Payrolls rose only 126,000 last month in a surprisingly downbeat reading on the state of the labor market. Unemployment remained unchanged at 5.5%, but the closely watched labor force rate fell a tenth in another sign of weakness.

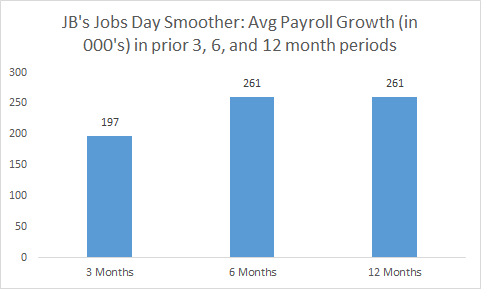

Contributing to the disappointing report, job gains for the prior two months were marked down by a total of 69,000. Thus, the average monthly gain over the first quarter of the year fell slightly below 200,000, as shown below.

Average weekly hours ticked down slighty as well in March, the first such decline in over a year.

Hourly wage growth, measured on a year-over-year basis, was up 2.1%, providing another month of evidence that despite the long-term improvement in job market conditions, nominal wage growth remains stuck in a narrow band around 2% where it has been for about five years.

In order to smooth out some of the monthly volatility in the data and get a better sense of underlying trends, the figure below shows average monthly payroll gains over the past 3, 6, and 12 months. As noted, the 197,000 monthly average over 2015q1 represents a marked deceleration over the prior 6 and 12 month gains of 261,000.

Source: BLS, my calculations.

Has the job market really downshifted, or is this month a temporary blip? While there's evidence for both sides of that argument, I'd give more weight to the 260K bars in the above figure than the lower first bar. The underlying trend, both for overall GDP growth and for job gains has been steady and moderate, productivity certainly hasn't accelerated (which would suggest employers could meet demands with fewer workers), and the unemployment rate has generally fallen for good reasons -- more jobseekers finding work -- than for bad ones -- more jobseekers giving up the search and leaving the labor market.

Also, weather factors have bedeviled first quarter statistics in recent years, so that may be a factor as well.

However, the first quarter downshift in employment growth should not be dismissed out of hand:

- The strong dollar appears to be taking a toll on manufacturing output and employment. The factory sector add 18,000 jobs over the first quarter of the year compared to 87,000 over the prior quarter.

- The low price of oil is taking a toll on employment in the extraction industry. Employment in mining was down 30,000 in the first quarter with the losses concentrated in the oil and gas extraction subsector.

- Despite very low consumer prices, consumer spending appears to have slowed a bit in recent months.

- While low prices are boosting real earnings, wage growth remains stuck at 2%. With the drop in hours last month, weekly earnings actually fell slightly.

So while I think it's very unlikely that the 126,000 payroll gain marks a new, much slower trend in job growth, there are reasons for caution, especially at the Federal Reserve. This job market has fooled us before, with more head fakes then an NCAA point guard. And the specter of having to lower rates shortly after raising them is one that should be assiduously avoided.

This post originally appeared at Jared Bernstein's On The Economy blog.