The nation's employers added 271,000 jobs in October, and the unemployment rate ticked down slightly to 5 percent in a solid report on labor market conditions. Wages grew 2.5 percent over the past year, their strongest yearly performance since the recession officially ended in June 2009.

Today's report portrayed a very different job market than that seen in the September release, when payrolls were up a by only (a revised) 137,000. As I stressed last month ("a weak report, but does it represent a true downshift?"), this sort of volatility is to be expected in "high-frequency" data and it is a strong reminder not to over-weight any one month's data when forming your views of the job market.

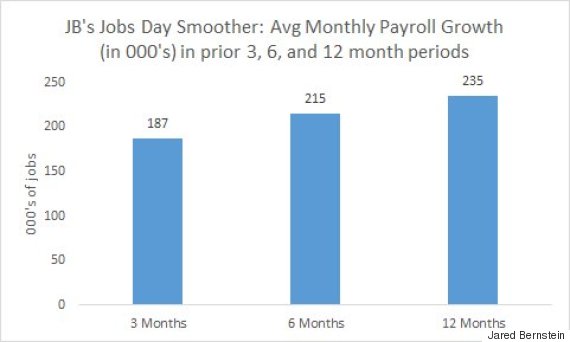

Better to average monthly payroll gains as seen in my monthly smoother below. Over the past three months, payrolls were up 187,000 on average, compared to 235,000 over the past year. That suggests a mild deceleration of job growth, but I consider anything above 150K to be solid employment growth meaning enough jobs per month to put legitimate downward pressure on the jobless rate.

Source: BLS, my calculations.

Other positive signs in today's report include:

-- A decline in the number of involuntary part-time workers, down 1.2 million over the past year.

-- We finally may be seeing some wage acceleration, and if it sticks, that would be a very big story. I already noted the annual 2.5 percent growth rate, but I also averaged hourly wages over the past three months and the three months before that, creating pseudo quarterly wage values (as opposed to calendar quarters). Annualized, wage growth is up 2.7 percent over the past three months, compared to 2.1 percent over the prior "quarter."

-- Outside of manufacturing and mining, which remain weakened by cheap oil and the strong dollar, most industries added jobs, with strong showings in construction, business services, health care, retail trade, and bars and restaurants. The latter two industry gains may reflect a broader swath of consumers flexing their spending muscles given stronger nominal wage growth amidst very low inflation.

Less positive signs include:

-- As mentioned, factory employment is being hurt by the strong dollar which makes our exported goods less competitive. The sector was flat last month, and is down 28,000 jobs over the past three months.

-- The labor force participation rate -- the share of the working-age population either working or looking for work -- remains historically low and was unchanged last month. Based on an aging/retiring labor force, no one should expect the LFPR to regain previous heights, but at least one of the 3.6 percentage points decline from its peak of 66 percent might be regained if labor demand remains strong, especially if job quality (i.e., compensation) improves as well, pulling more potential workers in off the sidelines.

Which brings us to the Federal Reserve. According to Chair Janet Yellen, before today's report, the Fed was already considering raising their target interest rate slightly in their December meeting -- she called the Dec. liftoff a "live possibility" but added they've "made no decision about it."

Today's report is likely to push them over the edge. Clearly the markets expect a Dec. rate increase as short-term Treasury yields this AM spiked to the highest levels in 5 years, as bond traders are trying to get ahead of the expected Fed rate bump.

You might well ask: "why should a jobs report be a deciding factor when inflation is so consistently below the Fed's 2 percent target?" Good question. The liftoff advocates would say they've got to see around corners, and the tightening job market may now be giving rise to wage pressures that will soon thereafter show up as price pressures.

But there's a lot of links in that chain, and [trigger warning -- life lesson from aged person follows!] I've learned to distrust economic arguments with a lot of steps. There's many a slip between those linkages. For example, wage growth does not appear to be bleeding over into price growth as it has in the past.

Also, unless the Fed allows the job market to heat up and stay hot, the benefits of growth won't reach significant swaths of the workforce who depend on lasting full employment to boost their sorely diminished bargaining clout. And remember, 2 percent inflation isn't a ceiling; it's an average, so having been below it for so long we've got room to rise above it for a while.

If today's numbers push the Fed to raise slightly, so be it; 25 basis points (a quarter of a percent) shouldn't make much of a difference to the macroeconomy, and we could finally be done with the "will-they-won't they?" game.

But the important discussion now turns to the pace of their "normalization" campaign. Once again, the critical factor here is to remember that a few months of decent average wage growth at freakishly low inflation does not make up for decades of inequality, wage stagnation, and the persistent, growing split between productivity growth and median compensation.

So go ahead and tap the breaks, if you must, Yellen and co., but this recovery, much like the last one, has yet to lift the poor and middle class. Please give it a chance to do so.

This post originally appeared at Jared Bernstein's On The Economy blog.