I'm not trying to do a "prebuttal" here -- that's an ugly Washington move where you present a counter-argument to a speech or idea that hasn't been delivered yet. But we're already hearing the Republicans attack the president's forthcoming jobs plan as reckless spending that will just increase the deficit, blow up the debt, yada, yada...

So I wanted to make an essential yet poorly understood point about spending on jobs programs of the type we expect to hear Thursday night:

Temporary spending does NOT increase either the long-term deficit or the growth of the national debt.

The measures the president will introduce are temporary programs needed to ensure there's enough economic activity to support the growth and jobs we badly need. In normal times, private sector firms carry out much more of this function, but there's still way too much slack out there, and federal fiscal policy is the main game in town.

I grant you, "temporary" in this context is proving to be a number of years, but that's to be expected given the depth of the recession, the long deleveraging cycle (people paying or writing off debts), and the fact that we've already made some wrongheaded austerity moves extending the slog in which we're stuck.

But the above rule still holds (and is complemented by the fact that borrowing costs are so low right now). By way of example, consider the Recovery Act, which, at $800 billion, added much more to the deficit than the sum of what I expect to hear from the president.

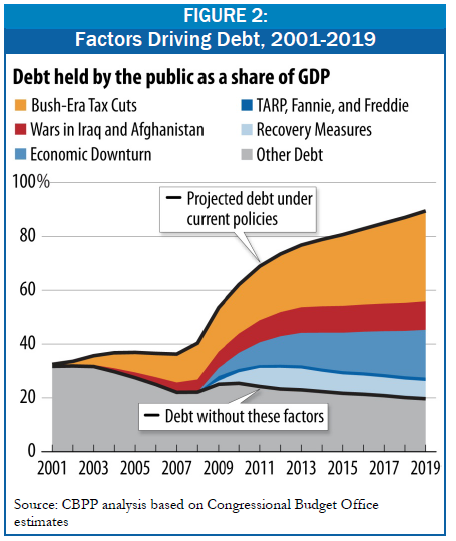

The first figure shows the Recovery Act's contribution to annual deficits; the second shows the debt (the sum of accumulated deficits) as a share of GDP. Stabilizing the debt/GDP ratio is the first goal of sustainable budgeting (the second is to get that ratio falling).

As you can see, even a large spending measure, as long as it's temporary, expands the deficit only for a few years, and then becomes a very small factor. While it raises the level of the debt, once it's over, it does not contribute to its growth.

Compare those results with the Bush tax cuts, which look much more like permanent programs that continuously boost both annual deficits and the growth of the debt.

There are simply no good fiscal reasons not to implement measures that will boost paychecks, help the unemployed, and get folks back to work fixing up our infrastructure. By dint of being temporary, they have little impact on the growth of the debt, and by increasing economic activity, jobs, spending and investment, they lead to faster growth than would otherwise occur.

This post originally appeared at Jared Bernstein's On The Economy blog.