The nation's payrolls increased by 117,000 last month, with the private sector posting a stronger gain of 154,000, its best month since April. Job gains for May and June were revised up by a combined 56,000, and hourly wages got a decent bump, up 0.4% over the month.

The unemployment rate ticked down slightly, from 9.2% to 9.1% but that decline was due to fewer people looking for work, not more people finding jobs (note that the payroll data and the unemployment data come from different surveys). The share of the population working-a good proxy for employers demand for workers-also ticked down slightly, to 58.1%, the lowest rate since July 1983-28 years ago!

Still, the job and wage gains were better than expected and such expectations matter a lot right now. Fear feeds fear in this hyper-skittish market environment, and today's jobs numbers should help calm some jittery nerves and dampen some destructive volatility.

Of course, gains of this magnitude along with what is really an unfavorable result on the unemployment rate -- it doesn't help if it falls because more people give up their job search -- don't change the overall story one bit. The economy is growing, but much too slowly to provide working families the jobs, hours or work, and paychecks they need to get ahead.

To see this more clearly, it's useful to average over the past three months, in order to smooth out some of the statistical noise in these monthly data. If you do so, you get average monthly private sector gains of 111,000 over the past three months, compared to 240,000 over the prior three months, so no question that employment growth has sharply slowed.

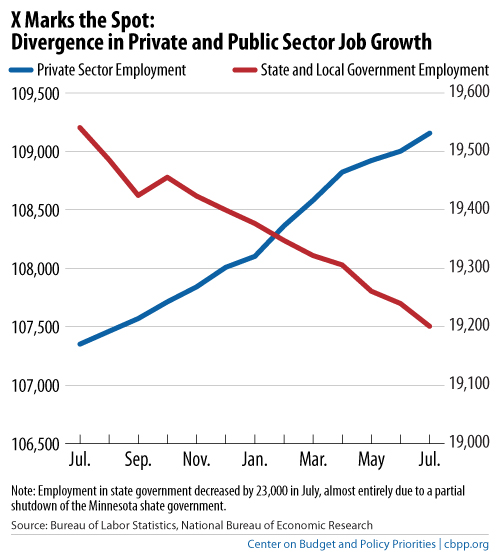

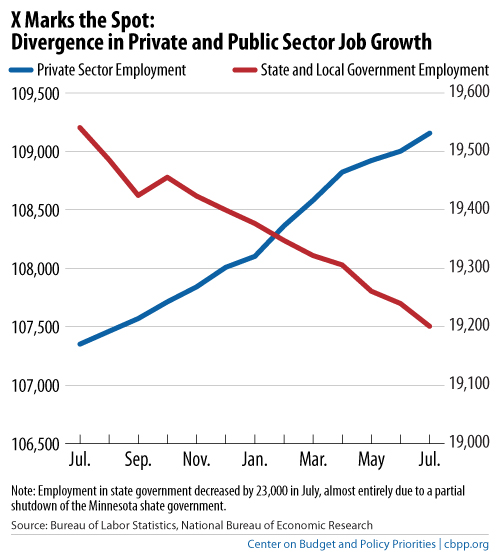

One important negative trend continues unabated in today's data: the loss of state and local jobs, as budget constraints, no longer offset by federal help, continue to force layoffs. States, cities, and towns laid off 39,000 workers in July (though this loss was largely due to the temporary government shutdown in Minnesota last month) and 340,000 over the past year.

Update: First, someone asked me this morning, "wouldn't it have been better if the jobs report were terrible, so as to force policy makers to do something?"

I don't think so. Even after yesterday's crash and the spate of weak reports -- and this jobs report is really not that much better, by the way -- I seriously doubt a worse report would have moved these folks, and frankly, we really need the jobs.

The federal government right now is like a fire truck outside a burning building, with the firefighters leaning on the truck looking at the flames and saying, "what a shame... too bad we can't help."

And don't try to tell me they can't help because they don't have any water in their tanks... they do, and they can borrow more at very low rates right now. At this point, the best way to reduce the deficit is to get more people back at work, earning paychecks and paying taxes.

Second point: I noted in my earlier post that state and local employment continues to tank. Though this month was made worse by the partial state government shutdown in Minnesota -- hey, state legislators do the self-inflicted wound thing too! -- the long-term trend is clear, and in stark contrast to the private sector jobs trends (state/local employment is on the right axis). Private sector job growth is too slow, as I noted earlier, but at least its moving the right way.

(Graphic by CBPPs Hannah Shaw)

This X is a function of the fact that states and towns are still cutting and laying off teachers, cops, sanitation workers, etc., because they must, by law balance their budgets. Two lessons here: 1) they need federal help, and 2) that line going down: this is your job market on a balanced budget amendment, another great Republican idea.

This post originally appeared at Jared Bernstein's On The Economy blog.

Our 2024 Coverage Needs You

It's Another Trump-Biden Showdown — And We Need Your Help

The Future Of Democracy Is At Stake

Our 2024 Coverage Needs You

Your Loyalty Means The World To Us

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

The 2024 election is heating up, and women's rights, health care, voting rights, and the very future of democracy are all at stake. Donald Trump will face Joe Biden in the most consequential vote of our time. And HuffPost will be there, covering every twist and turn. America's future hangs in the balance. Would you consider contributing to support our journalism and keep it free for all during this critical season?

HuffPost believes news should be accessible to everyone, regardless of their ability to pay for it. We rely on readers like you to help fund our work. Any contribution you can make — even as little as $2 — goes directly toward supporting the impactful journalism that we will continue to produce this year. Thank you for being part of our story.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

It's official: Donald Trump will face Joe Biden this fall in the presidential election. As we face the most consequential presidential election of our time, HuffPost is committed to bringing you up-to-date, accurate news about the 2024 race. While other outlets have retreated behind paywalls, you can trust our news will stay free.

But we can't do it without your help. Reader funding is one of the key ways we support our newsroom. Would you consider making a donation to help fund our news during this critical time? Your contributions are vital to supporting a free press.

Contribute as little as $2 to keep our journalism free and accessible to all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. Would you consider becoming a regular HuffPost contributor?

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. If circumstances have changed since you last contributed, we hope you'll consider contributing to HuffPost once more.

Already contributed? Log in to hide these messages.