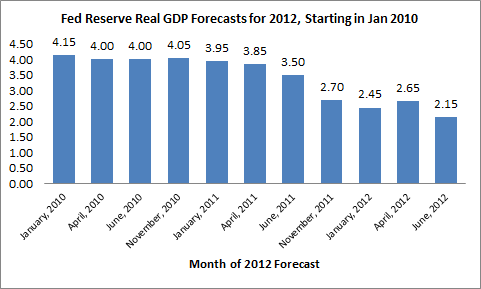

Here, I'd like to focus on yet another downgrade in the Fed's forecast. The figure below shows their estimate for 2012 real GDP growth start with their Jan 2010 forecast up through the one release yesterday (I've taken the average of their low/high estimates).

Source: Federal Reserve

As you see, they've steadily dropped such that their guess for 2012 is now 2% of GDP lower than it was a few years ago.

OK... what's the point? It's not that they're lousy forecasters. This is a common pattern -- for years now, economic forecasters have continuously predicted recovery, gotten a spate of bad news, and pushed their recovery prediction out a few quarters.

The problem is structural, i.e., it's in the models, which fail to adequately account for the loss of wealth that's beset most households, the subsequent deleveraging, and the impact of these dynamics on the macroeconomy (see here, e.g.).

As I've stressed elsewhere, the loss of housing wealth is particularly problematic in this regard. First, as Case et al show here, the impact on consumer spending from the loss of housing wealth is particularly large (relative to standard wealth effect estimates, their estimate from lost housing wealth is 3-4 times greater).

Second, when an equity bubble bursts, like the dot.com example in the late 1990s, it mops up more quickly as "mark-to-market" takes your pet rock shares to zero pretty fast. But in a debt-financed housing bubble, "extend-and-pretend" kicks in, as banks have strong incentives to avoid admitting that non-performing loans are burning a hole in their balance sheets.

These observations are known to Fed forecasters, I'm sure, as suggested by the downward adjustments to their estimates. After enough of your green shoots turn brown, you hopefully learn to recalibrate.

So, now that we're improving the models, how about improving the economy?