Employment was up 120,000 last month and the unemployment rate dropped significantly, to 8.6% in November down from 9% in October. Job growth in October and September was revised up by 72,000.

While the employment story has improved over the past few months, the decline in the November unemployment rate isn't as good as it sounds. People who drop out of the labor force, like those who give up looking for work, are not counted in the jobless rate, and about half of the 0.4 percentage point decline was due to this factor. In fact, about 190,000 of the unemployed left the labor force last month.

Once again, the private sector added jobs -- 140,000 last month -- and the public sector cut them (down 20,000).

The report is consistent with slightly better economic performance over the past few months. It's always useful to average over a few months to work out some of the monthly noise in the data and over the past three months, employment is up by an average of about 140,000 per month, compared to 84,000 over the prior three months.

But there's still a great deal of slack in the job market. Average weekly hours worked didn't budge and hourly wages ticked down slightly -- over the past year, hourly earnings, before inflation, are up 1.8%, well behind inflation.

In other words, we're a long way away from providing job seekers and workers with the job and wage increases they need to get ahead. Outside of the public sector, we're at least moving in the right direction, but very slowly.

Update: Why did the labor force decline? Well, first we should loudly establish the monthly caveat; there's a lot of noise in the monthly data so we shouldn't read too much into any one month.

That said, the labor force 315,000 last month and that explains about half of the large and unexpected decline in the jobless rate. We can get a better feel for the dynamics at play here if we consider the components of the monthly flows behind this drop.

The labor force is the sum of the employed and the unemployed from the BLS Household survey. Last month the labor force count was 153.9 million, the sum of 140.6m employed and 13.3m unemployed.

About 55% of the decline in the labor force last month was people giving up looking for work, meaning they are no longer classified as unemployed by the BLS -- they're out of the labor force. The rest were employed people who went from working to neither working nor looking for a job. Some of those may have gotten laid off and decided not to try to find another job yet. Others may just be retiring or taking some time out of work -- we don't know how those shares distribute.

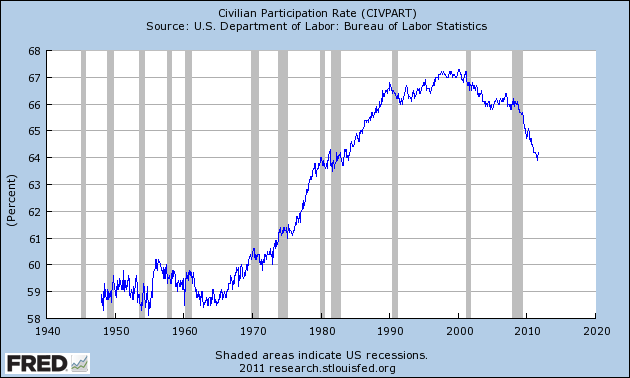

The figure shows the long term trend of the share of the population in the labor force (aka the labor force participation rate, LFPR -- this is from the invaluable FRED database but it doesn't have the Nov data in it yet, which ticks down from 64.2% to 64%). Note that in the 1990s recovery the LFPR slid in the recession and then grew in the recovery. That didn't happen in the 2000s and it's not happening now.

While some of this is demographics -- boomers aging out of the workforce -- the big story is weak labor demand. Remember, employment was up a measly 4% over the 2000s business cycle and tanked thereafter.

Other bullets from the report:

- Retail employment posted a big gain, up about 50K, perhaps reflecting stronger buying than expected so far this season. (Reminder: these numbers are seasonally adjusted, so that's 50K more jobs than you'd expect just based on seasonal hiring.)

Manufacturing is stuck in the mud, flatlining over the past three months after showing some promise in earlier reports. Jan-July this year, factories added 193K jobs; since then, 6K! Not sure what to make of that, but European troubles and their impact on our exports is a suspect. The share of the long term unemployed (jobless for at least half a year) remains extremely high at 43%; once Congressional R's stop dithering and stonewalling on the payroll tax cut, they'll need to start dithering and stonewalling on extending unemployment benefits. Thanks to a decline in involuntary part-timers the broader underemployment rate fell from 16.2% to 15.6%. Again, one month does not a trend make, but this bears watching--if it sticks, it's a positive re labor demand.This post originally appeared at Jared Bernstein's On The Economy blog.

Our 2024 Coverage Needs You

It's Another Trump-Biden Showdown — And We Need Your Help

The Future Of Democracy Is At Stake

Our 2024 Coverage Needs You

Your Loyalty Means The World To Us

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

The 2024 election is heating up, and women's rights, health care, voting rights, and the very future of democracy are all at stake. Donald Trump will face Joe Biden in the most consequential vote of our time. And HuffPost will be there, covering every twist and turn. America's future hangs in the balance. Would you consider contributing to support our journalism and keep it free for all during this critical season?

HuffPost believes news should be accessible to everyone, regardless of their ability to pay for it. We rely on readers like you to help fund our work. Any contribution you can make — even as little as $2 — goes directly toward supporting the impactful journalism that we will continue to produce this year. Thank you for being part of our story.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

It's official: Donald Trump will face Joe Biden this fall in the presidential election. As we face the most consequential presidential election of our time, HuffPost is committed to bringing you up-to-date, accurate news about the 2024 race. While other outlets have retreated behind paywalls, you can trust our news will stay free.

But we can't do it without your help. Reader funding is one of the key ways we support our newsroom. Would you consider making a donation to help fund our news during this critical time? Your contributions are vital to supporting a free press.

Contribute as little as $2 to keep our journalism free and accessible to all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. Would you consider becoming a regular HuffPost contributor?

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. If circumstances have changed since you last contributed, we hope you'll consider contributing to HuffPost once more.

Already contributed? Log in to hide these messages.